PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797782

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797782

Automotive Condenser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

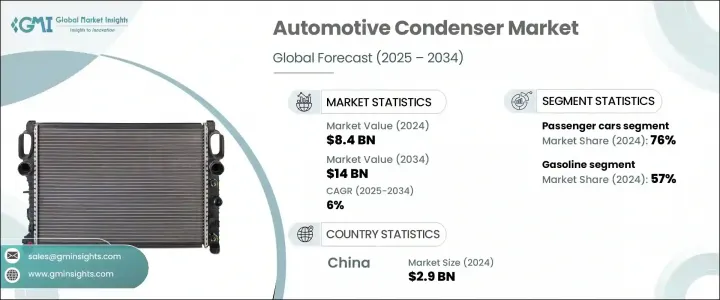

The Global Automotive Condenser Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 14 billion by 2034. The ongoing transformation toward electric vehicles and next-generation thermal management systems is significantly influencing the development and adoption of automotive condensers. As modern vehicles incorporate more compact and efficient components, there is a growing need for technical proficiency in advanced refrigerant flow, thermal load balancing, and EV-specific HVAC configurations. This evolution is prompting both OEMs and Tier-1 suppliers to prioritize workforce development and specialized training to align with emerging demands.

Automotive manufacturers are shifting focus toward low-GWP refrigerant usage, lightweight materials, and high-efficiency condenser systems tailored for hybrid and electric platforms. This technological transition has made role-based and task-specific training essential, especially in thermal systems maintenance, diagnostics, and component integration. The market's growth is also being supported by increased collaboration between training institutions and the private sector to produce a skilled labor force. As automotive platforms continue to evolve, ensuring product efficiency across climate zones and maintaining optimal thermal performance is becoming a key consideration for global manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $14 Billion |

| CAGR | 6% |

The passenger cars segment held a 76% share in 2024 and is expected to grow at a CAGR of 6.8% between 2025 and 2034. Condensers in this segment are being designed with an emphasis on space-saving architecture, fuel economy, and compliance with international standards for refrigerants. Automakers are enhancing both internal combustion engine and electric vehicle platforms by integrating high-efficiency, lightweight condenser units to support cabin climate control and battery temperature regulation. High production volumes, particularly across Asia-Pacific and Europe, are playing a vital role in propelling growth in this segment.

The gasoline-powered vehicles segment held a 57% share in 2024, with growth projected at a CAGR of 7% during 2025-2034. The sustained dominance of gasoline vehicles is largely due to their widespread global presence in both passenger and light commercial segments. As these vehicles demand reliable cooling and defogging performance, automakers are advancing aluminum-based condenser solutions that deliver excellent heat exchange efficiency while remaining cost-effective and lightweight. Design innovation remains central to improving thermal efficiency and meeting evolving vehicle platform needs in this category.

China Automotive Condenser Market generated USD 2.9 billion and held a 65% share in 2024. Its leadership position is supported by the country's vast vehicle manufacturing capacity, established supply chain networks, and ambitious push for vehicle electrification. Additionally, national policies around energy savings, emissions control, and refrigerant substitution are accelerating the deployment of advanced thermal technologies in domestic vehicle production, thereby reinforcing China's stronghold in the global condenser market.

The top-performing companies in the Automotive Condenser Market include Modine Manufacturing Company, Valeo, Keihin, Sanden Holdings, Hanon Systems, Denso Corporation, and MAHLE. These players are shaping the market through technological innovation and operational scale. To reinforce their competitive position in the automotive condenser market, leading companies are heavily investing in R&D to develop high-performance and lightweight condenser solutions optimized for EVs and hybrid platforms. Manufacturers like Hanon Systems, Keihin, and Modine are focused on designing compact and energy-efficient units that meet the thermal demands of modern mobility solutions. Collaboration with automotive OEMs to co-develop platform-specific thermal management systems is a core strategy. Many companies are also expanding global production facilities and enhancing regional supply chains to ensure faster delivery and local compliance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Design

- 2.2.5 Material

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Growing demand for vehicle air conditioning system

- 3.2.1.3 Technological advancements in HVAC systems

- 3.2.1.4 Government supports EV infrastructure and components

- 3.2.1.5 Shift towards lightweight, compact condenser designs

- 3.2.1.6 Integration of condensers in advanced battery thermal management systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Stringent environmental regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Increased vehicle electrification in commercial fleets

- 3.2.3.2 Demand for thermal solutions in autonomous vehicles

- 3.2.3.3 Development of eco-friendly refrigerant-compatible condenser technologies

- 3.2.3.4 Expansion of aftermarket demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.4.1 PHEV

- 6.4.2 HEV

- 6.4.3 FCEV

Chapter 7 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Serpentine

- 7.3 Parallel flow

- 7.4 Tube and fin

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Aluminium

- 8.3 Copper

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AVIC Xinhang

- 11.2 Calsonic Kansei

- 11.3 Chaoli Hi-Tech

- 11.4 Delphi Technologies

- 11.5 Denso

- 11.6 Fawer

- 11.7 Hanon Systems

- 11.8 Keihin

- 11.9 Koyorad

- 11.10 LUZHOU North Chemical Industries

- 11.11 MAHLE

- 11.12 Mitsubishi Electric

- 11.13 Modine Manufacturing Company

- 11.14 Nissens Automotive A/S

- 11.15 Pranav Vikas

- 11.16 Sanden Holdings

- 11.17 Tata AutoComp Systems

- 11.18 Transpro

- 11.19 Valeo

- 11.20 Zhejiang Yinlun Machinery