PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782128

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782128

Processing Industry Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

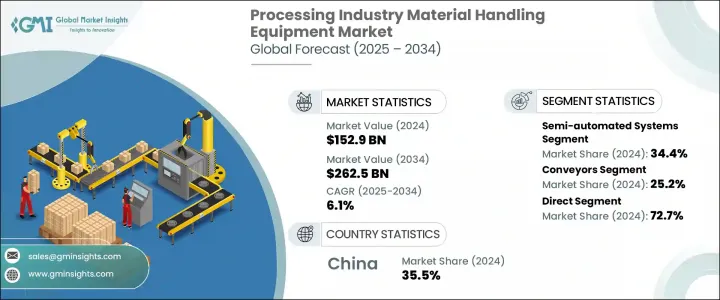

The Global Processing Industry Material Handling Equipment Market was valued at USD 152.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 262.5 billion by 2034. This steady rise is primarily attributed to the growing demand for advanced, automated solutions across processing sectors. The industry is increasingly embracing digital transformation, driven by the integration of intelligent technologies that are reshaping how materials are moved, stored, and managed. Automation is no longer a future trend-it has become an essential element of operational efficiency, cost reduction, and workforce safety.

Companies across processing industries are leveraging innovations such as robotics, AI, and IoT to streamline workflows, enhance real-time visibility, and gain a competitive edge through better process control. These digital systems not only improve production output but also support lean manufacturing by reducing reliance on manual labor, minimizing operational errors, and increasing uptime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.9 Billion |

| Forecast Value | $262.5 Billion |

| CAGR | 6.1% |

As businesses face heightened pressure to boost productivity and maintain agility in rapidly evolving markets, the shift toward modern material handling equipment continues to accelerate. The adoption of smart handling solutions has enabled companies to respond faster to dynamic production needs, while also supporting sustainability goals through energy-efficient operations and minimizing material waste. Furthermore, these automated systems can be tailored for various industrial requirements, making them ideal for processing applications where precision, consistency, and adaptability are critical.

From food and beverage processing to chemicals and electronics, enterprises are investing in equipment that enhances flow, reduces bottlenecks, and ensures seamless intra-facility movement. This push toward modernization is not only transforming large manufacturing operations but is also proving beneficial for mid-sized facilities aiming to stay competitive without investing heavily in fully autonomous systems. The cumulative effect of these shifts is a robust demand trajectory for material handling equipment tailored specifically to processing environments.

In terms of operation mode, the market is categorized into manual systems, semi-automated systems, fully automated systems, and IoT-enabled smart handling systems. Among these, the semi-automated segment emerged as the market leader in 2024, capturing around 34.4% of the overall revenue. This segment is forecasted to grow at a CAGR of over 4.4% through the forecast period. Semi-automated equipment offers an optimal blend of automation benefits and operator control, which is particularly appealing to businesses that require both flexibility and precision. These systems are especially suitable for facilities with varying workflows, enabling operators to manage customized tasks efficiently while mechanizing repetitive activities. Their affordability, ease of integration, and lower maintenance requirements make them a practical choice for many processing firms aiming to scale without transitioning fully to autonomous operations.

On the basis of application, the market is segmented into conveyors, cranes and hoists, forklifts and industrial trucks, automated guided vehicles (AGVs), storage and retrieval systems, robotic material handling systems, bulk material handling equipment, and others. The conveyors segment led the market in 2024 with a revenue share of 25.2%, and it is anticipated to register a CAGR of over 5.5% from 2025 to 2034. The widespread deployment of conveyor systems is due to their ability to transport materials seamlessly across different points within processing plants. Their design versatility supports the movement of a wide range of goods, from lightweight items to bulk loads, thereby improving throughput and minimizing handling times. These systems contribute significantly to process optimization by ensuring uninterrupted material flow, which is essential for industries that operate on continuous production cycles.

The market, based on distribution channel, is divided into direct and indirect channels. In 2024, the direct sales segment held the dominant position with a revenue share of 72.7% and is projected to grow at a CAGR of over 4.7% throughout the forecast period. Direct channels offer buyers better access to tailored solutions and technical support, creating strong value propositions. However, the indirect segment continues to play a critical role in market expansion. It enables broader customer reach and provides additional services such as customization, post-sale assistance, and flexible financing options, which are especially appealing to small and mid-sized enterprises. This dual-channel approach helps manufacturers maintain a balance between personalized service and wide-scale accessibility.

Regionally, China emerged as the front-runner in the Asia-Pacific processing industry material handling equipment market in 2024, securing approximately 35.5% of the regional share. The country's market is projected to exceed USD 2 billion by 2034. This dominance is fueled by rapid industrial development, a robust manufacturing infrastructure, and strong governmental initiatives aimed at boosting automation and smart manufacturing. Continued urbanization and regional industrialization efforts further drive the demand for advanced handling systems, making China a key contributor to the sector's growth across APAC.

Prominent players shaping the global landscape of the processing industry material handling equipment market include Daifuku, Crown Equipment Corporation, Dematic Group, GEA, Fives Group, Hyster-Yale Materials Handling, JBT Corporation, Intelligrated, Jungheinrich, Linde Material Handling, KION Group, Mitsubishi Logisnext, Tetra Pak, SSI Schaefer Group, and Toyota Industries Corporation. These companies are investing heavily in R&D, partnerships, and global expansions to strengthen their competitive positions and cater to the increasing need for intelligent and integrated material handling solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Mode of operation

- 2.2.2 Equipment type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements and automation

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Expansion of industrial and manufacturing sectors

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance expenses and complexity

- 3.2.2.2 Shortage of skilled workforce

- 3.2.2.3 High initial investment

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By mode of operation

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual handling equipment

- 5.3 Semi-automated systems

- 5.4 Fully automated systems

- 5.5 IoT-enabled smart handling systems

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Conveyors

- 6.3 Cranes & Hoists

- 6.4 Forklifts & Industrial Trucks

- 6.5 Automated Guided Vehicles (AGVs)

- 6.6 Storage & Retrieval Systems

- 6.7 Robotic Material Handling Systems

- 6.8 Bulk Material Handling Equipment

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Efficient movement of materials

- 7.3 Storage and organization

- 7.4 Improving safety

- 7.5 Increasing productivity

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage processing

- 8.3 Chemical and pharmaceutical processing

- 8.4 Mining & metals processing

- 8.5 Pharmaceutical manufacturing

- 8.6 Oil & gas

- 8.7 Logistics

- 8.8 Automotive and electronics manufacturing

- 8.9 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Crown Equipment Corporation

- 11.2 Daifuku

- 11.3 Dematic Group

- 11.4 Fives Group

- 11.5 GEA

- 11.6 Hyster-Yale Materials Handling

- 11.7 Intelligrated (a Honeywell company)

- 11.8 JBT Corporation

- 11.9 Jungheinrich

- 11.10 KION Group

- 11.11 Linde Material Handling

- 11.12 Mitsubishi Logisnext

- 11.13 SSI Schaefer Group

- 11.14 Tetra Pak

- 11.15 Toyota Industries Corporation