PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797827

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797827

Marine Engine Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

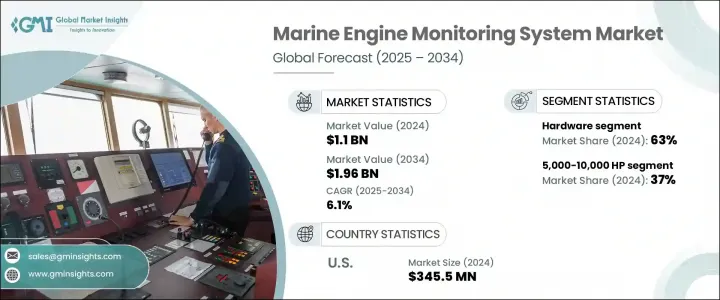

The Global Marine Engine Monitoring System Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 1.96 billion by 2034. As emission standards tighten and marine engine technologies become more advanced, monitoring systems have transitioned from basic maintenance tools to essential platforms for optimizing operations. These systems now rely on real-time data, digital connectivity, and predictive capabilities to deliver enhanced fuel efficiency, safety, and regulatory compliance. Technologies like IoT integration, AI-based analytics, and intelligent sensor networks are reshaping how operators manage fleet performance. The industry is also gaining momentum from public-private initiatives pushing digitalization in maritime, alongside OEM-led efforts to create advanced training ecosystems tailored for smart maritime operations. The demand for data-driven insights continues to accelerate the adoption of intelligent engine monitoring tools across the shipping industry.

Remote diagnostics and monitoring saw faster adoption following the pandemic, as restrictions prompted marine operators to adopt cloud-based tools to maintain operational continuity. Predictive and condition-based monitoring features are becoming standard across larger commercial fleets, enabling early detection of issues such as fuel inefficiency, excessive cylinder wear, or lubrication faults. These systems help minimize downtime and align with global sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.96 Billion |

| CAGR | 6.1% |

In 2024, the hardware segment held 63% share and is forecasted to grow at a CAGR of 5% through 2034. This segment includes key components such as control units, sensors, data loggers, and communication modules that facilitate seamless data collection and system integration onboard. The rise in new vessel construction and retrofitting activities is boosting demand for hardware installations, especially as compliance with emission regulations and predictive maintenance capabilities becomes more critical. Leading OEMs like Siemens, ABB, and Wartsila are embedding advanced sensor technologies directly into propulsion and auxiliary systems to enable comprehensive performance monitoring.

The 5,000-10,000 HP power range segment held 37% share in 2024 and is projected to grow at a CAGR of 6% through 2034. Vessels within this range-typically medium-sized tankers, offshore support ships, and cargo carriers-require robust monitoring due to extended operational hours and strict regulatory requirements. Monitoring systems for this power range offer detailed analytics, predictive insights, and AI-enabled diagnostics that support preventive maintenance, fleet optimization, and compliance with evolving environmental standards. OEMs targeting this range are increasingly integrating predictive tools into their service offerings.

United States Marine Engine Monitoring System Market held 83% share and earned USD 345.5 million in 2024. The country's leadership position is supported by a sizable fleet of commercial and defense vessels, regulatory pressure on emissions, and widespread use of digital maritime technologies. Investments in edge computing, AI-based engine diagnostics, and connected systems are helping both public and private marine operators streamline performance. Access to government contracts and strong tech infrastructure allows US-based OEMs and integrators to meet domestic demand with high-end, smart systems. Technologies like MEMS and on-site monitoring via biofuel cells are finding broader applications thanks to the advanced engineering capabilities of the region.

Key players actively shaping the Global Marine Engine Monitoring System Market include Caterpillar, Wartsila, Cummins, Siemens, ABB, Kongsberg Maritime, and MAN Energy Solutions. Companies competing in the marine engine monitoring system market are focused on expanding digital capabilities, developing smart components, and enhancing global service reach. Many are integrating AI, IoT, and cloud connectivity into engine monitoring solutions to offer advanced diagnostics, automated reporting, and real-time insights. Partnerships with shipping operators allow these firms to co-develop customized solutions that improve operational efficiency. Some companies are also focusing on hybrid propulsion systems, leveraging monitoring tools to optimize fuel consumption and emissions. Investments in training platforms and aftersales service ecosystems help ensure customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Power

- 2.2.4 Deployment mode

- 2.2.5 Propulsion

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in demand for fuel-efficient vessel operations

- 3.2.1.2 Surge in compliance needs due to IMO regulations

- 3.2.1.3 Rise in deployment of remote diagnostics and IoT-based solutions

- 3.2.1.4 Rising maritime trade & vessel fleet expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost for MEMS systems

- 3.2.2.2 Shortage of skilled maritime technicians for system deployment

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of MEMS in hybrid and electric propulsion systems

- 3.2.3.2 Surge in autonomous and remotely operated vessel projects

- 3.2.3.3 Rising investments in smart ports and connected shipping lanes

- 3.2.3.4 Adoption of digital twin technologies in shipyards

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Control units

- 5.2.3 Display

- 5.2.4 Controllers

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Data analytics software

- 5.3.2 Predictive maintenance software

- 5.3.3 Others

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Power, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 1,000 HP

- 6.3 1,000-5,000 HP

- 6.4 5,001-10,000 HP

- 6.5 10,000 HP and above

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-site monitoring

- 7.3 Remote monitoring

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Gas turbines

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Performance monitoring

- 9.3 Fuel efficiency optimization

- 9.4 Maintenance diagnosis

- 9.5 Safety and regulatory compliance

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Commercial vessels

- 10.1.1 Cargo ships

- 10.1.2 Tankers

- 10.1.3 Container ships

- 10.2 Naval vessels

- 10.3 Passenger vessels

- 10.3.1 Cruise ships

- 10.3.2 Ferries

- 10.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 France

- 11.3.3 Italy

- 11.3.4 Spain

- 11.3.5 Russia

- 11.3.6 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Vietnam

- 11.4.8 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Egypt

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 AST

- 12.3 Caterpillar

- 12.4 CMR

- 12.5 Cummins

- 12.6 Emerson Electric

- 12.7 General Electric

- 12.8 Hyundai Heavy Industries

- 12.9 Jason Marine

- 12.10 Kongsberg Maritime

- 12.11 MAN Energy Solutions

- 12.12 Mitsubishi Heavy Industries

- 12.13 MTU Friedrichshafen

- 12.14 NORIS

- 12.15 Rolls-Royce

- 12.16 Scania

- 12.17 Siemens

- 12.18 Volvo Penta

- 12.19 Wartsila

- 12.20 Yanmar