PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797733

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797733

Minimally Invasive Spine Surgery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

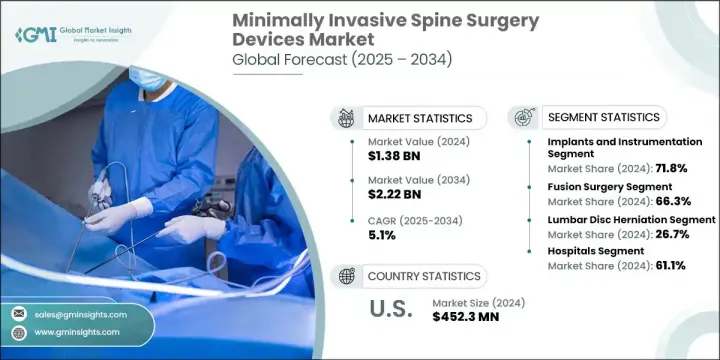

The Global Minimally Invasive Spine Surgery Devices Market was valued at USD 1.38 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 2.22 billion by 2034. The growing preference for minimally invasive spine surgery devices is fueled by the advantages of smaller incisions, shorter hospital stays, and quicker recovery periods. These procedures are less painful and reduce scarring, making them increasingly favored by patients. Advances in medical imaging and navigation technology have enhanced surgical accuracy, contributing to safer procedures and wider adoption.

As demand for minimally invasive spinal surgeries increases, the market continues to grow, supported by an aging population and rising spinal disorders. Aging populations worldwide are experiencing higher incidences of conditions like degenerative disc disease, spinal stenosis, and herniated discs, which often require surgical intervention. Additionally, lifestyle factors such as sedentary habits and increased physical strain contribute to the prevalence of spinal issues across all age groups. With patients and healthcare providers recognizing the benefits of minimally invasive techniques-such as reduced trauma, less blood loss, and quicker rehabilitation-the preference for these procedures is steadily climbing. Furthermore, advancements in surgical technology and growing access to high-quality healthcare facilities in emerging regions are broadening the patient base. As awareness improves and insurance coverage expands for these procedures, the market is expected to accelerate further, driven by both demographic shifts and medical innovations. This trend underscores a sustained demand for devices that facilitate safer, more efficient spinal surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.38 Billion |

| Forecast Value | $2.22 Billion |

| CAGR | 5.1% |

In 2024, implants and instrumentation segment accounted for 71.8% share, driven by the increasing use of advanced spinal fixation systems and implants designed to improve surgical precision and patient recovery. Surgeons prefer these devices due to their ability to enhance stability, reduce intraoperative complications, and support quicker healing. The growing integration of navigation-assisted instruments, interbody cages, and robotic-assisted technologies is also boosting the adoption of this segment.

The fusion surgery segment held 66.3% share in 2024, propelled by the rising prevalence of degenerative disc diseases, spinal stenosis, and spondylolisthesis, which require spinal stabilization. Minimally invasive fusion techniques are gaining popularity among patients and surgeons alike because they minimize tissue damage and accelerate recovery. Innovations in fusion devices, including better bone graft materials and enhanced interbody cages, have significantly improved surgical success rates and broadened their use across outpatient and hospital environments.

North America Minimally Invasive Spine Surgery Devices Market held 35.3% share in 2024, owing to its robust healthcare infrastructure that encourages swift adoption of cutting-edge surgical methods and devices. High patient and physician awareness regarding the benefits of minimally invasive procedures fuels demand. Furthermore, the region's concentration of key medical device manufacturers fosters ongoing innovation and ensures wide product availability.

Notable companies operating in the Minimally Invasive Spine Surgery Devices Market include Heraeus, Orthofix Medical, Globus Medical, SI-BONE, Invibio, Wenzel Spine, Xenco Medical, Matexcel, Premia Spine, B. Braun, Medtronic, DePuy Synthes (Johnson & Johnson), Spinal Elements, Nexus Spine, Stryker, Zimmer Biomet, NuVasive, and Evonik. Companies in the Minimally Invasive Spine Surgery Devices Market strengthen their foothold by focusing on continuous innovation and expanding their product portfolios with advanced implants, navigation tools, and robotic-assisted solutions. Strategic collaborations with hospitals and research institutions help improve device efficacy and surgeon training. Many firms invest heavily in R&D to develop patient-centric solutions that enhance surgical outcomes and reduce complications. Expanding geographic reach, particularly into emerging markets, is also a priority to tap into growing demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Indication trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of spine disorders

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Increased adoption of outpatient spine surgeries

- 3.2.1.4 Technological advancements in navigation and robotics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced MISS equipment

- 3.2.2.2 Lack of skilled surgeons in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and augmented reality

- 3.2.3.2 Development of cost-effective MISS solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Consumer behaviour trend

- 3.8 Go-to-market strategy analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Gap analysis

- 3.13 Pricing analysis, 2024

- 3.14 Patent Landscape

- 3.15 Reimbursement scenario

- 3.15.1 Impact of reimbursement policies on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants and instrumentation

- 5.2.1 Pedicle screws and rods

- 5.2.2 Interbody cages

- 5.2.3 Fixation systems

- 5.2.4 Other implants and instrumentations

- 5.3 Biomaterials

- 5.3.1 Bone graft substitutes

- 5.3.2 Synthetic bone grafts

- 5.3.3 Other biomaterials

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fusion surgery

- 6.3 Non-fusion surgery

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Lumbar disc herniation

- 7.3 Spinal stenosis

- 7.4 Degenerative spinal disease

- 7.5 Cervical disc disorders

- 7.6 Thoracic disc herniation

- 7.7 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 B. Braun

- 10.2 DePuy Synthes (Johnson & Johnson)

- 10.3 Evonik

- 10.4 Globus Medical

- 10.5 Heraeus

- 10.6 Invibio

- 10.7 Matexcel

- 10.8 Medtronic

- 10.9 Nexus Spine

- 10.10 NuVasive

- 10.11 Orthofix Medical

- 10.12 Premia Spine

- 10.13 SI-BONE

- 10.14 Spinal Elements

- 10.15 Stryker

- 10.16 Wenzel Spine

- 10.17 Xenco Medical

- 10.18 Zimmer Biomet