PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782117

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782117

Mass-loaded Vinyl (MLV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

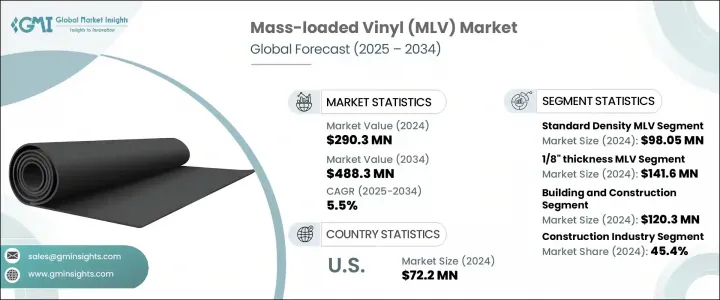

The Global Mass-loaded Vinyl (MLV) Market was valued at USD 290.3 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 488.3 million by 2034. Rising levels of urbanization and industrial activity are directly contributing to increased noise pollution, which in turn drives the need for efficient acoustic insulation solutions. MLV has gained popularity due to its non-toxic nature and its proven effectiveness in reducing sound transmission in both residential and commercial settings. As awareness grows around the impact of environmental noise on health and wellness, the demand for soundproofing materials continues to surge across infrastructure and architectural projects. In addition, a stronger emphasis on sustainable construction and modern acoustic compliance in building regulations further boosts MLV adoption across multiple sectors.

Tighter acoustic performance standards in facilities like educational institutions, medical buildings, and multi-unit housing developments are also prompting developers to choose MLV-based products. The material's versatility, durability, and ease of installation make it a preferred choice for renovations and new builds alike, particularly in space-restricted areas. Emerging economies with growing investments in infrastructure have shown a sharp rise in demand. MLV use is also gaining momentum in transportation hubs and automotive manufacturing, where effective noise reduction is critical to performance and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $290.3 Million |

| Forecast Value | $488.3 Million |

| CAGR | 5.5% |

In 2024, the standard density MLV segment was valued at USD 98.05 million and is projected to grow at a CAGR of 4.2% through 2034. This segment continues to dominate basic residential and light commercial soundproofing applications due to affordability and availability. However, market trends are shifting gradually toward customized solutions, particularly in sectors requiring precision-engineered sound control, such as healthcare, defense, and industrial manufacturing. Advanced composite MLVs and tailored formulations with specific density requirements are being preferred where higher sound isolation is essential or where weight limitations must be observed.

The building and construction segment generated USD 120.3 million in 2024 and is forecasted to grow at a CAGR of 5.9% during 2025-2034. MLV is frequently used in ceilings, partitions, and flooring systems to ensure compliance with evolving noise control regulations and to enhance indoor sound comfort. While its primary application remains in construction, automotive manufacturers are also increasingly adopting MLVs to elevate cabin quietness and reduce external noise. Consumer-facing applications like home studios, gaming rooms, and small entertainment spaces are expanding rapidly as individuals seek affordable and DIY-friendly noise management alternatives.

United States Mass-loaded Vinyl (MLV) Market was valued at USD 72.2 million in 2024 and is projected to grow at a CAGR of 2.3% from 2025 to 2034. A combination of stricter building codes, rising home renovations, and growing enthusiasm for do-it-yourself soundproofing is supporting market expansion. Simultaneously, the rising use of vehicle interior components to meet NVH (Noise, Vibration, and Harshness) standards is propelling MLV usage in the automotive sector. The combination of construction sector rebound and increased spending on acoustic quality creates a positive long-term outlook.

Major players such as Technicon Acoustics, Soundproof Direct, Acoustical Surfaces, All Noise Control, and Niko Coatings are actively competing across global markets. To strengthen their presence in the MLV industry, leading companies are focusing on tailored product development, diversification, and strategic supply chain optimization. A core approach includes expanding portfolios with multi-layered or composite MLV materials that address specific market niches such as industrial machinery, medical spaces, and aerospace interiors. These players are also investing in R&D to offer lightweight and eco-friendly solutions that align with sustainability goals. Geographic expansion, digital marketing, and e-commerce channels are helping brands reach DIY consumers, while partnerships with construction and automotive manufacturers ensure repeat business in high-volume segments. Innovation in roll sizes and application methods also plays a key role in improving market adoption and reducing project costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Thickness

- 2.2.4 Format and Packaging

- 2.2.5 Application

- 2.2.6 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Standard density MLV

- 5.2.1 1 lb/sq ft MLV products

- 5.2.1.1 Residential applications

- 5.2.1.2 Commercial applications

- 5.2.1.3 Industrial applications

- 5.2.2 2 lb/sq ft MLV products

- 5.2.2.1 High-performance applications

- 5.2.2.2 Specialized industrial uses

- 5.2.2.3 Premium residential projects

- 5.2.1 1 lb/sq ft MLV products

- 5.3 Custom density MLV

- 5.3.1 Half-pound MLV products

- 5.3.2 High-density MLV (>2 lb/sq ft)

- 5.3.3 Application-specific custom formulations

- 5.4 Composite MLV Products

- 5.4.1 MLV with foam backing

- 5.4.2 MLV with fabric facing

- 5.4.3 Multi-layer composite systems

- 5.5 Specialty MLV products

- 5.5.1 Fire-resistant MLV

- 5.5.2 UV-resistant outdoor MLV

- 5.5.3 Antimicrobial MLV

- 5.5.4 Transparent and decorative MLV

Chapter 6 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 1/16" thickness MLV

