PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797856

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797856

Travel Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

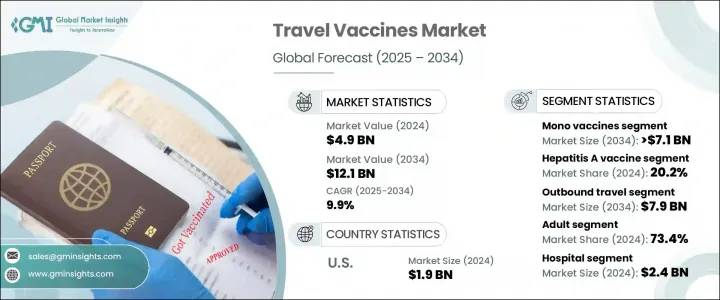

The Global Travel Vaccines Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 12.1 billion by 2034. This market is gaining momentum due to a mix of global health awareness, rapid advancements in vaccine development, and evolving international travel patterns. Increasing recognition of regional disease risks and the role of vaccination in preventing illness while abroad is fueling widespread demand. Government health policies, education efforts, and digital health platforms are reinforcing the critical role vaccines play in pre-travel planning.

As global travel recovers and diversifies, preventive immunization becomes a crucial component in maintaining public health, particularly in areas with limited healthcare infrastructure. Technology is enhancing vaccine production and delivery through innovations that streamline logistics, reduce costs, and improve shelf life. These shifts are enabling wider adoption of travel vaccines globally, especially in underserved and high-risk areas. Travel vaccines are administered to protect travelers from infections like rabies, typhoid, yellow fever, and hepatitis. The market is segmented into mono and combination vaccines, distributed through both public and private healthcare channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $12.1 Billion |

| CAGR | 9.9% |

The mono vaccines segment generated USD 2.9 billion in 2024 and is forecast to reach USD 7.1 billion by 2034 at a CAGR of 9.7%. Their continued dominance stems from targeted protection and lower risk of side effects, making them a preferred choice for travelers heading to areas with poor sanitation and high disease prevalence. Immunizations for diseases like typhoid and rabies are often recommended depending on the destination, duration of travel, and local healthcare conditions.

In terms of vaccine type, the Hepatitis A segment held a 20.2% share in 2024. Its strong position is linked to its essential role in protecting against food and water-borne illness, particularly in regions across Latin America, Asia, and Africa where sanitation remains a major concern. Even short visits can pose a risk, especially for those consuming local cuisine or staying in non-commercial accommodations. Due to the high transmission risk, global health authorities strongly recommend Hepatitis A vaccination as a standard measure for most international travelers.

United States Travel Vaccines Market generated USD 1.9 billion in 2024 and is expected to grow at a CAGR of 9.3% between 2025 and 2034. This growth aligns with increasing international departures and proactive public health initiatives. Federal agencies are supporting market expansion by encouraging travel-related immunization through updated guidelines and outreach efforts. The increase in outbound tourism, combined with rising disease awareness, continues to drive vaccine uptake across the country.

Leading players in the Global Travel Vaccines Market include Meiji Group, Dynavax Technologies, Serum Institute of India, Sanofi, GlaxoSmithKline plc (GSK), Valneva SE, Bharat Biotech, Pfizer, CSL, Emergent BioSolutions, Merck, and Bavarian Nordic. To maintain a competitive advantage, companies in the travel vaccines sector are implementing strategies centered around innovation, expansion, and accessibility. Investments in advanced technologies like mRNA and single-dose solutions are helping improve vaccine efficacy and delivery. Firms are enhancing their manufacturing scalability to meet global demand, particularly in regions with limited access. Strategic partnerships with public health institutions and travel health providers are being leveraged to increase awareness and distribution reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vaccine type trends

- 2.2.3 Disease type trends

- 2.2.4 Application trends

- 2.2.5 Age group trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising outbound or international travel

- 3.2.1.2 Growing awareness of preventive measures

- 3.2.1.3 Advancements in vaccine formulation and production efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Logistical & infrastructure challenges

- 3.2.2.2 Stringent regulatory approval process

- 3.2.3 Market opportunities

- 3.2.3.1 Customized & combination vaccines

- 3.2.3.2 Growing travel and tourism

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mono vaccines

- 5.3 Combination vaccines

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hepatitis A

- 6.3 Meningococcal diseases

- 6.4 Influenza

- 6.5 Diphtheria, pertussis, tetanus (DPT)

- 6.6 Rabies

- 6.7 Yellow fever

- 6.8 Typhoid

- 6.9 Measles, mumps, and rubella (MMR)

- 6.10 Hepatitis B

- 6.11 Other disease types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Outbound travel

- 7.3 Domestic travel

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.2.1 Public

- 9.2.2 Private

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Bavarian Nordic

- 11.2 Bharat Biotech

- 11.3 CSL

- 11.4 Dynavax Technologies

- 11.5 Emergent BioSolutions

- 11.6 GlaxoSmithKline plc (GSK)

- 11.7 Meiji Group

- 11.8 Merck

- 11.9 Pfizer

- 11.10 Sanofi

- 11.11 Serum Institute of India

- 11.12 Valneva SE