PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797752

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797752

Intelligent Battery Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

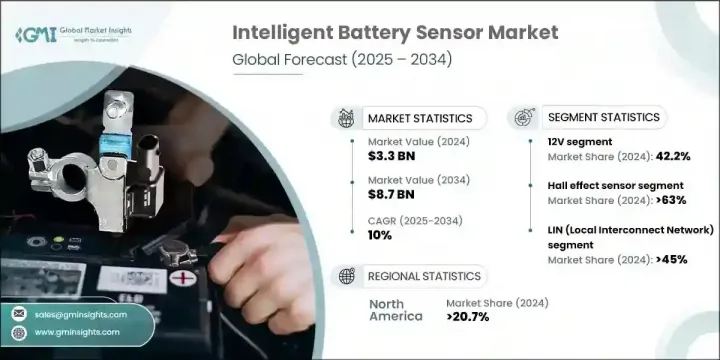

The Global Intelligent Battery Sensor Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 8.7 billion by 2034. The market's rapid growth is primarily fueled by the increasing adoption of electric and hybrid vehicles, as well as the rise of connected and autonomous automotive systems that require advanced power management solutions. Stringent emission regulations and a global push for enhanced fuel efficiency further accelerate demand. Additionally, the aerospace industry's shift towards electrification is driving the need for more sophisticated battery management systems that improve safety, real-time monitoring, and system performance.

The industry is also experiencing significant move toward multi-parameter sensors that integrate voltage, current, and temperature monitoring within a single compact device. This consolidation not only simplifies the sensor architecture but also enhances overall system performance by providing real-time, comprehensive data from one source. These advanced sensors improve energy management accuracy, reduce wiring complexity, and lower installation costs, all while boosting reliability and responsiveness in battery management systems. By combining multiple measurement capabilities into one streamlined unit, manufacturers can deliver smarter, more efficient solutions that meet the increasing demands of modern electric and hybrid vehicles, as well as aerospace applications where space and weight savings are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 10% |

In 2024, the hall-effect sensors segment held a 63% share and is expected to maintain growth at a CAGR of 9.7% through 2034. Their non-contact current measurement capability, high accuracy, and reliability in tough environments make them a preferred choice over traditional shunt-based sensors. These sensors provide automotive manufacturers and battery management system suppliers with the tools necessary to meet the evolving demands of electrified drivetrains.

The 12V segment held a 42.2% share in 2024, driven by the prevalence of internal combustion engine vehicles and mild hybrids operating on 12V electrical systems. Manufacturers focusing on improving sensor accuracy and durability within the 12V architecture will be positioned well to maintain market share while advancing high-voltage technology development.

North America Intelligent Battery Sensor Market held 20.7% share in 2024, with the United States capturing 75% share. The increasing adoption of electric vehicles in the U.S., propelled by consumers seeking sustainable mobility, is a key driver for advanced battery management solutions. To strengthen their positions, manufacturers are urged to prioritize R&D efforts centered on AI-powered diagnostics, compact sensor designs, and enhanced thermal management. Supportive policies that ease collaboration between battery manufacturers and electric vehicle producers, along with incentives to localize key component production, are crucial for sustaining growth in this region.

Key players in the Global Intelligent Battery Sensor Market include Analog Devices, Inc., Continental AG, DENSO Corporation, ams OSRAM, Eberspacher, Furukawa Electric Co., Ltd., HELLA GmbH & Co. KGaA, Robert Bosch GmbH, General Motors (Delphi Technologies), and AVX Corporation. To strengthen their foothold in the intelligent battery sensor market, companies are focusing on innovation by integrating multiple sensing parameters into single compact units that reduce complexity and cost. They are investing heavily in research to enhance sensor accuracy, durability, and thermal management, which are critical for the demanding environments of electric vehicles and aerospace applications. Collaborations with automotive OEMs and battery manufacturers help tailor solutions to specific vehicle architectures and emerging technologies. Strategic regional expansions, especially in key markets with growing EV adoption, are also prioritized.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Sensor type

- 2.2.2 Sensor functionality

- 2.2.3 Voltage range

- 2.2.4 Technology

- 2.2.5 Battery type

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles

- 3.2.1.2 Expansion of autonomous and connected vehicles

- 3.2.1.3 Advancements in microcontrollers and sensor technology

- 3.2.1.4 Expansion of global aerospace industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs of IBS technology

- 3.2.2.2 Complexity in integration with existing vehicle systems

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for lightweight, smart battery components

- 3.2.3.2 Expansion of electric vehicle infrastructure and charging networks

- 3.2.3.3 Integration with IoT and connected vehicle technologies

- 3.2.3.4 Increasing government incentives for clean energy and EV adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Mn & Units)

- 5.1 Key trends

- 5.2 Hall effect sensor

- 5.3 Shunt sensor

Chapter 6 Market Estimates & Forecast, By Sensor Functionality, 2021-2034 (USD Mn & Units)

- 6.1 Key trends

- 6.2 Current monitoring sensors

- 6.3 Voltage monitoring sensors

- 6.4 Temperature monitoring sensors

- 6.5 Multi-parameter sensors (SOC/SOH)

Chapter 7 Market Estimates & Forecast, By Voltage Range, 2021-2034 (USD Mn & Units)

- 7.1 Key trends

- 7.2 12V

- 7.3 24V

- 7.4 36V and above

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Mn & Units)

- 8.1 Key trends

- 8.2 LIN (Local Interconnect Network)

- 8.3 CAN (Controller Area Network)

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Battery Type, 2021-2034 (USD Mn & Units)

- 9.1 Key trends

- 9.2 Lead-acid batteries

- 9.3 Lithium-ion batteries

- 9.4 Nickel-metal hydride batteries

- 9.5 Other battery types

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Mn & Units)

- 10.1 Key trends

- 10.2 State of charge measurement

- 10.3 State of health monitoring

- 10.4 Battery management systems

- 10.5 Energy recovery

- 10.6 Start-stop functions

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2021-2034 (USD Mn & Units)

- 11.1 Key trends

- 11.2 Automotive

- 11.3 Marine

- 11.4 Aerospace

- 11.5 Industrial

- 11.6 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Mn & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Netherlands

- 12.3.5 Spain

- 12.3.6 Italy

- 12.3.7 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 ams OSRAM

- 13.1.2 Analog Devices, Inc.

- 13.1.3 AVX Corporation

- 13.1.4 Bosch (Robert Bosch GmbH)

- 13.1.5 Continental AG

- 13.1.6 DENSO Corporation

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 General Motors

- 13.2.1.2 Littelfuse, Inc.

- 13.2.1.3 SENSATA Technologies

- 13.2.1.4 Johnson Controls International plc

- 13.2.2 Europe

- 13.2.2.1 HELLA GmbH & Co. KGaA

- 13.2.2.2 MTA S.p.A.

- 13.2.2.3 Valeo SA

- 13.2.3 Asia-Pacific

- 13.2.3.1 Hitachi Astemo, Ltd.

- 13.2.3.2 Hyundai Mobis

- 13.2.3.3 LG Innotek

- 13.2.3.4 Furukawa Electric Co., Ltd.

- 13.2.3.5 Murata Manufacturing Co., Ltd.

- 13.2.3.6 Panasonic Corporation

- 13.2.4 Niche Players/ Disruptors

- 13.2.4.1 Bascom Hunter

- 13.2.4.2 Eberspacher

- 13.2.4.3 Renesas Electronics Corporation

- 13.2.4.4 Lear Corporation

- 13.2.4.5 Infineon Technologies AG

- 13.2.4.6 STMicroelectronics

- 13.2.1 North America