PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797731

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797731

Europe Electric Bus Charging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

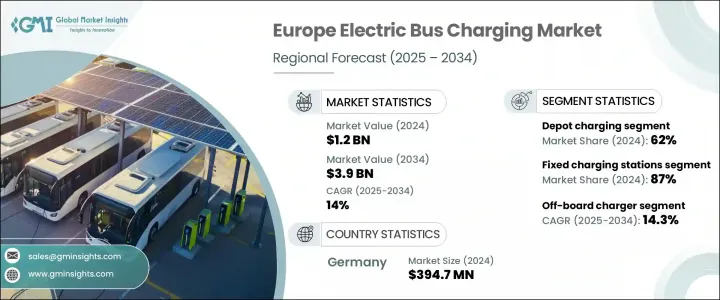

Europe Electric Bus Charging Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 14% to reach USD 3.9 billion by 2034. As public transportation systems shift rapidly toward electrification, electric bus charging is evolving beyond a basic utility function into a strategic component of future urban mobility. The increasing rollout of smart grid-enabled infrastructure, integration of vehicle-to-grid (V2G) capabilities, and automation at depots have redefined the market landscape. Operators are now required to possess not only technical knowledge in charging optimization and energy management but also competencies in city infrastructure and transit planning, pushing the demand for skilled labor and specialized workforce training.

The EU's post-pandemic recovery strategy, underpinned by the Green Deal, has intensified investment in zero-emission transport solutions. This shift is fast-tracking the adoption of electric bus fleets and their supporting charging networks. To keep pace, there's a strong demand for hybrid education models that combine hands-on instruction with scenario-based simulations. Specialized training programs are now being developed for high-capacity charging systems, including pantograph-based and fast-charging infrastructure. Upskilling in areas such as real-time energy monitoring, charger interconnectivity, and local grid load planning is crucial for ensuring seamless operation across increasingly complex fleet networks. Municipalities across Europe are actively backing initiatives to develop qualified personnel to support scalable, grid-compliant charging setups for urban and long-distance routes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 14% |

In 2024, the depot charging segment held a 62% share and is projected to grow at a CAGR of 14.8% through 2034. This form of charging remains the preferred model for fleet operators due to its reliability, cost-effectiveness, and operational efficiency. With charging typically taking place overnight or during scheduled downtimes at bus depots, the system offers convenience without interfering with daily transit schedules. Major solution providers like Heliox, Siemens, and ABB are enabling operators to implement intelligent load management systems and scheduling platforms, helping cities manage large-scale fleet electrification with ease and flexibility.

The fixed charging station segment held 87% share in 2024 and is expected to grow at a CAGR of 14.7% during 2034. These permanent charging infrastructures form the backbone of electric fleet operations, enabling consistent and scalable deployment across both public transit systems and private operators. Fixed stations typically serve high-demand depots or terminal points and are optimized for high-power, scheduled charging. Prominent manufacturers, including ABB, Heliox, and Siemens, are rolling out sophisticated fixed charging networks integrated with energy management and smart grid technologies, especially in transit-focused cities across Western Europe.

Germany Electric Bus Charging Market generated USD 394.7 million in 2024 and captured 56.3% share. The country's dominance stems from strong legislative support for decarbonized transport, technological leadership in automation and manufacturing, and a highly organized network of automotive OEMs and energy firms. With major urban centers like Berlin, Hamburg, and Munich actively electrifying their bus fleets, Germany continues to be a hub for both innovation and deployment of EV charging infrastructure. The presence of key players, including Ekoenergetyka, Siemens, and MAN Truck & Bus, further consolidates its market leadership and accelerates project scalability across federal and municipal levels.

