PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797724

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797724

Digital Mammography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

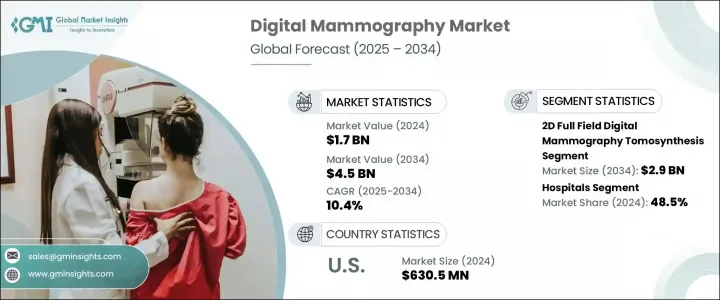

The Global Digital Mammography Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 4.5 billion by 2034. This market is growing rapidly, driven by the increasing incidence of breast cancer worldwide, heightened awareness about early detection, proactive government initiatives, and advancements in imaging technology. Digital mammography allows healthcare providers to capture high-resolution images of breast tissue, which aids in early detection and diagnosis of breast cancer. This technology is widely used in clinical environments such as hospitals, diagnostic centers, and specialty clinics. Leading companies in the sector include GE Healthcare, Hologic, Siemens Healthineers, Fujifilm Holdings, and Koninklijke Philips. The market primarily focuses on devices such as full-field digital mammography (FFDM) and 3D tomosynthesis systems, which improve diagnostic accuracy, reduce radiation exposure, and enhance patient outcomes.

The adoption of digital and AI-powered mammography systems has seen a significant rise, aided by government-supported screening programs and continuous advancements in imaging technology. With a growing emphasis on patient-centered care in the healthcare industry, digital mammography is becoming the preferred choice due to its higher image accuracy, reduced diagnostic errors, and enhanced patient comfort. Additionally, the rising prevalence of breast cancer underscores the need for early and accurate detection to improve clinical outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 10.4% |

In 2024, 2D full-field digital mammography tomosynthesis segment was valued at USD 1.1 billion and is expected to grow at a CAGR of 10.2%, to reach USD 2.9 billion by 2034. This technology is integral to breast cancer diagnosis, providing high-resolution digital images that help radiologists detect subtle abnormalities such as microcalcifications and small masses. The increased use of integrated imaging solutions, AI-driven diagnostics, and comprehensive breast cancer screening programs is contributing to the growth of this segment. Enhanced clarity of images helps detect early-stage breast cancer, improving the chances of successful intervention and patient outcomes.

The hospitals segment held 48.5% share in 2024. The hospital segment holds the largest share due to its advanced imaging infrastructure and the presence of skilled radiologists who play a vital role in breast cancer screening and diagnosis. Hospitals are central to breast cancer treatment, which drives the demand for multimodal imaging systems and AI-integrated digital mammography. Furthermore, the development of healthcare infrastructure in emerging markets, especially in regions like Asia-Pacific, the Middle East, and Africa, is accelerating the adoption of advanced mammography technologies within hospital settings, including both 2D and 3D tomosynthesis systems.

U.S. Digital Mammography Market was valued at USD 630.5 million in 2024, with growth largely driven by the increasing prevalence of breast cancer in the country. As the demand for early and accurate breast cancer detection rises, the need for advanced diagnostic tools like digital mammography is growing. This trend significantly contributes to the market's expansion in the U.S.

The key players in the Digital Mammography Market include Siemens Healthineers, GE Healthcare, Koninklijke Philips, Fujifilm Holdings, and Hologic. To strengthen their market position, companies in the digital mammography industry are focusing on a few key strategies. One approach is the continuous innovation of imaging technologies, such as the integration of artificial intelligence (AI) into mammography systems to enhance diagnostic accuracy and speed. Another strategy involves forming partnerships with healthcare providers and organizations to expand the reach of their products and services. Many companies are also investing in developing more user-friendly, patient-centric solutions that reduce discomfort during screenings, which is a growing concern for patients. Additionally, companies are working on expanding their market share by targeting emerging markets, particularly in regions where healthcare infrastructure is rapidly developing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of breast cancer across the globe

- 3.2.1.2 Growing awareness regarding early breast cancer detection

- 3.2.1.3 Rising government initiatives and screening programs

- 3.2.1.4 Technological advancements in digital mammography

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment and maintenance

- 3.2.2.2 Radiation exposure concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of AI-powered predictive monitoring tools and AI integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Future market trends

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.9 Patent analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 2D full field digital mammography tomosynthesis

- 5.3 3D full field digital mammography tomosynthesis

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Specialty clinics

- 6.4 Diagnostic centers

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Allengers

- 8.2 Canon

- 8.3 Carestream

- 8.4 Fujifilm Holdings

- 8.5 GE Healthcare

- 8.6 Genoray

- 8.7 Hologic

- 8.8 IDETEC Medical Imaging

- 8.9 IMS Giotto

- 8.10 Koninklijke Philips

- 8.11 Planmed

- 8.12 Siemens Healthineers

- 8.13 SINO MDT

- 8.14 SternMed

- 8.15 Trivitron Healthcare

- 8.16 Vannin Healthcare