PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797699

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797699

Compute Express Link (CXL) Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

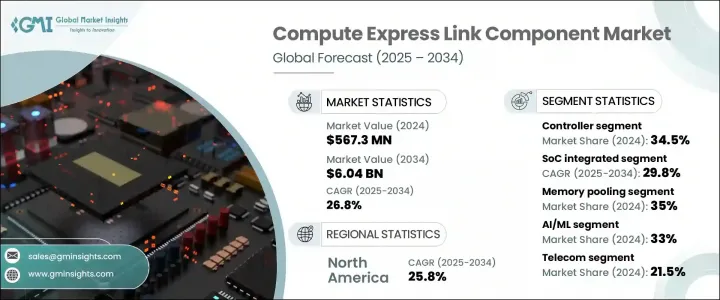

The Global Compute Express Link Component Market was valued at USD 567.31 million in 2024 and is estimated to grow at a CAGR of 26.8% to reach USD 6.04 billion by 2034. This rapid expansion reflects surging demand for high-performance computing, AI/ML workloads, and memory disaggregation in modern data centers. CXL technology enables flexible memory architectures and pooled access, making it a key driver for next-generation infrastructure. Organizations are increasingly seeking scalable memory management to avoid redundancy and reduce hardware costs. CXL's pooled memory models emerged in the early 2020s as data centers sought better resource utilization. By decoupling compute from memory, overprovisioning becomes unnecessary, enabling cost efficiencies. Innovations in memory tiering and composable server architectures powered by CXL are reshaping server design, facilitating dynamic sharing of memory and storage across nodes.

The technology is reshaping data center architecture and setting new standards for resource optimization, efficiency, and agility. By decoupling memory from compute resources, it enables unprecedented scalability and flexibility in workload allocation. This shift supports real-time data processing, high-bandwidth connectivity, and dynamic resource sharing across systems-drastically reducing latency and infrastructure costs. It also fosters more energy-efficient environments by minimizing idle resources and streamlining operational workflows. As organizations strive for faster innovation cycles and smarter resource utilization, this advancement becomes a foundational element of next-generation, software-defined data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $567.31 Million |

| Forecast Value | $6.04 Billion |

| CAGR | 26.8% |

The network interface controller (NIC) segment was significantly smaller than controllers in 2024, capturing a 5.9% share with USD 33.2 million, but it is expanding very rapidly. NICs are essential to support low-latency interconnects in composable systems. As CXL becomes widespread, NICs play a vital role in enabling scalable, high-throughput connections across compute and memory tiers, positioning them as the fastest-growing component category.

The SoC-integrated component segment is projected to reach USD 1.8 billion by 2034, making it the fastest-growing form factor. SoC-based CXL solutions offer compact, energy-efficient architectures ideal for edge and cloud deployments. These high-density modules deliver operational efficiency and space savings, making them increasingly attractive where size or power constraints are critical, and enabling streamlined hardware configurations that support modern compute needs.

United States Compute Express Link (CXL) Component Market generated USD 190.8 million in 2024 and is forecast to grow at a CAGR of 25.1% through 2034. Expansion of cloud services and demand for advanced computing and data processing are driving growth. In addition, continued data center buildouts and upgrades in the U.S. are fueling demand for high-speed interconnect technologies like CXL to support evolving performance and scalability needs.

Key industry players in the Global Compute Express Link (CXL) Component Market include Intel Corporation, Advanced Micro Devices, Inc. (AMD), Samsung Electronics Co., Ltd, Micron Technology, Inc., SK hynix Inc., Rambus Inc., Cadence Design Systems, Inc., Montage Technology Co., Ltd., Astera Labs, Mobiveil, Inc., Marvell Technology, Inc., and Synopsys, Inc. Leading companies in the CXL component market are prioritizing collaboration on open industry standards, strategic partnerships, and product innovation to deepen their market presence. Many are forging alliances with hyperscale data center operators and cloud providers to validate CXL designs and ensure interoperability. R&D investments are focused on enhancing speed, power efficiency, and integration capabilities, especially in SoC-embedded CXL solutions. Firms are also leveraging mergers and acquisitions to broaden their portfolio and technological access. Expanding global manufacturing capabilities and aligning with data center infrastructure roll-outs allow providers to scale with demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising Demand for Memory Disaggregation

- 3.3.1.2 Acceleration of AI and Machine Learning Workloads

- 3.3.1.3 Adoption of CXL-Compatible Server Platforms

- 3.3.1.4 Emergence of CXL 2.0 and 3.0 Standards

- 3.3.1.5 Growth in Hyperscale and HPC Infrastructure

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Cost and Supply Chain Complexity

- 3.3.2.2 Software and Ecosystem Readiness Lag

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 CXL switches

- 5.3 Memory expanders

- 5.4 Controllers

- 5.5 Retimers

- 5.6 Network interface card

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form Factor, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Add-in card

- 6.3 Enterprise and datacenter standard form factor

- 6.4 SoC integrated

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Memory-pooling

- 7.3 Accelerators

- 7.4 Tiered memory architecture

- 7.5 Composable infrastructure

- 7.6 High-speed interconnect

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Workload, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 AI/ML

- 8.3 High performance computing

- 8.4 Data analytics

- 8.5 Cloud computing

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Telecom

- 9.3 Finance

- 9.4 Healthcare

- 9.5 Oil & Gas

- 9.6 Aerospace

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Infrastructure, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 CSP/Hyperscalers

- 10.3 Neoclouds

- 10.4 Enterprise datacenters

- 10.5 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Advanced Micro Devices, Inc. (AMD)

- 12.2 Astera Labs

- 12.3 Cadence Design Systems, Inc.

- 12.4 Intel Corporation

- 12.5 Marvell Technology, Inc.

- 12.6 Micron Technology, Inc.

- 12.7 Microchip Technology Inc.

- 12.8 Mobiveil, Inc.

- 12.9 Montage Technology Co., Ltd.

- 12.10 Rambus Inc.

- 12.11 Samsung Electronics Co., Ltd

- 12.12 SK hynix Inc.

- 12.13 Synopsys, Inc.