Top manufacturers actively shaping the electric bus charging ecosystem in Europe include ChargePoint, Alstom, Heliox, Proterra, Furrer + Frey, Momentum Dynamics, IES Synergy, Ekoenergetyka, ABB, and Siemens. These companies are leveraging advanced engineering, local partnerships, and long-term contracts to expand their network reach across the continent. To solidify their position in the growing Europe electric bus charging market, companies are employing a range of forward-focused strategies. Leading players are investing in R&D to develop modular, grid-responsive charging systems capable of managing high loads with intelligent distribution. Strategic alliances with public transport authorities and energy providers are enabling large-scale deployments tailored to local infrastructure. Companies are also focusing on regional expansion by establishing service hubs, maintenance networks, and training programs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Charging

- 2.2.3 Deployment Mode

- 2.2.4 Charging Infrastructure

- 2.2.5 Bus

- 2.2.6 Power Output

- 2.2.7 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of electric bus manufacturing

- 3.2.1.2 Integration with renewable energy

- 3.2.1.3 Energy efficiency and cost savings

- 3.2.1.4 Advancements in fast charging technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront infrastructure costs

- 3.2.2.2 Grid capacity constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Pantograph and opportunity charging expansion

- 3.2.3.2 Rural and intercity expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Charging stations, 2021 -2024

- 3.9.1 Western Europe

- 3.9.2 Eastern Europe

- 3.9.3 Northern Europe

- 3.9.4 Southern Europe

- 3.10 Electric bus statistics, 2021 -2024

- 3.10.1 Production

- 3.10.2 Sales

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 UK

- 4.2.2 Germany

- 4.2.3 France

- 4.2.4 Italy

- 4.2.5 Spain

- 4.2.6 Denmark

- 4.2.7 Sweden

- 4.2.8 Norway

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Depot charging

- 5.3 Opportunity charging

- 5.4 Inductive charging

- 5.5 Pantograph charging

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fixed charging stations

- 6.3 Mobile charging units

Chapter 7 Market Estimates & Forecast, By Charging Infrastructure, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Onboard charger

- 7.3 Offboard charger

Chapter 8 Market Estimates & Forecast, By Bus, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Battery electric bus

- 8.3 Plug-in-hybrid bus

Chapter 9 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Below 50 kWh

- 9.3 50-150 kWh

- 9.4 150-300 kWh

- 9.5 Above 300 kWh

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Public transport

- 10.3 Private or institutional fleets

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 11.1 Key trends

- 11.2 Western Europe

- 11.2.1 Germany

- 11.2.2 Austria

- 11.2.3 France

- 11.2.4 Switzerland

- 11.2.5 Belgium

- 11.2.6 Luxembourg

- 11.2.7 Netherlands

- 11.2.8 Portugal

- 11.3 Eastern Europe

- 11.3.1 Poland

- 11.3.2 Romania

- 11.3.3 Czechia

- 11.3.4 Slovenia

- 11.3.5 Hungary

- 11.3.6 Bulgaria

- 11.3.7 Slovakia

- 11.3.8 Croatia

- 11.4 Northern Europe

- 11.4.1 UK

- 11.4.2 Denmark

- 11.4.3 Sweden

- 11.4.4 Finland

- 11.4.5 Norway

- 11.5 Southern Europe

- 11.5.1 Italy

- 11.5.2 Spain

- 11.5.3 Greece

- 11.5.4 Bosnia and Herzegovina

- 11.5.5 Albania

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.2 ABB

- 12.2.1 Siemens

- 12.2.2 Heliox BV

- 12.2.3 Schunk Transit Systems

- 12.3 European companies

- 12.3.1 Alstom

- 12.3.2 Schneider Electric

- 12.3.3 Enel X

- 12.3.4 Fortum

- 12.4 Bus manufacturers with integrated charging solutions

- 12.4.1 Volvo Group

- 12.4.2 BYD Europe

- 12.4.3 Solaris Bus & Coach

- 12.4.4 VDL Bus 7 Coach

- 12.5 Regional and specialized companies

- 12.5.1 Ebusco

- 12.5.2 Irizar

- 12.5.3 Hess

- 12.6 Energy management specialist companies

- 12.6.1 Iberdrola

- 12.6.2 Orsted

- 12.6.3 Engie

- 12.6.4 Kempower

- 12.6.5 JEMA Energy

- 12.6.6 Efacec Power Solutions

- 12.7 Emerging companies

- 12.7.1 Wireless Advanced Vehicle Electrification (WAVE)

- 12.7.2 Electreon Wireless

- 12.7.3 InductEV