PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797743

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797743

Europe Connected Car Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

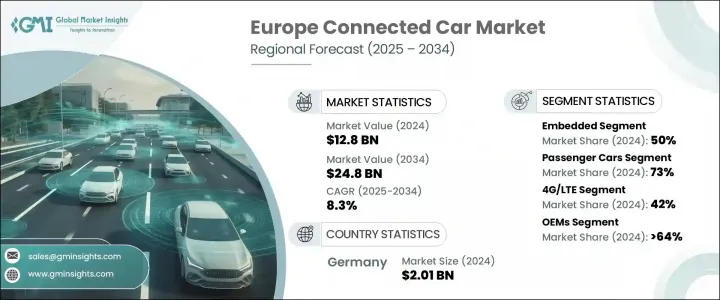

Europe Connected Car Market was valued at USD 12.8 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 24.8 billion by 2034.Europe Connected Car Market was valued at USD 12.8 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 24.8 billion by 2034. Rapid growth in this space is being driven by expanding 5G coverage, increasing electric vehicle (EV) adoption, and rising demand for integrated digital features that enhance safety and performance. Automakers are focusing on seamless experiences through features like remote diagnostics, live traffic updates, and software upgrades delivered over-the-air. Backed by supportive digital strategies and advancing regulations for vehicle-to-everything (V2X) communication, Europe is positioning itself as a leader in connected mobility innovation.

The region is also investing heavily in cybersecurity, real-time analytics, and fleet intelligence systems, as manufacturers and tech companies work together to redefine the automotive experience. With businesses embracing connected technologies for predictive maintenance, energy optimization, and compliance, the demand for these solutions continues to grow. In commercial mobility, telematics-based services are gaining adoption, especially within electric fleet operations. As automakers prioritize personalization, remote feature access, and subscription-based services, collaborations with software providers and platform developers are expanding across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.8 Billion |

| Forecast Value | $24.8 Billion |

| CAGR | 8.3% |

In 2024, the embedded segment held a 50% share and is anticipated to grow at a CAGR of 9% from 2025 to 2034. This category leads due to its built-in connectivity, secure data handling, and full compliance with EU regulations. Embedded solutions offer real-time connectivity and robust integration capabilities that align with the complex needs of electric and autonomous vehicles. These systems are preferred by OEMs for supporting continuous data exchange, ensuring user safety, and enhancing driver engagement. As regulatory frameworks around vehicle data and road safety tighten, embedded platforms have become essential in delivering future-proof connected mobility solutions.

The passenger vehicles segment held a 73% share in 2024 and is projected to grow at a CAGR of 8% through 2034. Growing consumer interest in infotainment, high-end safety systems, and consistent in-car connectivity is fueling this trend. Automotive brands across Europe are integrating advanced features to stay ahead in a competitive environment shaped by digital transformation. Enhanced vehicle software, seamless updates, and interactive ecosystems are becoming central to product offerings, especially in the mainstream passenger car segment. Automakers are embedding user-centric digital services to align with evolving preferences and EU standards on digital access and vehicle intelligence.

Germany Connected Car Market held a 43% share and generated USD 2.01 billion in 2024. The country's leadership is backed by a strong automotive manufacturing base and favorable policies that support testing and deployment of smart mobility systems. Its regulatory environment encourages the development of telematics and V2X communications. Public-private programs are accelerating the adoption of advanced transportation technologies, making Germany a leading testing ground for next-gen mobility platforms. The country's strategic investments in digital infrastructure are reinforcing its status as a critical hub for Europe's evolving connected vehicle ecosystem.

Key players contributing to the Europe Connected Car Market include Tesla, BMW Group, Stellantis N.V., Hyundai Motor Company, Mercedes-Benz Group, Renault Group, and Volkswagen Group. Leading automotive firms in Europe are advancing their market presence through the strategic integration of AI, cloud, and telematics technologies into vehicle platforms. These companies are collaborating closely with software providers and mobility tech startups to accelerate innovation in embedded systems, infotainment, and vehicle connectivity. Many are investing in proprietary operating systems to offer seamless user experiences and reduce dependence on third-party platforms. Strong emphasis is being placed on over-the-air upgrade capabilities, cybersecurity architecture, and data monetization models.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Connectivity

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased consumer focus on driver and pedestrian safety

- 3.2.1.2 Expansion of 5G and V2X communication

- 3.2.1.3 Growth in electric and autonomous vehicles

- 3.2.1.4 Growing consumer preference for in-car digital experience

- 3.2.1.5 Fleet management and telematics adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 High infrastructure investment requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Enhanced in-car infotainment and personalization

- 3.2.3.2 Smart city infrastructure integration

- 3.2.3.3 Vehicle-to-everything (V2X) communication

- 3.2.3.4 5G network expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Sustainability and environmental aspects

- 3.8.1 Sustainable practices

- 3.8.2 Waste reduction strategies

- 3.8.3 Energy efficiency in production

- 3.8.4 Eco-friendly Initiatives

- 3.8.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northern Europe

- 4.2.2 Western Europe

- 4.2.3 Southern Europe

- 4.2.4 Eastern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Embedded

- 5.3 Tethered

- 5.4 Integrated

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light-duty

- 6.3.2 Medium-duty

- 6.3.3 Heavy-duty

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Navigation

- 7.3 Infotainment

- 7.4 Telematics

- 7.5 Remote diagnostics

- 7.6 Safety and security

- 7.7 Fleet management

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 5G

- 8.3 4G/LTE

- 8.4 3G

- 8.5 Wi-Fi

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 France

- 10.2.3 Netherlands

- 10.2.4 Belgium

- 10.2.5 Switzerland

- 10.2.6 Austria

- 10.2.7 Luxembourg

- 10.2.8 Liechtenstein

- 10.2.9 Ireland

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Czech Republic

- 10.3.3 Portugal

- 10.3.4 Serbia

- 10.3.5 Albania

- 10.3.6 Slovakia

- 10.3.7 Romania

- 10.3.8 Slovenia

- 10.3.9 Bulgaria

- 10.3.10 Estonia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Norway

- 10.4.5 Iceland

- 10.4.6 Faroe Islands

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Vatican City

- 10.5.4 San Marino

- 10.5.5 Greece

- 10.5.6 Cyprus

Chapter 11 Company Profiles

- 11.1 Automotive OEMs

- 11.1.1 BMW Group

- 11.1.2 Ford Motors

- 11.1.3 General Motors

- 11.1.4 Mercedes Benz

- 11.1.5 Renault Group

- 11.1.6 Stellantis

- 11.1.7 Tesla

- 11.1.8 Toyota Motors

- 11.1.9 Volkswagen

- 11.1.10 Volvo

- 11.2 Regional players

- 11.2.1 Aston Martin

- 11.2.2 Ferrari NV

- 11.2.3 Geely (Volvo, Polestar)

- 11.2.4 McLaren Automotive

- 11.2.5 SAIC Motors

- 11.2.6 Tata Motors (Jaguar Land Rover)

- 11.3 Emerging players

- 11.3.1 BYD

- 11.3.2 Honda Motors

- 11.3.3 Hyundai Motors

- 11.3.4 Koenigsegg Automotive

- 11.3.5 NIO

- 11.3.6 Xpeng Motors