PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797730

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797730

Asphalt Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

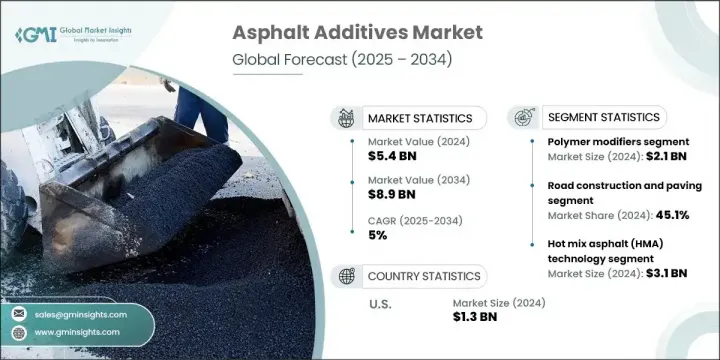

The Global Asphalt Additives Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 8.9 billion by 2034. As large-scale infrastructure projects increase worldwide, demand continues to rise for asphalt solutions that offer durability, sustainability, and cost-effectiveness. Additives such as rejuvenators, anti-stripping agents, and polymer modifiers are increasingly used to enhance asphalt mixtures by improving resistance to rutting, cracking, and moisture-related damage. Governments are turning to these materials as they seek to extend the lifespan of roads while keeping long-term maintenance budgets under control.

Environmental mandates are shaping innovation in this sector, as lower-temperature mixing technologies and greater use of recycled materials become standard. Asphalt additives are gaining traction not only for their performance benefits but also for their environmental advantages, including lower emissions and reduced energy usage. The rise of bio-based and nano-modified alternatives further aligns with global goals for greener construction practices. North America remains the leading market, backed by modern infrastructure and progressive construction policies. Meanwhile, Europe is rapidly advancing in this space as it enforces sustainability-focused construction standards and emphasizes circular economy models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 billion |

| Forecast Value | $8.9 billion |

| CAGR | 5% |

The polymer modifiers segment generated USD 2.1 billion in 2024. Their continued dominance in asphalt enhancement stems from the ability to boost elasticity and strength while resisting deformation under intense traffic and severe weather. These additives blend seamlessly into existing asphalt formulations and help roads maintain long-term performance with minimal disruption.

The road construction and paving segment represented a 45.1% share in 2024. The sector's growth reflects increased demand for long-lasting, high-performance roads that can withstand both heavy traffic loads and shifting weather patterns. Use of polymer-modified and anti-stripping additives remains essential for delivering surface durability and crack resistance in new urban roadways and highway infrastructure projects.

United States Asphalt Additives Market generated USD 1.3 billion in 2024. The region continues to lead thanks to its robust road systems, clear regulatory direction, and rising public and private sector investment in transportation upgrades. Research and innovation efforts in the country are focused on developing sustainable, high-performance materials that lower maintenance requirements while enhancing infrastructure resilience. This trend is largely driven by the urgent need for climate-adapted road networks and environmentally conscious construction materials, including warm mix technologies and next-generation polymer formulations.

The Asphalt Additives Market shows moderate consolidation, with leading companies such as BASF SE, Arkema Group, Evonik Industries AG, Ingevity Corporation, and DuPont de Nemours, Inc. playing a major role in the sector. Leading firms in the asphalt additives space are investing in sustainable product innovation, focusing on the development of low-VOC, bio-based, and warm mix-compatible additives. These companies are actively expanding R&D capabilities to address the growing demand for climate-resilient road infrastructure. Many are forming partnerships with infrastructure developers and government agencies to pilot advanced additive formulations that meet environmental guidelines and improve road longevity. Geographic expansion remains a core strategy, with companies targeting emerging markets through distribution partnerships and local production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo tons)

- 5.1 Key trends

- 5.2 Polymer modifiers

- 5.2.1 Styrene-butadiene-styrene (sbs)

- 5.2.2 Styrene-butadiene rubber (sbr)

- 5.2.3 Ethylene vinyl acetate (eva)

- 5.2.4 Polyethylene and polypropylene

- 5.2.5 Other polymer modifiers

- 5.3 Anti-stripping agents

- 5.3.1 Amine-based agents

- 5.3.2 Lime-based agents

- 5.3.3 Phosphoric acid derivatives

- 5.3.4 Organosilane compounds

- 5.4 Emulsifiers and surfactants

- 5.4.1 Anionic emulsifiers

- 5.4.2 Cationic emulsifiers

- 5.4.3 Non-ionic emulsifiers

- 5.5 Warm mix asphalt additives

- 5.5.1 Wax-based additives

- 5.5.2 Chemical-based additives

- 5.5.3 Foaming additives

- 5.6 Rejuvenators and recycling agents

- 5.7 Nanomaterial additives

- 5.7.1 Nanosilica

- 5.7.2 Nanoclay

- 5.7.3 Carbon nanotubes

- 5.7.4 Graphene and graphene oxide

- 5.8 Bio-based and sustainable additives

- 5.9 Other specialty additives

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo tons)

- 6.1 Key trends

- 6.2 Road construction and paving

- 6.2.1 Highway construction

- 6.2.2 Urban road development

- 6.2.3 Rural road infrastructure

- 6.3 Road maintenance and rehabilitation

- 6.3.1 Surface treatments

- 6.3.2 Overlay applications

- 6.3.3 Crack sealing and repair

- 6.4 Airport runway construction

- 6.5 Roofing applications

- 6.5.1 Commercial roofing

- 6.5.2 Residential roofing

- 6.5.3 Industrial roofing

- 6.6 Waterproofing and sealing

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo tons)

- 7.1 Key trends

- 7.2 Hot mix asphalt (hma) technology

- 7.3 Warm mix asphalt (wma) technology

- 7.4 Cold mix asphalt technology

- 7.5 Half-warm mix asphalt technology

- 7.6 Recycling technologies

- 7.6.1 Hot in-place recycling

- 7.6.2 Cold in-place recycling

- 7.6.3 Plant-based recycling

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 United Kingdom

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema Group

- 9.2 BASF SE

- 9.3 DuPont de Nemours, Inc.

- 9.4 Evonik Industries AG

- 9.5 Nouryon (formerly AkzoNobel Specialty Chemicals)

- 9.6 Ingevity Corporation

- 9.7 Kraton Corporation

- 9.8 Honeywell International Inc.

- 9.9 The Dow Chemical Company

- 9.10 Sasol Limited