PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797818

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797818

Cake Mix Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

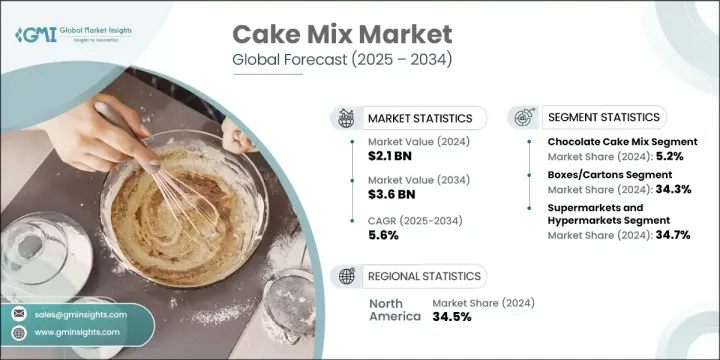

The Global Cake Mix Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 3.6 billion by 2034. Over the past decade, the market has experienced a consistent upward trend, driven by shifts in consumer behavior favoring quick and easy meal preparation. The rise of social media and renewed interest in at-home activities during the COVID-19 pandemic contributed significantly to the home baking resurgence. While leading brands long dominated by simplifying baking for busy households, modern consumers are now seeking cleaner labels and better-for-you alternatives. The growing popularity of gluten-free, vegan, organic, and allergen-conscious options is reshaping product portfolios.

Recent innovations and the growing influence of health and wellness trends have prompted brands to launch new formulations that align with consumer demands. There's also growing enthusiasm for creative flavor infusions using natural ingredients, reflecting a shift toward adventurous and artisanal preferences. As digital platforms make products more accessible, online retail has become a vital sales channel, allowing brands to reach global markets and support their growth with increasing ease.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 5.6% |

The boxes and cartons segment held a 34.3% share and generated USD 710.3 million in 2024. Packaging preferences in the cake mix industry continue to evolve as consumers seek eco-conscious, practical, and visually appealing solutions. Traditional box and carton formats remain popular due to their durability, shelf appeal, and space for impactful branding and nutritional labeling. However, flexible packaging is gaining momentum because of its lightweight design, resealability, and convenience-especially for consumers seeking quick and accessible baking solutions. These modern alternatives are also becoming increasingly aligned with sustainability initiatives, incorporating user-friendly, environmentally conscious materials that appeal to the values of today's shoppers.

In terms of distribution, the supermarkets and hypermarkets segment accounted for a 34.7% share in 2024, reaching a value of USD 802.1 million. As the primary retail touchpoints, these stores offer wide ranges and trusted availability in a convenient format for everyday shopping. Their dominance is largely attributed to their role in aggregating product diversity and brand variety under one roof. Simultaneously, convenience stores are rising in importance due to their proximity, flexible hours, and appeal to last-minute or on-the-go baking needs. This diversification in retail strategy is helping cake mix brands extend their reach and meet varied shopper preferences more effectively.

North America Cake Mix Market held a 34.5% share in 2024. This region has seen a shift in consumer expectations, with shoppers increasingly embracing health-centric and time-saving baking solutions. The market is well established, but growth continues through the introduction of diet-specific options and cleaner-label formulations. Busy lifestyles have prompted the development of resealable, eco-friendly packaging formats, making products more accessible and practical for everyday use. In addition, evolving cultural and economic factors continue to shape regional preferences, with consumers seeking unique flavors and more transparent sourcing of ingredients.

Companies competing in the Global Cake Mix Industry include McKee Foods Corporation, Grupo Bimbo, S.A.B. de C.V., The J.M. Smucker Company, General Mills, Inc., Dawn Food Products, Inc., King Arthur Baking Company, Pamela's Products, Dr. August Oetker KG, Associated British Foods plc, Chelsea Milling Company, Simple Mills, Inc., Conagra Brands, Inc., and Flowers Foods, Inc. To strengthen their position in the cake mix market, leading companies are employing a blend of innovation, product diversification, and sustainability. They are consistently reformulating mixes to meet rising consumer demands for health-oriented options such as gluten-free, plant-based, and organic offerings. Many are also investing in environmentally responsible packaging, including recyclable or biodegradable formats, to align with eco-conscious values. Strategic expansions through e-commerce platforms are allowing brands to enhance global visibility and reach niche consumer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Chocolate cake mix

- 5.3 Vanilla cake mix

- 5.4 Red velvet cake mix

- 5.5 Funfetti and specialty flavor mixes

- 5.6 Gluten-free cake mix

- 5.7 Organic cake mix

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Supermarkets and hypermarkets

- 6.3 Convenience stores

- 6.4 Online retail/e-commerce

- 6.5 Specialty stores and gourmet retailers

- 6.6 Foodservice and commercial bakeries

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Boxes/cartons

- 7.3 Pouches and flexible packaging

- 7.4 Bulk packaging

- 7.5 Single-serve packaging

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 1.1 Key trends

- 1.2 North America

- 1.2.1 U.S.

- 1.2.2 Canada

- 1.3 Europe

- 1.3.1 Germany

- 1.3.2 UK

- 1.3.3 France

- 1.3.4 Spain

- 1.3.5 Italy

- 1.3.6 Netherlands

- 1.3.7 Rest of Europe

- 1.4 Asia Pacific

- 1.4.1 China

- 1.4.2 India

- 1.4.3 Japan

- 1.4.4 Australia

- 1.4.5 South Korea

- 1.4.6 Rest of Asia Pacific

- 1.5 Latin America

- 1.5.1 Brazil

- 1.5.2 Mexico

- 1.5.3 Argentina

- 1.5.4 Rest of Latin America

- 1.6 Middle East and Africa

- 1.6.1 Saudi Arabia

- 1.6.2 South Africa

- 1.6.3 UAE

- 1.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 General Mills, Inc.

- 9.2 Conagra Brands, Inc. (Duncan Hines)

- 9.3 The J.M. Smucker Company (Pillsbury)

- 9.4 Grupo Bimbo, S.A.B. de C.V.

- 9.5 Associated British Foods plc

- 9.6 Chelsea Milling Company (Jiffy Mix)

- 9.7 Flowers Foods, Inc.

- 9.8 McKee Foods Corporation

- 9.9 Dawn Food Products, Inc.

- 9.10 Dr. August Oetker KG

- 9.11 Simple Mills, Inc.

- 9.12 King Arthur Baking Company

- 9.13 Pamela's Products