PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782111

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782111

Dynamic Pricing and Yield Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

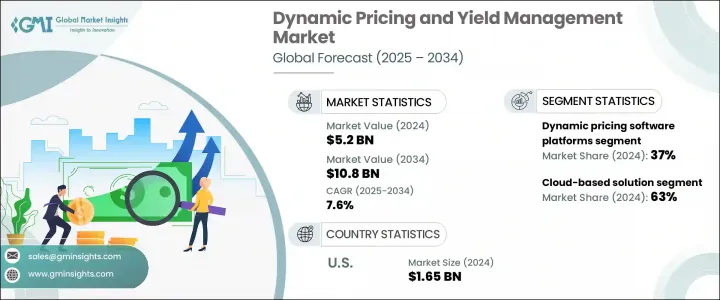

The Global Dynamic Pricing and Yield Management Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 10.8 billion by 2034. This growth is driven by the accelerating pace of digital transformation, the booming e-commerce sector, and the increasing adoption of real-time pricing solutions across sectors such as entertainment, travel, hospitality, and trading. As pricing becomes more fluid in response to customer behavior, competitive landscapes, and supply dynamics, fixed pricing models are rapidly losing relevance. Businesses are turning to intelligent pricing tools powered by advanced algorithms to optimize profit margins and respond quickly to demand shifts.

AI and machine learning play a critical role in these strategies, helping companies analyze large volumes of market data and automate price adjustments instantly. These technologies are reshaping how firms manage inventory, improve customer experience, and stay ahead of their competitors by responding dynamically to market forces. They enable organizations to make smarter, data-driven pricing decisions that account for consumer behavior, seasonality, regional trends, and competitor activity in real time. By continuously analyzing massive volumes of structured and unstructured data, these tools help optimize pricing at the product, category, or even individual customer level. Businesses can minimize stockouts and overstocks, ensuring better inventory turnover and improved operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 7.6% |

In 2024, the dynamic pricing software platforms segment held a 37% share and is anticipated to grow at 8.4% CAGR through 2034. As digital-first strategies continue to evolve, these platforms offer automation and real-time pricing intelligence that are increasingly essential for both large-scale enterprises and small to medium businesses. By reducing the need for manual oversight, these solutions enhance agility and improve decision-making. The expanding presence of online retail and mobile commerce, along with the development of smart cities, has further fueled the demand for adaptable pricing systems tailored to fast-changing digital ecosystems.

The cloud-based segment captured a 63% share in 2024 and is expected to grow at a CAGR of 7.5% during 2025- 2034. These platforms are cost-effective, easy to scale, and offer rapid deployment, making them particularly attractive to startups and smaller firms. They support secure, real-time data access and continuous performance optimization, allowing businesses to update pricing strategies swiftly. With ever-increasing data availability in the digital space, cloud infrastructure gives companies the flexibility to manage pricing dynamically across multiple channels while maintaining security and speed.

United States Dynamic Pricing and Yield Management Market held an 85% share, generating USD 1.65 billion in 2024. A strong presence of advanced digital businesses and established AI-powered pricing systems continues to drive the region's leadership. The U.S. has long leveraged yield management strategies in areas such as travel and hospitality, where demand-based pricing is essential. The country's robust digital and e-commerce infrastructure supports the widespread use of cloud and analytics-driven pricing tools that adapt to real-time variables, customer preferences, and inventory conditions.

Key companies operating in this space include Blue Yonder, PROS, Dynamic Yield, SAP SE, Revionics, Oracle, Pricefx, Duetto, Zilliant, and IDeaS Revenue Solutions. To solidify their market position, leading firms in the dynamic pricing and yield management industry are focusing on integrating AI and predictive analytics into their platforms for more accurate forecasting and automation. Companies are also prioritizing product scalability, ensuring their solutions are adaptable for both large enterprises and SMEs. Many players are offering modular, cloud-based systems that can be rapidly deployed with minimal infrastructure. Strategic partnerships with e-commerce providers, hospitality chains, and logistics firms are expanding their user base and market access.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Application

- 2.2.4 Deployment mode

- 2.2.5 Industry vertical

- 2.2.6 Pricing strategy

- 2.2.7 Organization size

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging e-commerce and digital retail growth

