PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797839

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797839

Blood Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

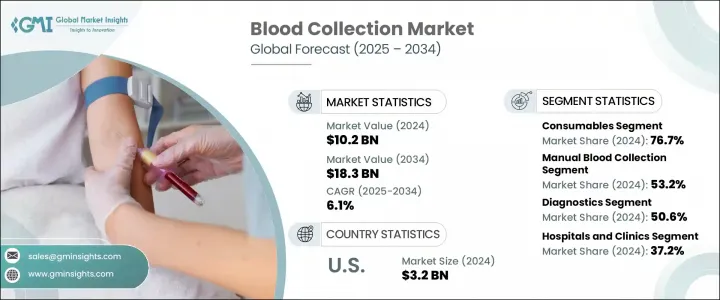

The Global Blood Collection Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 18.3 billion by 2034. Market expansion is being driven by the growing burden of chronic and infectious diseases, rapid technological innovation, a higher volume of surgical procedures, and a rising elderly population. The demand for advanced blood collection solutions is increasing as healthcare providers prioritize safe, accurate, and efficient sample collection for diagnostics, treatment, and research. Blood collection devices are critical tools in clinical workflows, ensuring that blood samples are obtained with precision and patient safety in mind. These devices are widely used in hospitals, diagnostic laboratories, and blood banks, serving as the backbone of various medical testing processes. The market is also witnessing greater investment in systems that streamline operations, reduce contamination risk, and improve patient experience, further reinforcing its long-term growth trajectory.

By product type, the market is divided into systems and consumables. The consumables segment held the largest share at 76.7% in 2024, driven by its essential role in consistent and accurate sample collection. This segment is expected to reach over USD 13.9 billion by 2034, advancing at a CAGR of 6% during the forecast period. Systems, on the other hand, are forecast to grow at a slightly higher CAGR of 6.3% between 2025 and 2034, supported by the rising adoption of integrated solutions that improve operational efficiency and patient comfort. Healthcare providers are increasingly favoring systems designed to enhance diagnostic accuracy and reduce procedural risks, adding to the segment's momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 billion |

| Forecast Value | $18.3 billion |

| CAGR | 6.1% |

Based on method, the market is segmented into manual and automated blood collection. Manual blood collection accounted for 53.2% of the total market in 2024, with growth supported by its cost-effectiveness, availability, and ease of use in various clinical environments. This approach continues to be a key component of healthcare practices worldwide, relying on trained professionals to perform accurate sample extraction. The process typically involves using tailored devices such as needles or vacuum systems to meet specific patient and test requirements, ensuring reliability in diverse settings.

In terms of application, the market is categorized into diagnostics, treatment, and research. Diagnostics remained the dominant segment in 2024 with a 50.6% share, fueled by the growing number of tests that depend on blood samples for disease detection, monitoring, and prevention. Rising demand for early and precise identification of health conditions is spurring the need for advanced blood collection systems, which in turn is accelerating the segment's growth.

Regionally, North America led the global blood collection market with a 35.4% share in 2024, underpinned by a strong healthcare infrastructure, increasing cases of chronic illnesses, and a high volume of diagnostic testing. The region also benefits from the rapid adoption of innovative blood collection technologies and an emphasis on improving diagnostic speed and accuracy. Within the region, the United States remains the primary contributor, with the market size growing from USD 3.1 billion in 2023 to USD 3.2 billion in 2024. Consistent demand for high-quality diagnostic services, supported by continuous improvements in blood collection methodologies, is expected to sustain the country's leadership position throughout the forecast period.

Key players influencing the competitive landscape include Thermo Fisher Scientific, Terumo Corporation, McKesson Corporation, Haemonetics Corporation, Abbott Laboratories, QIAGEN, Fresenius SE & Co, Sarstedt AG & Co, Greiner, FL MEDICAL, Becton, Dickinson and Company, Cardinal Health, F. Hoffmann-La Roche, Streck, Siemens Healthineers, and Nipro Corporation. These companies are consistently focused on driving product innovation, strengthening their global reach, and delivering solutions that meet the changing requirements of healthcare providers across the world.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Method

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic and infectious diseases

- 3.2.1.2 Advancements in blood collection technologies

- 3.2.1.3 Increasing number of surgical procedures

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risks associated with blood transfusions

- 3.2.2.2 Lack of skilled healthcare professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising government-led campaigns for promoting blood donation and disease screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 System

- 5.2.1 Automated systems

- 5.2.2 Manual systems

- 5.3 Consumables

- 5.3.1 Venous

- 5.3.1.1 Needles and syringes

- 5.3.1.1.1 Double-ended needles

- 5.3.1.1.2 Winged blood collection sets

- 5.3.1.1.3 Standard hypodermic needles

- 5.3.1.1.4 Other blood collection needles

- 5.3.1.2 Blood collection tubes

- 5.3.1.2.1 Serum-separating

- 5.3.1.2.2 EDTA

- 5.3.1.2.3 Heparin

- 5.3.1.2.4 Plasma-separating

- 5.3.1.3 Blood bags

- 5.3.1.4 Other venous products

- 5.3.1.1 Needles and syringes

- 5.3.2 Capillary

- 5.3.2.1 Lancets

- 5.3.2.2 Micro-container tubes

- 5.3.2.3 Micro-hematocrit tubes

- 5.3.2.4 Warming devices

- 5.3.2.5 Other capillary products

- 5.3.1 Venous

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual blood collection

- 6.3 Automated blood collection

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Treatment

- 7.4 Research

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 1.1 Key trends

- 1.2 Hospitals and clinics

- 1.3 Diagnostic centers

- 1.4 Blood banks

- 1.5 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 1.5.1 U.S.

- 1.5.2 Canada

- 9.3 Europe

- 1.5.3 Germany

- 1.5.4 UK

- 1.5.5 France

- 1.5.6 Spain

- 1.5.7 Italy

- 1.5.8 Netherlands

- 9.4 Asia Pacific

- 1.5.9 China

- 1.5.10 Japan

- 1.5.11 India

- 1.5.12 Australia

- 1.5.13 South Korea

- 9.5 Latin America

- 1.5.14 Brazil

- 1.5.15 Mexico

- 1.5.16 Argentina

- 9.6 Middle East and Africa

- 1.5.17 South Africa

- 1.5.18 Saudi Arabia

- 1.5.19 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Becton, Dickinson, and Company

- 10.3 Cardinal Health

- 10.4 F. Hoffmann-La Roche

- 10.5 FL MEDICAL

- 10.6 Fresenius SE & Co

- 10.7 Greiner

- 10.8 Haemonetics Corporation

- 10.9 McKesson Corporation

- 10.10 Nipro Corporation

- 10.11 QIAGEN

- 10.12 Sarstedt AG & Co

- 10.13 Siemens Healthineers

- 10.14 Streck

- 10.15 Terumo Corporation

- 10.16 Thermo Fisher Scientific