PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797781

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797781

Small Launch Vehicle (SLV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

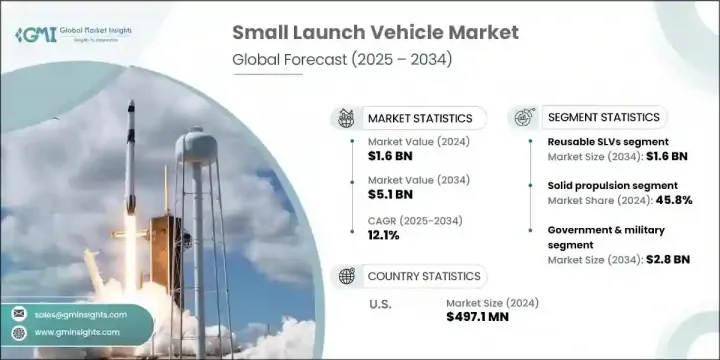

The Global Small Launch Vehicle Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 5.1 billion by 2034. Expansion in this market is largely driven by the increasing commercialization of space and a shift toward lower-cost and more agile launch solutions. As private entities deepen their involvement in satellite deployment, analytics, and space-based services, the industry is witnessing rapid shifts in innovation, affordability, and service customization. This evolving commercial space landscape is giving rise to more specialized business models across telecommunications, Earth imaging, and IoT-enabled systems, further fueling SLV demand. The shift from shared launch payloads to tailored schedules and customized orbital delivery is pushing the need for responsive and mission-specific vehicle design.

Growing demand for faster deployment cycles and greater launch frequency is compelling operators to create low-cost, adaptable systems that support rapid turnaround and increased mission control. As commercial and governmental space missions increasingly prioritize on-demand access to orbit, the need for scalable, modular launch solutions has become critical. Operators are shifting toward lean manufacturing, additive production methods, and simplified design architectures to reduce development timelines and streamline integration. These agile systems are built to accommodate a wide variety of payloads while enabling last-minute adjustments to orbital parameters, which is essential for time-sensitive applications such as Earth observation, defense communication, and disaster response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 12.1% |

The solid propulsion segment led the market in 2024 with a 45.8% share. Solid propulsion systems remain a preferred choice for rapid-response, suborbital, and defense-related missions due to their reliability, ease of integration, and storage benefits. New entrants are leaning on solid-based SLVs to minimize design complexity and streamline launch readiness. Providers are positioning solid-fueled vehicles for strategic use cases where simplicity and dependability are top priorities.

The reusable launch systems are increasingly being adopted to cut per-launch expenses and increase turnaround times. The reusable SLV segment is projected to reach USD 1.6 billion by 2034. Many players are focusing on reusability by developing scalable hardware for recovery, refurbishment, and relaunch. These technologies are proving essential in reducing waste, lowering operational costs, and supporting long-term environmental and economic sustainability for frequent orbital access.

North America Small Launch Vehicle (SLV) Market held 34.6% share in 2024 and is projected to grow at a CAGR of 11.1% through 2034. With strong financial backing, increasing government-private sector collaboration, and a robust ecosystem of small satellite manufacturers and operators, the region is at the forefront of the global SLV industry. There's a marked shift toward faster, more flexible launch options catering to national security and commercial demands alike.

Key players shaping the Global Small Launch Vehicle (SLV) Market include C6 Launch, Astra Space, Agnikul Cosmos, Interstellar Technologies, Galactic Energy, Firefly Aerospace, CAS Space, ABL Space Systems, HyImpulse, and Dawn Aerospace. Companies active in the small launch vehicle market are intensifying their efforts around innovation, reusability, and mission-specific configurations. Many are investing in modular launch systems and reusable stage development to offer cost-effective and frequent deployment cycles. Strategic collaborations with satellite manufacturers and space agencies help extend their client reach and bolster credibility. A growing number of firms are also focusing on vertical integration, controlling every step from component fabrication to post-launch data services, ensuring quality, reducing costs, and speeding up time-to-market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Propulsion type trends

- 2.2.2 Capacity trends

- 2.2.3 Reusability trends

- 2.2.4 Launch platform trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for small satellites and satellite constellations

- 3.2.1.2 Increasing commercialization of space

- 3.2.1.3 Demand for cost-effective and dedicated launch services

- 3.2.1.4 Growth in defense and national security applications

- 3.2.1.5 Expansion of low-cost launch infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and launch costs for new entrants

- 3.2.2.2 Payload capacity limitations of SLVs

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in demand for constellation-based satellite deployments

- 3.2.3.2 Growing adoption of SLVs in emerging space nations

- 3.2.3.3 Integration of reusable technologies to enhance cost efficiency

- 3.2.3.4 Expansion of on-demand and rapid launch services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Propulsion Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solid propulsion

- 5.3 Liquid propulsion

- 5.4 Hybrid propulsion

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Upto 100 kg

- 6.3 100-500 kg

- 6.4 500-1000 kg

- 6.5 1000 -2000 kg

Chapter 7 Market Estimates and Forecast, By Reusability, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Reusable SLVs

- 7.3 Non-reusable SLVs

Chapter 8 Market Estimates and Forecast, By Launch Platform, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Land-based

- 8.3 Sea-based

- 8.4 Air-based

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.1.1 Government & Military

- 9.1.2 Defense agencies

- 9.1.3 Civil space agencies

- 9.1.4 National security organizations

- 9.1.5 Public research institutions & universities

- 9.1.6 Others

- 9.2 Commercial

- 9.2.1 Satellite operators

- 9.2.2 Space startups & technology demonstrators

- 9.2.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Rocket Lab

- 11.1.2 Virgin

- 11.1.3 Relativity Space

- 11.1.4 Firefly Aerospace

- 11.1.5 Isar Aerospace

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 ABL Space Systems

- 11.2.1.2 Astra Space

- 11.2.1.3 X-Bow Systems

- 11.2.2 Europe

- 11.2.2.1 Rocket Factory Augsburg

- 11.2.2.2 Orbex

- 11.2.2.3 Skyrora Limited

- 11.2.2.4 HyImpulse

- 11.2.2.5 PLD Space

- 11.2.3 APAC

- 11.2.3.1 Agnikul Cosmos

- 11.2.3.2 Skyroot Aerospace

- 11.2.3.3 CAS Space

- 11.2.3.4 Interstellar Technologies

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Dawn Aerospace

- 11.3.2 Galactic Energy