- 3.2.1.2 Increased use of AI and machine learning algorithms

- 3.2.1.3 Cloud-based platform adoption

- 3.2.1.4 Rising demand for revenue optimization

- 3.2.1.5 Expansion of omnichannel sales models

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation complexity

- 3.2.2.2 Data privacy and compliance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in subscription and usage-based models

- 3.2.3.2 Integration with predictive analytics and demand sensing

- 3.2.3.3 Adoption of generative AI for pricing simulation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Dynamic pricing market evolution

- 3.12.1 Historical Development 1980-2023

- 3.12.2 Current market status 2024-2025

- 3.13 Future market trajectory (2026-2034)

- 3.14 Pricing strategy frameworks

- 3.14.1 Time-based pricing strategies

- 3.14.2 Demand-based pricing models

- 3.14.3 Competitive pricing strategies

- 3.14.4 Customer segmentation pricing

- 3.15 Performance measurement and analytics

- 3.15.1 Key Performance Indicators (KPIs)

- 3.15.2 ROI and value measurement

- 3.15.3 Analytics and reporting frameworks

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Dynamic pricing software platforms

- 5.2.1 Enterprise dynamic pricing suites

- 5.2.2 Mid-market pricing solutions

- 5.2.3 Specialized pricing applications

- 5.3 Revenue management systems

- 5.3.1 Airline revenue management

- 5.3.2 Hotel revenue management

- 5.3.3 Other

- 5.4 Yield optimization and analytics tools

- 5.4.1 Yield management platforms

- 5.4.2 Pricing analytics and intelligence

- 5.4.3 Business intelligence and reporting

- 5.5 Professional services and implementation

- 5.5.1 Consulting and strategy services

- 5.5.2 Implementation and integration services

- 5.5.3 Managed services and support

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Revenue management

- 6.3 Inventory optimization

- 6.4 Competitive pricing analysis

- 6.5 Promotional campaign management

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Airlines and aviation industry

- 8.2.1 Commercial airlines

- 8.2.2 Airport and ground services

- 8.2.3 Aircraft leasing and MRO

- 8.3 Hotels and hospitality industry

- 8.3.1 Hotel operations

- 8.3.2 Alternative accommodations

- 8.3.3 Food and beverage services

- 8.3.4 Resort and leisure services

- 8.4 Retail and e-commerce industry

- 8.4.1 Online retail and e-commerce

- 8.4.2 Brick-and-mortar retail

- 8.4.3 Fashion and apparel

- 8.4.4 Customer electronics

- 8.5 Transportation and mobility service

- 8.5.1 Ride sharing and taxi services

- 8.5.2 Public transportation

- 8.5.3 Car rental and sharing

- 8.5.4 Logistics and freight

- 8.6 Utilities and energy sector

- 8.6.1 Electric utilities

- 8.6.2 Gas and water utilities

- 8.6.3 Telecommunications

- 8.7 Sports and entertainment industry

- 8.7.1 Sports teams and venues

- 8.7.2 Entertainment and events

- 8.7.3 Theme parks and attractions

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Pricing Strategy, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Time based pricing strategy

- 9.3 Demand based pricing models

- 9.4 Competitive based pricing

- 9.5 Customer-centric pricing

Chapter 10 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 10.1 Large enterprises

- 10.2 SME

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 North America

- 11.1.1 U.S.

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Russia

- 11.2.7 Nordics

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 South Korea

- 11.3.6 Singapore

- 11.3.7 Indonesia

- 11.3.8 Vietnam

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.4.4 Chile

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Atomize

- 12.2 BlackCurve

- 12.3 Blue Yonder

- 12.4 Competera

- 12.5 Duetto

- 12.6 Dynamic Yield

- 12.7 IDeaS Revenue Solutions

- 12.8 Omnia Retail

- 12.9 Oracle

- 12.10 Pricefx

- 12.11 PriceLabs

- 12.12 Prisync

- 12.13 PROS

- 12.14 Qcue

- 12.15 RealPage

- 12.16 Revionics

- 12.17 SAP

- 12.18 Wheelhouse

- 12.19 YieldPlanet

- 12.20 Zilliant