PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797760

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797760

Bituminous Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

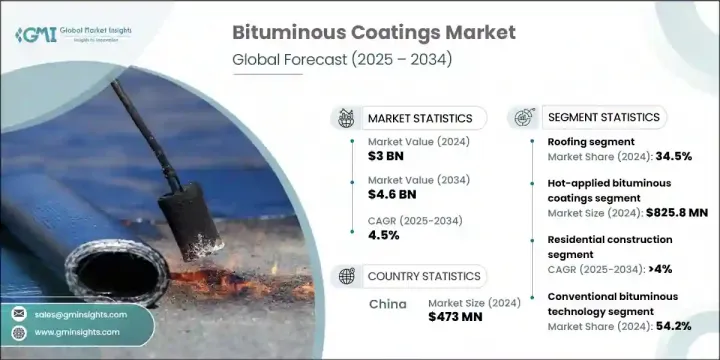

The Global Bituminous Coatings Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 4.6 billion by 2034. Over time, the industry has transitioned from traditional hot-applied bitumen systems to more advanced and sustainable coating solutions. Historically, high-temperature coatings were favored for their ability to withstand harsh environments in large infrastructure applications, but the market has since moved toward more efficient, environmentally friendly alternatives. Innovation has played a central role, with manufacturers introducing enhanced formulations like emulsions and thermoplastics that offer easier application and lower emissions.

This shift is largely driven by the increasing demand for long-lasting, versatile coatings that adapt to modern construction needs. As sustainability becomes a key factor in infrastructure development, the market is benefitting from continued investment in R&D to develop intelligent, high-performance bituminous products. The growing use of polymer-modified bitumen (PMB) and cold-applied emulsions in urban and residential projects is a direct response to changing construction standards, safety concerns, and climate adaptability. While hot-applied coatings remain a top choice for heavy-duty applications, newer technologies are reshaping the market dynamics across multiple global regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 4.5% |

The hot-applied bituminous coatings segment generated USD 825.8 million in 2024. Known for their strong adhesion, moisture resistance, and extended service life, these coatings are widely used in infrastructure projects like tunnels, foundations, and bridge decks, particularly in environments subject to mechanical wear or extreme weather. Their durability and cost-effectiveness continue to make them a reliable solution in civil engineering, especially in North America and parts of Asia.

The roofing segment held 34.5% share in 2024. Bituminous coatings are favored in this segment for their waterproofing capabilities, thermal insulation, and resistance to UV damage. These attributes make them ideal for both new construction and renovation projects, especially for flat and low-pitched roofs. Their ease of application and affordability contribute further to their dominance in both residential and commercial buildings.

China Bituminous Coatings Market generated USD 473 million and accounting for 40% share in 2024. The Asia Pacific region is the fastest-growing market, supported by massive investments in transport, telecommunications, sanitation, and power infrastructure. This rapid expansion-driven by urban growth and large-scale state-backed projects-continues to boost demand for bituminous coatings. Countries such as Vietnam, Indonesia, and India are also seeing strong momentum in infrastructure development, further fueling regional growth.

The competitive landscape of the Global Bituminous Coatings Market includes several major players, notably TotalEnergies SE, ExxonMobil Corporation, BASF SE, Sika AG, and Nynas AB. Companies in the bituminous coatings market are adopting a variety of strategies to reinforce their market position. A primary focus is on product innovation, with R&D investments targeted at creating eco-friendly formulations that lower emissions while maintaining durability. Many firms are transitioning toward cold-applied and polymer-modified solutions to meet changing environmental and safety standards. Strategic partnerships and collaborations with construction firms help improve product application and distribution efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Infrastructure Investment and Urbanization

- 3.2.1.2 Climate Change Adaptation and Extreme Weather Protection Needs

- 3.2.1.3 Energy Efficiency and Building Performance Requirements

- 3.2.1.4 Maintenance and Lifecycle Cost Optimization Demands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw Material Price Volatility and Cost Pressures

- 3.2.2.2 Environmental Regulations and Sustainability Requirements

- 3.2.2.3 Application Complexity and Skilled Labor Requirements

- 3.2.2.4 Competition from Alternative Waterproofing Technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hot-applied bituminous coatings

- 5.3 Cold-applied bituminous coatings

- 5.4 Polymer-modified bitumen (PMB) coatings

- 5.5 Bituminous emulsions

- 5.6 Self-adhesive bituminous systems

- 5.7 Bio-based and sustainable bituminous coatings

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Roofing

- 6.3 Waterproofing

- 6.4 Road and infrastructure

- 6.5 Industrial and protective coatings

- 6.6 Specialty applications

- 6.6.1 Parking deck coatings and traffic-bearing

- 6.6.2 Green roof systems and sustainable

- 6.6.3 Sports facility and recreational surface

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Single-family housing

- 7.2.2 Multi-family housing and apartment complex

- 7.2.3 Residential renovation and retrofit

- 7.3 Commercial construction

- 7.3.1 Office buildings and commercial real estate

- 7.3.2 Retail and shopping center

- 7.3.3 Hospitality and entertainment facility

- 7.3.4 Commercial renovation and maintenance

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities and industrial plants

- 7.4.2 Warehouse and distribution center

- 7.4.3 Energy and utility infrastructure

- 7.5 Industrial maintenance

- 7.5.1 Infrastructure and public works

- 7.5.2 Transportation infrastructure and highway

- 7.5.3 Water and wastewater treatment facilities

- 7.5.4 Government buildings and public facilities

- 7.6 Specialty end use

- 7.6.1 Healthcare facilities and hospital

- 7.6.2 Educational institutions and school buildings

- 7.6.3 Sports and recreation facilities

- 7.6.4 Emergency and disaster recovery

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Conventional bituminous technology

- 8.2.1 Traditional asphalt-based formulations

- 8.2.2 Standard application methods and equipment

- 8.3 Advanced polymer-modified technology

- 8.3.1 SBS (styrene-butadiene-styrene) modification systems

- 8.3.2 App (atactic polypropylene) modification technologies

- 8.3.3 Hybrid polymer systems and advanced formulations

- 8.4 Sustainable and bio-based technology

- 8.4.1 Bio-bitumen and plant-based alternative

- 8.4.2 Recycled content integration and circular economy solutions

- 8.4.3 Low-voc and environmentally friendly formulations

- 8.5 Smart and advanced technology

- 8.5.1 Self-healing and adaptive coating technologies

- 8.5.2 Nanotechnology-enhanced formulations

- 8.5.3 IOT-integrated monitoring and maintenance systems

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Carlisle Coatings & Waterproofing

- 10.3 ExxonMobil Corporation

- 10.4 GAF Materials Corporation

- 10.5 Graco Inc.

- 10.6 Johns Manville (Berkshire Hathaway)

- 10.7 Nynas AB

- 10.8 Owens Corning Corporation

- 10.9 Polyglass U.S.A., Inc

- 10.10 Shell Global Solutions

- 10.11 Sika AG

- 10.12 SOPREMA Group

- 10.13 Titan Tool Inc

- 10.14 Total Energies SE

- 10.15 Tremco Roofing and Building Maintenance

- 10.16 Polyguard Products, Inc

- 10.17 Sika AG

- 10.18 Soprema Group