PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797771

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797771

Sweet Biscuits Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

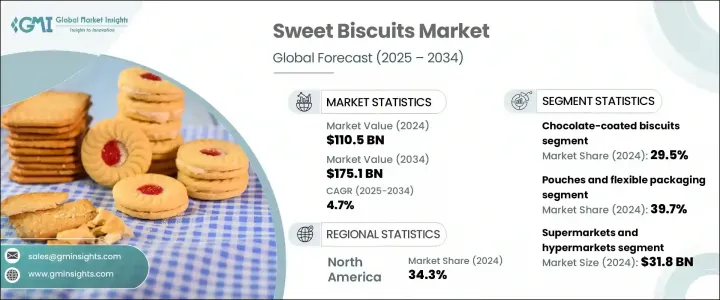

The Global Sweet Biscuits Market was valued at USD 110.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 175.1 billion by 2034. This growth is driven by a growing demand for flavorful, on-the-go snacks and urban lifestyles that increase disposable income and snacking frequency. As consumers demand more convenience without compromising taste, manufacturers are responding with innovative recipes, organic ingredients, and novel flavor combinations. Health concerns are reshaping the category, with surging interest in low-sugar, gluten-free, and functional biscuits fortified with probiotics, vitamins, and whole-food extracts. Product premiumization is accelerating in mature markets, while emerging regions in Asia and Africa offer rapid expansion potential driven by shifting dietary habits and increasing snack consumption.

Continued product diversification and alignment with health-conscious trends position the sweet biscuits industry for sustainable expansion, as manufacturers increasingly invest in developing low-sugar, high-fiber, gluten-free, and fortified variants to cater to shifting consumer lifestyles. These innovations, paired with growing demand for on-the-go and functional snacks, allow brands to reach broader demographics, including health-aware millennials, aging populations, and wellness-driven consumers. Furthermore, the incorporation of plant-based ingredients, natural sweeteners, and digestive health benefits into sweet biscuit formulations is reinforcing consumer loyalty while opening up new revenue streams across both mature and emerging markets."

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.5 Billion |

| Forecast Value | $175.1 Billion |

| CAGR | 4.7% |

The wafer biscuits segment generated USD 16.3 billion in 2024 and is expected to reach USD 24.5 billion by 2034, reflecting a CAGR of 4.2%. These light and crispy products are increasingly popular thanks to their layered texture and wide range of flavor options-such as fruit creams, chocolate, and vanilla. Manufacturers are enhancing appeal by adding functional ingredients like antioxidants, probiotics, fiber, and superfood extracts. As consumers seek healthier snacking options, these fortified wafers offer both indulgence and nutritional benefit.

The flexible packaging formats segment captured 39.7% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. These packaging formats deliver user-friendly advantages-lightweight, easy to open, resealable, and freshness-preserving, making them ideal for modern, fast-paced lifestyles. Traditional box packaging remains relevant but is being redesigned with eye-catching graphics and sustainable materials to attract attention on shelves and support eco-friendly branding.

North America Sweet Biscuits Market held 34.3% share in 2024 and is estimated to grow at a CAGR of 4% through 2034, which is underpinned by strong consumer purchasing power, health-driven innovation, and demand for premium and niche products. Meanwhile, Asia-Pacific region is experiencing rapid expansion thanks to accelerating urbanization, evolving eating habits, and heightened snack consumption in populous markets like India and China.

Leading players shaping the competitive sweet biscuits market include Ferrero Group, Mondelez International, Grupo Bimbo, Mars, Incorporation, and Nestle S.A. These companies continue to set the pace in innovation, branding, and distribution across global markets. Top firms in the sweets category are pursuing innovation by launching premium, health-forward products-such as low-sugar, gluten-free, and functional biscuits. They are investing in R&D to develop unique flavor profiles and incorporate nourishing ingredients like fiber, probiotics, and superfoods. Expanding their footprint in emerging markets through localized production and distribution provides growth opportunities. Partnerships with retail chains and food service platforms amplify visibility and reach. Brands are also enhancing packaging, transitioning to flexible, resealable, and sustainable formats. Marketing tactics emphasize ingredient transparency, clean-label credentials, and lifestyle alignment to build customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plain Sweet Biscuits

- 5.3 Chocolate-Coated Biscuits

- 5.4 Cream-Filled and Sandwich Biscuits

- 5.5 Wafer Biscuits

- 5.6 Healthy and Functional Biscuits

- 5.7 Breakfast Biscuits

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches and Flexible Packaging

- 6.3 Boxes

- 6.4 Jars and Containers

- 6.5 Individual Wrapping and Portion Control

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets and Hypermarkets

- 7.3 Convenience stores

- 7.4 E-commerce and online retail

- 7.5 Specialty food stores

- 7.6 Food service and Institutional sales

- 7.7 Traditional trade and Independent retailers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Mondelez International, Inc.

- 9.2 Nestle S.A.

- 9.3 Ferrero Group

- 9.4 Mars, Incorporated

- 9.5 Pladis (United Biscuits)

- 9.6 Britannia Industries Limited

- 9.7 Parle Products Pvt. Ltd.

- 9.8 ITC Limited

- 9.9 Grupo Bimbo

- 9.10 Lotus Bakeries

- 9.11 UNIBIC Foods India Pvt. Ltd.

- 9.12 Anmol Industries Ltd.

- 9.13 Bisk Farm (SAJ Food Products)

- 9.14 Burton's Biscuit Company

- 9.15 Walkers Shortbread Ltd.

- 9.16 Kellogg Company