PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797794

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797794

Fish Farming Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

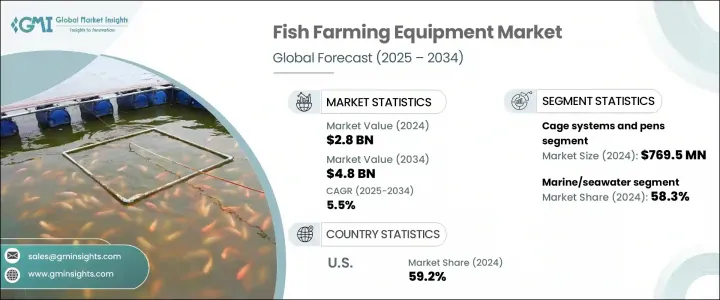

The Global Fish Farming Equipment Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 4.8 billion by 2034. This growth reflects the rising global demand for seafood and an increasing emphasis on food security. The market encompasses a broad range of equipment, including tanks, aeration systems, feeding units, filtration technologies, water quality monitors, and various automated monitoring devices. As the aquaculture sector evolves, the push for sustainable and high-efficiency equipment becomes stronger. These tools help maximize fish health, improve growth rates, and enhance operational productivity, all while minimizing the environmental footprint.

Governments worldwide are encouraging modern aquaculture practices by investing in infrastructure and regulating sustainability guidelines. Technological integration, including automation, IoT, and smart analytics, is transforming the way fish farms are managed, allowing for real-time observation of environmental parameters and fish conditions. These innovations not only increase efficiency but also reduce manual labor costs. As recirculating aquaculture systems and offshore fish farming practices continue to expand, the need for specialized and advanced equipment is set to grow, creating new business opportunities for manufacturers and suppliers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 5.5% |

The cage systems and pens segment generated USD 769.5 million in 2024. These systems dominate the market due to their scalability, flexibility, cost-effectiveness, and ease of installation. Their adaptability to various aquatic environments-ranging from freshwater to saltwater-makes them a preferred choice among fish farmers. Cage systems and pens support a wide variety of species, making them highly versatile for different aquaculture operations.

The marine or seawater segment held the largest share in 2024, accounting for 58.3% share and generating USD 1.6 billion. This segment continues to lead due to strategic geographic utilization and the farming of premium species that thrive in marine environments. Seawater farming helps reduce reliance on land and freshwater sources and can be paired with responsible environmental practices. Governments are also providing strong backing through supportive regulations and infrastructure development, which enhances the viability of offshore aquaculture operations and promotes the use of marine-based farming systems.

U.S. Fish Farming Equipment Market held a 59.2% share in 2024. The U.S. market is transitioning toward sustainable fish farming approaches and witnessing growing consumer demand for seafood. Technological advancements in this region are leading to the adoption of smart monitoring equipment and automated systems, enhancing overall farm productivity and environmental compliance.

Leading companies in the Global Fish Farming Equipment Market include CPI Equipment, Frea Aquaculture Solutions, PentairAES, eWater Aquaculture Equipment Technology Limited, Merck & Co. Inc., Grundfos Holding A/S, Morenot, ABB, LINN Geratebau, Asakua, Innovasea, Pioneer Group, INVE Aquaculture, AKVA Group, and Xylem. To maintain their competitive edge, companies in the fish farming equipment market are prioritizing technological innovation and sustainability. Many leading firms like Innovasea, ABB, and AKVA Group are investing in R&D to enhance the efficiency and automation capabilities of their systems. There is a growing emphasis on integrating AI, real-time monitoring tools, and IoT sensors to streamline feeding, water quality control, and fish health tracking. Businesses are expanding their reach into emerging markets by forming strategic partnerships with regional aquaculture companies and governments. Product customization based on species type and water conditions is also helping brands capture niche market segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Fish type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for seafood

- 3.2.1.2 Rising investments in fish farming

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Slow adoption rate of innovative technologies

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.1.1 Water treatment systems

- 5.1.1.1 Aerators

- 5.1.1.2 Pumps

- 5.1.1.3 Filtration systems

- 5.1.1.4 UV sterilizers

- 5.1.2 Monitoring and control systems

- 5.1.3 Cleaning and waste management

- 5.1.4 Harvesting and grading equipment

- 5.1.5 Cage systems and pens

- 5.1.6 Others

- 5.1.1 Water treatment systems

Chapter 6 Market Estimates and Forecast, By Fish Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Salmon

- 6.3 Catfish

- 6.4 Trout

- 6.5 Carp

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Freshwater

- 7.3 Marine/Sea water

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial fish farms

- 8.3 Research & academic institutes

- 8.4 Government fisheries

- 8.5 Small-scale farms

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AKVA Group

- 10.3 Asakua

- 10.4 CPI Equipment

- 10.5 eWater Aquaculture Equipment Technology Limited

- 10.6 Frea Aquaculture Solutions

- 10.7 Grundfos Holding A/S

- 10.8 Innovasea

- 10.9 INVE Aquaculture

- 10.10 LINN Geratebau

- 10.11 Merck & Co. Inc.

- 10.12 Morenot

- 10.13 PentairAES

- 10.14 Pioneer Group

- 10.15 Xylem