PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797793

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797793

Dual In-line Memory Module (DIMM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

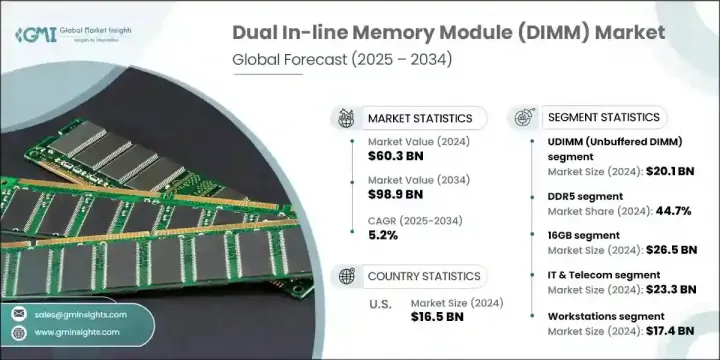

The Global Dual In-line Memory Module Market was valued at USD 60.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 98.9 billion by 2034. The principal factor driving this growth is the widespread adoption of DDR5 memory technology, which offers up to three times the bandwidth of DDR4, improved energy efficiency, and support for much higher memory capacities-exceeding 124GB per module. The increasing deployment of DIMMs in next-generation cloud infrastructure, AI accelerators, and enterprise-grade servers is accelerating globally. Data center expansion, particularly across North America, Asia Pacific, and Europe, is compelling enterprises to upgrade to DDR5-based modules to meet rising demands for faster data processing and scalable memory solutions.

This trend is fueled by growing workloads in artificial intelligence, big data analytics, and 5G networks. Memory manufacturers are prioritizing the development of high-density, low-power DIMMs optimized for AI, edge computing, and cloud applications, emphasizing enhanced error correction, low latency, and compatibility with emerging standards like CXL. Strategic partnerships with OEMs, hyperscalers, and chipmakers are crucial to capturing the surge in demand across mature and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $60.3 Billion |

| Forecast Value | $98.9 Billion |

| CAGR | 5.2% |

In 2024, the UDIMM segment generated USD 20.1 billion, maintaining a leading position driven by its extensive use in consumer desktops, laptops, and entry-level servers. The demand for affordable yet high-performance memory solutions in gaming PCs, professional workstations, and educational computing has significantly boosted UDIMM adoption. Its simplicity, cost-effectiveness, and compatibility with standard motherboards make it a popular choice, especially amid growing trends in remote learning, home office setups, and digital content creation.

The DDR5 segment led the DIMM market in 2024, accounting for a 44.7% share. This dominance is propelled by its rapid integration into data centers, AI-intensive environments, and enterprise-grade servers. DDR5's superior bandwidth, power efficiency, and scalability position it as the preferred memory technology for modern workloads such as machine learning, real-time data analytics, and 5G infrastructure development. Demand from hyperscale cloud providers and the release of DDR5-compatible processors by leading CPU manufacturers have further accelerated this transition.

U.S. Dual In-line Memory Module (DIMM) Market reached USD 16.5 billion in 2024, supported by widespread adoption of high-performance computing solutions across cloud service providers, government sectors, and enterprises. The increasing use of DDR5 memory in AI model training, data analytics, and virtualization has been a key growth driver. The country's strong presence in gaming hardware and professional content creation further boosts demand for high-capacity, high-speed memory modules.

The competitive landscape of the Dual In-line Memory Module (DIMM) Market is dominated by major global memory manufacturers, including Micron Technology, Inc., SK Hynix Inc., Samsung Electronics Co., Ltd., Kingston Technology Corporation, and IBM Corporation. These companies hold significant market shares and continue to lead innovation and capacity expansion. To solidify their market positions, DIMM manufacturers focus on several key strategies. Investing heavily in R&D enables them to improve DDR5 technology, increase memory density, and enhance energy efficiency, catering to emerging computing needs. Establishing strategic alliances with OEMs, cloud hyperscalers, and AI chip developers allows these companies to tailor products to specific applications and rapidly scale deployment. They also emphasize modularity and interoperability by ensuring compatibility with future interconnect standards like CXL. Additionally, firms concentrate on supply chain optimization and regional expansion to meet the rising global demand, particularly in fast-growing markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Operating trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from data centers and cloud infrastructure

- 3.2.1.2 Adoption of DDR5 memory technology

- 3.2.1.3 Integration of DIMMs in consumer and gaming systems

- 3.2.1.4 Use of DIMMs in industrial and embedded systems

- 3.2.1.5 Deployment of DIMMs in automotive and AI edge devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and upgrade costs

- 3.2.2.2 Competition from alternative memory and storage technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 UDIMM (Unbuffered DIMM)

- 5.3 RDIMM (Registered DIMM)

- 5.4 LRDIMM (Load Reduced DIMM)

- 5.5 SO-DIMM (Small Outline DIMM)

- 5.6 FBDIMM (Fully Buffered DIMM)

- 5.7 Other

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 DDR3

- 6.3 DDR4

- 6.4 DDR5

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 ≤ 8GB

- 7.3 16GB

- 7.4 32GB

- 7.5 64GB and Above

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 IT & Telecom

- 8.3 Consumer Electronics

- 8.4 BFSI

- 8.5 Healthcare

- 8.6 Government & Defense

- 8.7 Manufacturing

- 8.8 Retail & E-commerce

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion and Units)

- 9.1 Key trends

- 9.2 Consumer PCs and Laptops

- 9.3 Workstations

- 9.4 Servers

- 9.5 Data Centers

- 9.6 Industrial Automation Systems

- 9.7 Gaming Systems

- 9.8 Embedded Systems / IoT Devices

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Samsung Electronics Co., Ltd.

- 11.2 SK Hynix Inc.

- 11.3 Micron Technology, Inc.

- 11.4 Kingston Technology Corporation

- 11.5 Corsair Components, Inc.

- 11.6 ADATA Technology Co., Ltd.

- 11.7 G.SKILL International Enterprise Co., Ltd.

- 11.8 Patriot Memory LLC

- 11.9 TeamGroup Inc.

- 11.10 Mushkin Enhanced MFG

- 11.11 Hewlett Packard Enterprise (HPE)

- 11.12 Dell Technologies Inc.

- 11.13 Lenovo Group Limited

- 11.14 Cisco Systems, Inc.

- 11.15 IBM Corporation

- 11.16 SMART Modular Technologies, Inc.

- 11.17 Viking Technology (Sanmina Corporation)

- 11.18 Innodisk Corporation

- 11.19 Transcend Information, Inc.

- 11.20 Apacer Technology Inc.

- 11.21 Netlist, Inc.

- 11.22 Panram International Corp.

- 11.23 Silicon Power Computer & Communications Inc.

- 11.24 Exceleram

- 11.25 PNY Technologies Inc.