PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797888

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797888

Parcel Sorting System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

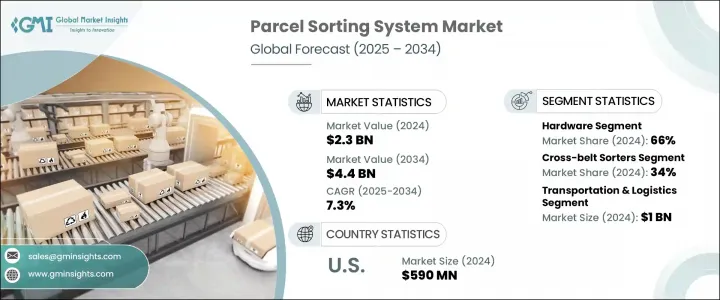

The Global Parcel Sorting System Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 4.4 billion by 2034. This steady growth is largely driven by the increasing demand for faster, smarter, and more cost-effective solutions in the logistics and e-commerce sectors. As the volume of parcels continues to rise and customer expectations tighten, logistics operators are shifting away from outdated manual methods toward advanced automation technologies. The integration of artificial intelligence, machine learning, and cloud-powered platforms is transforming sorting operations by improving speed, minimizing errors, and enhancing overall operational efficiency. Real-time adaptability and seamless processing across distribution hubs have become core priorities, making intelligent automation a central feature in modern parcel handling strategies.

Automated mobile robots and AI-driven systems are reducing handling time and boosting efficiency across logistics operations. Companies are also leveraging IoT and digital twin technologies to enable predictive maintenance, helping to improve equipment uptime and reliability. Innovations in performance tracking and proactive system alerts are being rolled out to avoid operational delays and maximize throughput. These tech-driven advancements reflect how logistics automation is evolving from assisted tasks to highly collaborative, intelligent ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 7.3% |

The hardware segment held a 66% share in 2024 and is estimated to grow at 7% CAGR through 2034. The increased need for modular, scalable hardware to handle rising parcel volumes is driving heavy investment in physical infrastructure. These systems are engineered for high-speed, high-accuracy operations and are critical to maintaining efficient logistics performance as order sizes and frequencies continue to rise globally.

Among sorting types, the cross-belt segment held a 34% share in 2024 and is expected to grow at a CAGR of 8% through 2034. Their ability to sort packages of various shapes and sizes with precision, while maintaining gentle handling for delicate items, has made them a top choice for high-volume logistics centers. Their versatility allows logistics providers to handle the growing variety of parcel types driven by global e-commerce growth, ensuring long-term adaptability.

U.S. Parcel Sorting System Market held an 80% share and generated USD 590 million in 2024. The country's leadership stems from its aggressive adoption of logistics automation, a strong e-commerce ecosystem, and continued investments in smart warehouse infrastructure. Companies are deploying advanced equipment alongside intelligent software platforms to improve output, manage sorting capacity, and optimize distribution across vast fulfillment networks.

Leading players in the Global Parcel Sorting System Market include BEUMER Group, Vanderlande, Korber, Honeywell Intelligrated, Daifuku, Interroll Group, and Dematic. To secure a stronger market position, companies in the parcel sorting system industry are deploying strategic initiatives that focus on innovation, expansion, and collaboration. They are enhancing product lines with AI-based automation, cloud integration, and real-time monitoring features. Firms are also forming global partnerships, expanding into emerging markets, and investing in next-gen technologies like AMRs, digital twins, and IoT-enabled diagnostics. Many companies are scaling their modular hardware offerings and customizing solutions for e-commerce, retail, and third-party logistics clients to ensure broader adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw materials manufacturer

- 3.1.1.2 Parcel sorting system manufacturer

- 3.1.1.3 Technology vendors and developers

- 3.1.1.4 System integrators and consultants

- 3.1.1.5 Distribution partners and channels

- 3.1.1.6 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-commerce growth and last-mile delivery demands

- 3.2.1.2 Rising labor costs and workforce optimization needs

- 3.2.1.3 Automation and ai integration in logistics operations

- 3.2.1.4 Sustainability requirements and environmental regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment and ROI considerations

- 3.2.2.2 High implementation and maintenance costs

- 3.2.3 Market opportunities

- 3.2.3.1 E-commerce driving advanced sorting needs

- 3.2.3.2 Growing need for flexible systems to sort varied parcel sizes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By type

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Push tray sorters

- 6.3 Tilt-tray sorter

- 6.4 Crossbelt sorter

- 6.5 Shoe sorter

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Transportation & Logistics

- 7.3 Retail & E-commerce

- 7.4 Food & Beverage

- 7.5 Pharmaceutical

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 Germany

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Belgium

- 8.2.7 Netherlands

- 8.2.8 Sweden

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Australia

- 8.3.5 Singapore

- 8.3.6 South Korea

- 8.3.7 Vietnam

- 8.3.8 Indonesia

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.2 Mexico

- 8.4.3 Argentina

- 8.5 MEA

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

Chapter 9 Company Profiles

- 9.1 Amazon

- 9.2 Alstef Group's

- 9.3 Bastian Solutions (Toyota Advanced Logistics)

- 9.4 BEUMER Group

- 9.5 BOWE INTRALOGISTICS

- 9.6 Daifuku

- 9.7 Dematic (KION Group)

- 9.8 Equinox MHE

- 9.9 Falcon Autotech

- 9.10 Five Group

- 9.11 GBI Intralogistics

- 9.12 GreyOrange

- 9.13 Honeywell Intelligrated

- 9.14 Interroll Group

- 9.15 Korber Supply Chain (formerly Consoveyo)

- 9.16 Kuecker Pulse Integration (KPI)

- 9.17 MHS Global

- 9.18 Okura Yusoki

- 9.19 Schaefer Systems International (SSI SCHAFER)

- 9.20 Vanderlande