PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797773

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797773

Ventilated Rainscreen Facade Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

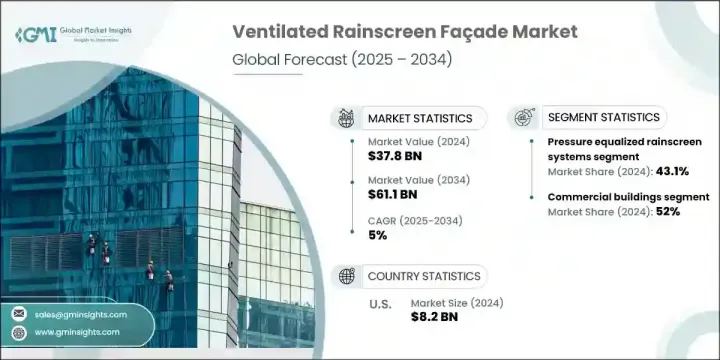

The Global Ventilated Rainscreen Facade Market was valued at USD 37.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 61.1 billion by 2034. The growing demand for energy-efficient construction and modern architectural design is reshaping the facade solutions landscape. Urbanization and the rapid growth of commercial infrastructure are fueling the need for sustainable building systems. Ventilated facade installations are gaining popularity due to their ability to offer thermal regulation, moisture management, and extended building durability. Industries such as education, hospitality, and commercial real estate are increasingly incorporating these systems to align with green building standards and environmental regulations. Aesthetic versatility combined with performance continues to drive consumer interest, especially where building envelope efficiency is prioritized.

To meet evolving design and performance demands, manufacturers are investing in next-generation materials, including aluminum composites, fiber cement, and high-pressure laminates, to ensure structural integrity and visual flexibility. These facades also support passive cooling strategies, helping reduce operational energy use in varied climate zones by lowering HVAC dependency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.8 Billion |

| Forecast Value | $61.1 Billion |

| CAGR | 5% |

In 2024, pressure-equalized rainscreen systems led the global market, representing 43.1% of total revenue, and are expected to grow at a 5.4% CAGR through 2034. These systems are preferred for their advanced moisture and air management capabilities, especially in high-rise and wind-exposed environments. Their internal cavity design allows for equalized air pressure, effectively minimizing water ingress. With the rise in infrastructure performance requirements, such solutions are becoming integral to modern design philosophies. Their capacity to protect insulation layers and maintain thermal stability contributes to long-term energy savings.

The commercial structures held the largest share of the market in 2024, accounting for 52% share, and are anticipated to grow at a CAGR of 5.4% during 2025-2034. The rise of high-efficiency and visually distinctive commercial properties is a major factor driving demand. Office towers, shopping centers, and mixed-use developments are opting for ventilated facade systems for their ability to improve indoor climate control and reduce overall energy usage. These systems enhance exterior appeal while boosting asset performance, making them a go-to option for densely occupied urban buildings. As cities evolve into business hubs, facades that deliver on both aesthetics and performance are increasingly vital to market competitiveness.

U.S. Ventilated Rainscreen FaASade Market held 76% share in 2024, generating USD 8.2 billion. This regional dominance is supported by advanced construction practices, stringent building codes, and a strong push for energy efficiency. High-performing facade solutions are widely adopted across commercial and institutional developments, driven by retrofitting initiatives and corporate green building investments. The region's resilient infrastructure needs, paired with a sophisticated manufacturing base, support the widespread integration of pressure-equalized facade systems. Climate considerations and maintenance optimization further contribute to market momentum.

Key companies shaping the Ventilated Rainscreen FaASade Market include Trespa International, Benson Industries, Zahner, Simpson Strong-Tie, Cladding Corp, Enclos Corp, SFS Group (NV 1 Systems), Kingspan Group, Powers Fasteners, ITW Construction Products, Central International, Permasteelisa North America, Walters & Wolf, James Hardie Industries, and Hilti Corporation. To expand their presence, leading Ventilated Rainscreen FaASade Market companies are leveraging several core strategies. These include heavy investment in material innovation for improved weather resistance, thermal performance, and design adaptability. Collaboration with architects and contractors is being emphasized to deliver customized solutions for varied applications. Companies are also focusing on sustainability certifications and green compliance to attract institutional clients. Geographic expansion into emerging construction markets, along with digitalization in facade system design and installation processes, is helping firms enhance service delivery and customer experience. Additionally, retrofitting solutions and energy-efficient upgrades are being prioritized to serve both new construction and renovation sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By system type

- 2.2.2 By material type

- 2.2.3 By application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for energy-efficient building solutions

- 3.2.1.2 Preference for modern architectural aesthetics

- 3.2.1.3 Supportive green building regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High installation and material costs

- 3.2.2.2 Low awareness in developing regions

- 3.2.3 Opportunities

- 3.2.3.1 Retrofit demand in aging buildings

- 3.2.3.2 Expansion in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By System Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Pressure equalized rainscreen systems

- 5.3 Drained and back-ventilated systems

- 5.4 Ventilated cavity systems

- 5.5 Cross-system analysis

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Metal composite materials

- 6.3 Fiber cement panels

- 6.4 Natural stone panels

- 6.5 Ceramic and terracotta panels

- 6.6 High-pressure laminate panels

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Commercial buildings

- 7.3 Residential buildings

- 7.4 Industrial buildings

- 7.5 Institutional buildings

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Benson Industries

- 9.2 Centria International

- 9.3 Cladding Corp

- 9.4 Enclos Corp

- 9.5 Hilti Corporation

- 9.6 ITW Construction products

- 9.7 James Hardie Industries

- 9.8 Kingspan Group

- 9.9 Permasteelisa North America

- 9.10 Power Fasteners

- 9.11 SFS Group (NV1 Systems)

- 9.12 Simpson Strong-Tie

- 9.13 Trespa International

- 9.14 Walters & Wolf

- 9.15 Zahner