PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797802

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797802

Poultry Pharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

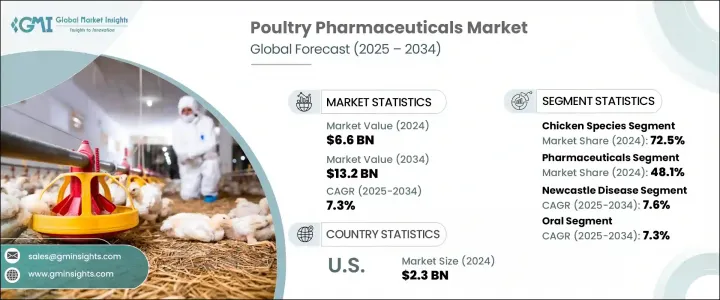

The Global Poultry Pharmaceuticals Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 13.2 billion by 2034. Rising poultry consumption worldwide, driven by the affordability and high protein content of products like chicken and eggs, continues to fuel market demand. At the same time, the growing focus on animal health, preventive care, and disease management in commercial poultry operations is accelerating the need for effective pharmaceutical solutions. As concerns about antibiotic resistance increase, regulatory agencies are placing stricter limitations on antibiotic use, leading to greater adoption of vaccines, probiotics, and other alternatives.

Poultry farmers are shifting to sustainable health strategies to meet consumer demand for antibiotic-free and organic poultry products. This trend has boosted the uptake of biologics, advanced vaccines, and probiotic-based medications. The sector includes a wide range of health solutions for chickens, ducks, turkeys, and other birds, focusing on reducing disease outbreaks and maintaining consistent production quality. The overall market growth is supported by ongoing investments in poultry healthcare innovation and a shift toward natural, non-antibiotic approaches for maintaining biosecurity and productivity in large-scale operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 7.3% |

In 2024, the chicken segment held 72.5% and will reach USD 9.4 billion by 2034 at a CAGR of 7.2%. Chicken dominate poultry production and are especially prone to diseases such as Marek's disease, IBD, Newcastle disease, and coccidiosis. As a result, pharmaceutical interventions are primarily focused on improving flock immunity and supporting large-scale broiler and layer farming operations with preventive treatments and structured vaccination schedules.

The pharmaceuticals segment held a 48.1% share in 2024. This segment's growth is driven by widespread use of products like anti-infectives, parasiticides, and analgesics, which are favored for their safety, convenience, and preventive capabilities. A broader movement toward reducing antibiotic dependency has shifted attention to probiotic and prebiotic-based solutions that improve gut health and minimize infection risks. Increasing pressure from regulatory bodies regarding antimicrobial usage has further encouraged the adoption of these alternatives.

U.S. Poultry Pharmaceuticals Market was valued at USD 2.3 billion in 2024. The U.S. continues to lead regional growth due to its strong poultry consumption rates and reliance on large-scale commercial farming. Enhanced disease risks within intensive farming systems, along with strict biosecurity mandates, have prompted farmers across the U.S. and Canada to prioritize early vaccination and consistent health monitoring through pharmaceutical products.

Key industry players operating in the Global Poultry Pharmaceuticals Market include Zoetis, Ceva Sante Animale, Phibro Animal Health, Boehringer Ingelheim, and Elanco. Major companies in the poultry pharmaceuticals market are focusing on R&D to deliver next-generation biologics, vaccines, and sustainable alternatives to conventional antibiotics. Businesses like Elanco and Ceva Sante Animale are expanding their biologics portfolios to meet growing demand for antibiotic-free products. Strategic acquisitions, partnerships with poultry producers, and regional expansion remain critical approaches. Companies are also investing in digital tools to monitor flock health, improving treatment precision and compliance. Tailoring products for species-specific diseases, expanding product registrations across emerging markets, and ensuring regulatory compliance are strengthening global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Species trends

- 2.2.3 Product trends

- 2.2.4 Disease type trends

- 2.2.5 Route of administration trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for poultry products

- 3.2.1.2 Growing incidence of poultry disease

- 3.2.1.3 Increasing focus on food safety and antimicrobial stewardship

- 3.2.1.4 Advancement in veterinary healthcare and vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of new drug development

- 3.2.2.2 Antimicrobial resistance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for preventive healthcare in poultry animals

- 3.2.3.2 Rising demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Species, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chicken

- 5.3 Turkey

- 5.4 Ducks

- 5.5 Other species

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biologics

- 6.2.1 Vaccines

- 6.2.1.1 Modified/ attenuated live

- 6.2.1.2 Inactivated (killed)

- 6.2.1.3 Other vaccines

- 6.2.2 Other biologics

- 6.2.1 Vaccines

- 6.3 Pharmaceuticals

- 6.3.1 Parasiticides

- 6.3.2 Anti-infectives

- 6.3.3 Anti-inflammatory and analgesics

- 6.3.4 Other pharmaceuticals

- 6.4 Medicated feed additives

Chapter 7 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Newcastle disease

- 7.3 Infectious bronchitis

- 7.4 Infectious bursal disease

- 7.5 Coccidiosis

- 7.6 Salmonella

- 7.7 Marek's disease

- 7.8 Other disease types

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Poultry farms

- 9.4 Retail veterinary pharmacies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avimex

- 11.2 Boehringer Ingelheim International

- 11.3 Calier

- 11.4 Ceva Sante Animale

- 11.5 Elanco

- 11.6 Hester Biosciences

- 11.7 Indovax

- 11.8 Kemin Industries

- 11.9 Merck

- 11.10 Phibro Animal Health

- 11.11 Vaxxinova (EW Group)

- 11.12 Vetanco

- 11.13 Virbac

- 11.14 Zoetis