- 6.3 1/8" thickness MLV (Standard)

- 6.4 1/4" thickness MLV

- 6.5 Custom thickness products

Chapter 7 Market Estimates & Forecast, By Format and Packaging, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Roll format products

- 7.3 Sheet format products

- 7.4 Pre-cut and custom shapes

- 7.5 Adhesive-backed products

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Building and construction

- 8.2.1 Residential construction

- 8.2.1.1 Single-family homes

- 8.2.1.2 Multi-family housing

- 8.2.1.3 Renovation and retrofit projects

- 8.2.2 Commercial construction

- 8.2.2.1 Office buildings

- 8.2.2.2 Healthcare facilities

- 8.2.2.3 Educational institutions

- 8.2.2.4 Hospitality and entertainment

- 8.2.3 Industrial construction

- 8.2.3.1 Manufacturing facilities

- 8.2.3.2 Data centers

- 8.2.3.3 Laboratories and clean rooms

- 8.2.1 Residential construction

- 8.3 Automotive and transportation

- 8.3.1 Passenger vehicles

- 8.3.1.1 Luxury and premium vehicles

- 8.3.1.2 Mid-range and economy vehicles

- 8.3.1.3 Electric and hybrid vehicles

- 8.3.2 Commercial vehicles

- 8.3.2.1 Trucks and heavy-duty vehicles

- 8.3.2.2 Buses and public transportation

- 8.3.2.3 Specialty and emergency vehicles

- 8.3.3 Marine and aerospace

- 8.3.3.1 Marine vessels and boats

- 8.3.3.2 Aircraft and aerospace applications

- 8.3.3.3 Rail transportation

- 8.3.1 Passenger vehicles

- 8.4 Industrial and equipment

- 8.4.1 HVAC systems and ductwork

- 8.4.2 Generator and compressor enclosures

- 8.4.3 Manufacturing equipment noise control

- 8.4.4 Power generation and utility applications

- 8.5 Consumer and specialty applications

- 8.5.1 Home theater and audio rooms

- 8.5.2 Recording studios and music venues

- 8.5.3 Appliance and electronics noise control

- 8.5.4 Temporary and portable barriers

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Construction industry

- 9.2.1 Residential construction market

- 9.2.2 Commercial construction market

- 9.2.3 Infrastructure and public works

- 9.2.4 Renovation and retrofit market

- 9.3 Automotive industry

- 9.3.1 OEM applications

- 9.3.2 Aftermarket applications

- 9.3.3 Electric vehicle segment

- 9.3.4 Commercial vehicle segment

- 9.4 Industrial manufacturing

- 9.4.1 Heavy machinery and equipment

- 9.4.2 Process industries

- 9.4.3 Power generation

- 9.4.4 Oil and gas industry

- 9.5 Entertainment and media

- 9.5.1 Recording and broadcasting studios

- 9.5.2 Theaters and performance venues

- 9.5.3 Home entertainment systems

- 9.5.4 Gaming and virtual reality applications

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 MLV Insulation

- 11.2 Trademark Soundproofing

- 11.3 Acoustic Barrier Factory

- 11.4 Mass Loaded Vinyl Australia

- 11.5 Niko Coatings

- 11.6 Commercial Acoustics

- 11.7 Soundproof Direct

- 11.8 TotalMass MLV Barrier Store

- 11.9 Acoustical Surfaces

- 11.10 RPR Products

- 11.11 All Noise Control

- 11.12 Technicon Acoustics

- 11.13 Acoustiguard

- 11.14 Sound Acoustics Solutions

- 11.15 MMT Acoustix

- 11.16 Soundproofing Company

- 11.17 Second Skin Audio

- 11.18 ResoNix Sound Solutions

- 11.19 Soundproofing MLV

- 11.20 Buy Insulation Product Store

- 11.21 3M Company

- 11.22 BASF SE

- 11.23 The Dow Chemical Company

- 11.24 Autoneum Holding AG

- 11.25 Sumitomo Riko Company Limited

- 11.26 Zhuzhou Times New Material Technology

- 11.27 Huntsman Corporation

- 11.28 Exxon Mobil Corporation

- 11.29 Covestro AG

- 11.30 Sika AG

- 11.31 Owens Corning

- 11.32 Saint-Gobain

- 11.33 Knauf Insulation

- 11.34 Rockwool International

- 11.35 Johns Manville

- 11.36 Armacell GmbH

- 11.37 National Gypsum Company

- 11.38 USG Corporation

- 11.39 CertainTeed Corporation

- 11.40 Guardian Building Products

- 11.41 Venator Materials Corporation

- 11.42 Sachtleben Chemie GmbH

- 11.43 Huntsman Pigments and Additives

- 11.44 Cimbar Performance Minerals

- 11.45 Bausano & Figli S.p.A.

- 11.46 LANXESS AG

- 11.47 Shin-Etsu Chemical Co., Ltd.

- 11.48 Formosa Plastics Corporation

- 11.49 Westlake Chemical Corporation

- 11.50 INEOS Group Holdings S.A.