PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797854

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797854

Breast Cancer Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

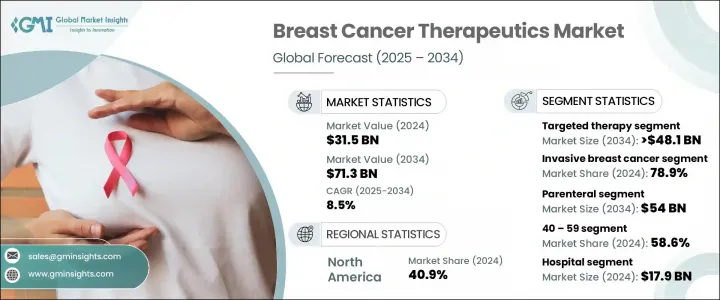

The Global Breast Cancer Therapeutics Market was valued at USD 31.5 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 71.3 billion by 2034. The market growth is attributed to a combination of factors: high incidence of breast cancer, expanded awareness of early detection and treatment, and rising support from government and nonprofit screening initiatives. As screening increases and more cases are identified at earlier stages, demand for effective treatment options rises, supporting the market's momentum. Also, rising rates of aging populations, obesity, sedentary lifestyles, and urbanization are contributing to higher breast cancer prevalence. Expanded health access in developing markets further boosts therapy uptake. Advances in personalized medicine-such as targeted treatments, hormone therapy, and immunotherapy-are enhancing outcomes and fueling market expansion.

Breast cancer therapeutics encompass a spectrum of treatments aimed at controlling disease progression, preventing recurrence, and improving survival. Leading pharmaceutical firms such as Merck, AstraZeneca, Novartis, Pfizer, and F. Hoffmann-La Roche are investing heavily in R&D, particularly focusing on precision oncology and biomarker-driven therapies. Government screening programs and awareness campaigns are accelerating early diagnosis, which in turn drives demand for advanced treatments. Growth in emerging economies' healthcare infrastructure and reimbursement reforms enabling broader access. The shift toward more targeted interventions-including monoclonal antibodies, small-molecule inhibitors, and immuno-oncology agents-is improving efficacy while reducing side effects, further boosting adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $31.5 Billion |

| Forecast Value | $71.3 Billion |

| CAGR | 8.5% |

The targeted therapies generated USD 21.4 billion in 2024, dominating due to their ability to target cancer-associated biomarkers with fewer adverse reactions. Formats such as antibody-drug conjugates, HER2 inhibitors, and PARP inhibitors are widely adopted across both early- and late-stage treatment protocols. Innovations in HER2 low subtype therapies and AI guided patient stratification support continued market leadership of this category.

The invasive breast cancer segment held 78.9% share in 2024 and is the most prevalent form of disease. Invasive ductal carcinoma alone accounts for about 80% of all invasive cases and roughly 55% of breast cancer diagnoses. Because of its aggressive nature and potential to metastasize beyond the ducts, invasive breast cancer demands broad treatment approaches, including targeted agents, hormone modulators such as SERMs, chemotherapy, and immunotherapies, driving strong clinical demand.

North America Breast Cancer Therapeutics Market held 40.9% share in 2024, with the United States and Canada leading. Advanced healthcare infrastructure, high early detection awareness, strong oncology research investment, and favorable reimbursement systems drove therapeutic adoption. This region benefits from rapid regulatory approvals, high proprietary therapy penetration, and widespread uptake of emerging treatment modalities, reinforcing its leadership in the global breast cancer therapeutics landscape.

Major companies shaping this industry include Pfizer, F. Hoffmann-La Roche, Merck, AstraZeneca, Novartis, and Eli Lilly, driving innovation and global reach. Leading pharmaceutical players are focusing heavily on patient stratification by molecular subtype, enabling precision-targeted therapies optimized with companion diagnostics. Many firms are expanding pipelines in novel modalities such as antibody-drug conjugates, bispecific antibodies, CDK4/6 inhibitors, and immunotherapy combinations to strengthen portfolio depth. Strategic acquisitions, licensing agreements, and strategic partnerships with biotech firms accelerate access to innovative compounds and emerging R&D talent. Global expansion into emerging markets is being achieved through collaborations with regional distributors and healthcare systems. Additionally, firms invest in real-world studies and value-based outcomes to support reimbursement negotiations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Therapy

- 2.2.3 Cancer type

- 2.2.4 Route of administration

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global incidence of breast cancer

- 3.2.1.2 Advancements in targeted and immunotherapies

- 3.2.1.3 Growing awareness and early detection programs

- 3.2.1.4 Increasing demand for personalized medicine and biomarker testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Side effects and toxicity of treatments

- 3.2.3 Market opportunities

- 3.2.3.1 Development of novel therapeutics

- 3.2.3.2 Collaborations and strategic partnerships

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Pipeline analysis

- 3.6 Regulatory landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

Chapter 5 Market Estimates and Forecast, By Therapy, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Targeted therapy

- 5.3 Hormonal therapy

- 5.4 Chemotherapy

- 5.5 Immunotherapy

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ductal carcinoma in situ (DCIS)

- 6.3 Invasive breast cancer

- 6.3.1 Invasive ductal carcinoma (IDC)

- 6.3.1.1 Hormone receptor

- 6.3.1.2 HER2+

- 6.3.1.3 Triple-negative breast cancer (TNBC)

- 6.3.1.4 Other invasive ductal carcinoma (IDC) types

- 6.3.2 Invasive lobular carcinoma (ILC)

- 6.3.1 Invasive ductal carcinoma (IDC)

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 20 - 39

- 8.3 40 - 59

- 8.4 Above 60

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Oncology clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amgen

- 11.2 AstraZeneca

- 11.3 Eisai

- 11.4 Eli Lilly and Company

- 11.5 F. Hoffmann La Roche

- 11.6 GE HealthCare

- 11.7 Gilead Sciences

- 11.8 Macrogenics

- 11.9 Merck

- 11.10 Novartis

- 11.11 Pfizer

- 11.12 Sun Pharmaceutical