PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782120

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782120

Southeast Asia (SEA) Thoracolumbar Spinal Fusion Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

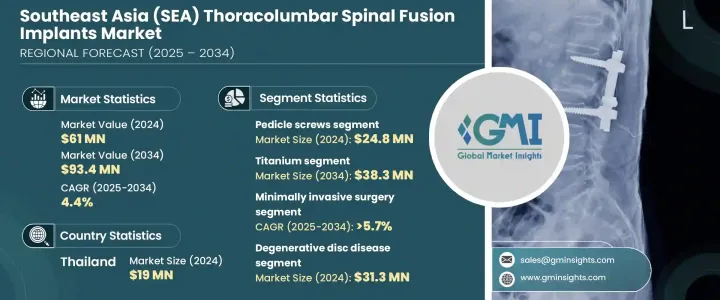

Southeast Asia Thoracolumbar Spinal Fusion Implants Market was valued at USD 61 million in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 93.4 million by 2034. This market growth is largely driven by advancements in implant technologies, the surge in medical tourism, and a rising incidence of spinal conditions throughout the region. The increasing number of traffic-related trauma cases, greater public awareness of modern, minimally invasive surgical techniques, and expanding access to specialized spinal care are all contributing to product adoption. An aging population in countries like Vietnam and Thailand has intensified the burden of spine-related degenerative disorders, creating a higher demand for fusion procedures.

Moreover, the influx of highly trained orthopedic and neurosurgeons-many of whom have studied or practiced in the U.S., Europe, or Australia-has significantly improved surgical quality, safety, and availability across local healthcare systems. These professionals have helped elevate the standard of care and increase confidence in thoracolumbar spinal fusion techniques. Implants used in these procedures are specifically engineered to stabilize the connection between the thoracic and lumbar sections of the spine, providing long-term support and promoting proper healing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61 Million |

| Forecast Value | $93.4 Million |

| CAGR | 4.4% |

In 2024, the pedicle screws segment was valued at USD 24.8 million. These screws are widely used by surgeons due to their ability to deliver robust three-dimensional spinal stability. They are commonly employed in cases involving trauma, degeneration, or spinal deformities where solid fixation is essential. Their use has become increasingly popular in complex surgical interventions, especially in the thoracolumbar region, where their effectiveness in stabilizing the spine has been well documented. Demand continues to grow as clinicians rely on their strength and adaptability in a wide range of clinical scenarios.

The titanium segment also held a dominant position in 2024 and is expected to reach approximately USD 38.3 million by 2034. Titanium-based implants are seeing increased demand due to their excellent biocompatibility, corrosion resistance, and mechanical strength. These materials are particularly valued in spinal fusion procedures because they offer lightweight durability and reduce the risk of complications such as stress shielding. Surgeons prefer titanium over stainless steel because it more closely matches the elasticity of natural bone, helping to prevent complications in adjacent spinal segments. Titanium's imaging compatibility with CT and MRI scans, along with its high fatigue strength, also makes it the material of choice for both primary and revision surgeries, including those with higher complexity.

Thailand Thoracolumbar Spinal Fusion Implants Market was valued at USD 19 million in 2024. The country's private hospitals are central to market expansion, offering advanced treatment approaches that include robotic-assisted surgeries and intraoperative navigation. These innovations rely on precision-focused implants to deliver consistent outcomes. With increasing pressure on public healthcare budgets, hospitals are also opting for implants that combine long-term durability with economic value. The local preference for cost-effective, high-performance devices continues to reinforce favorable market conditions across Thailand, especially in facilities that prioritize cutting-edge technology and patient outcomes.

Notable companies actively shaping the competitive landscape of the Southeast Asia (SEA) Thoracolumbar Spinal Fusion Implants Market include B. Braun, Medtronic, Orthofix Medical, DOUBLE MEDICAL, GS Medical, Spineart, Stryker (VB Spine), Highridge Medical (ZimVie), WASTON MEDICAL, Globus Medical, Alphatec Spine, and DePuy Synthes (JnJ).

To enhance their competitive advantage in Southeast Asia's thoracolumbar spinal fusion implants market, leading companies are focusing on several critical strategies. They are investing in localization efforts by expanding regional manufacturing and distribution networks to improve supply chain efficiency and reduce costs. Many firms are collaborating with regional hospitals and training institutions to support surgeon education and technical skill development. Product innovation remains a top priority, with companies working to improve implant materials, design precision, and compatibility with robotic and navigation-assisted systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates & calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 Material

- 2.2.4 Surgery type

- 2.2.5 Indication

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of spinal diseases

- 3.2.1.2 Increasing demand for minimally invasive procedures

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing medical tourism in the region

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of spinal implants and surgeries

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Opportunities

- 3.2.3.1 Integration of AI and robotics in spine surgery

- 3.2.3.2 Growing focus on outpatient settings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Southeast Asia

- 4.2.2 Thailand

- 4.2.3 Singapore

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pedicle screws

- 5.3 Intervertebral body fusion device (IBFD)

- 5.4 Rods

- 5.5 Plates

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Polyether-ether-ketone (PEEK)

- 6.4 Cobalt chrome

- 6.5 Stainless steel

- 6.6 Other materials

Chapter 7 Market Estimates and Forecast, By Surgery Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Open surgery

- 7.3 Minimally invasive surgery

Chapter 8 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Degenerative disc disease

- 8.3 Spinal trauma

- 8.4 Spinal deformities

- 8.5 Spinal tumors

- 8.6 Other indications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Orthopedic clinics

Chapter 10 Market Estimates and Forecast, By Country, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Singapore

- 10.3 Malaysia

- 10.4 Thailand

- 10.5 Indonesia

- 10.6 Vietnam

- 10.7 Philippines

- 10.8 Rest of SEA

Chapter 11 Company Profiles

- 11.1 Alphatec Spine

- 11.2 B. Braun

- 11.3 DePuy Synthes (JnJ)

- 11.4 DOUBLE MEDICAL

- 11.5 Globus Medical

- 11.6 GS Medical

- 11.7 Highridge Medical (ZimVie)

- 11.8 Medtronic

- 11.9 Orthofix Medical

- 11.10 Spineart

- 11.11 Stryker (VB Spine)

- 11.12 WASTON MEDICAL