PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801803

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801803

Expanded Polystyrene for Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

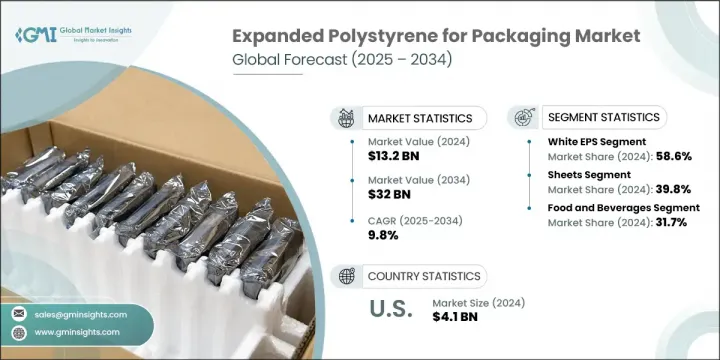

The Global Expanded Polystyrene for Packaging Market was valued at USD 13.2 billion in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 32 billion by 2034. This market growth is being driven by the need for lightweight, shock-absorbing packaging materials that offer high insulation properties. EPS helps protect goods-especially perishables-during long-distance transport by maintaining structural integrity and preserving freshness. The rising preference for ready-to-eat meals and convenient food solutions is also prompting increased demand for efficient and reliable packaging formats.

Surging e-commerce activities and rapid doorstep delivery services continue to influence the expansion of the EPS packaging market. As more consumers shift toward purchasing items like groceries, electronics, and pharmaceuticals online, there is a stronger emphasis on packaging that is lightweight yet resilient enough to protect goods in transit. Manufacturers and logistics providers increasingly favor EPS as it checks these boxes and supports cost-effective shipping. The material's reliability, strength-to-weight ratio, and insulation capabilities make it a key choice across sectors responding to modern distribution and delivery needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $32 Billion |

| CAGR | 9.8% |

White EPS remained the top-performing segment in 2024 with a market valuation of USD 7.7 billion. This variant is widely preferred for its affordability, proven reliability, and suitability across diverse packaging applications. From FMCG and agricultural produce to electronics and household appliances, white EPS continues to dominate. Advances in molding and surface technology have improved its compatibility with high-speed automated packaging systems. Although it appears simple, white EPS is widely utilized in high-volume, cost-sensitive packaging environments that prioritize speed and functionality.

The EPS sheets segment generated USD 5.2 billion in 2024. These sheets offer excellent impact resistance, are lightweight, and are known for being highly economical. They are often die-cut or laminated with foam backings to enhance structural protection in packaged electronics, machinery, and consumer appliances. The rising demand for tailored and protective packaging in these sectors ensures that EPS sheets will remain a preferred material in the years to come.

United States Expanded Polystyrene for Packaging Market generated USD 4.1 billion in 2024, registering a CAGR of 9% through 2034. The country's robust food and beverage industry continues to drive EPS usage, especially in cold chain logistics and insulation applications. Online shopping trends further amplify demand for EPS-based protective packaging. Market players are now exploring bio-based alternatives and sustainable recycling options to respond to increasing environmental concerns. Emphasis on lighter packaging that reduces shipping emissions and lowers costs is prompting innovations, creating new avenues for growth in the US.

Key players shaping the Global Expanded Polystyrene for Packaging Market include BASF SE, KANEKA CORPORATION, Alpek S.A.B. de C.V., TotalEnergies, Synthos, Dart Container Corporation, Wuxi Xingda Foam Plastic, Tamai Kasei Corporation, DuPont, Styrotech, Inc., Versalis S.p.A., Michigan Foam Products LLC, Engineered Foam Products, Foamcraft USA, LLC, and Styropek. Leading companies in the EPS packaging market are implementing a mix of product innovation, regional expansion, and sustainability initiatives to maintain a competitive edge. Many are investing in the development of recyclable and bio-based EPS solutions to align with global eco-conscious trends. Strategic partnerships with logistics firms and FMCG companies allow them to address evolving packaging needs. Automation in production and customized EPS molds are being prioritized to meet high-volume demand from online retail and cold-chain supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand in food and beverage industry

- 3.2.1.2 Rapid expansion of e-commerce and home delivery services

- 3.2.1.3 Construction industry growth

- 3.2.1.4 Cost-effectiveness and versatile applications

- 3.2.1.5 Recyclability and technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental concerns and regulatory pressure

- 3.2.2.2 Substitution by sustainable packaging alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Black

- 5.3 Grey

- 5.4 White

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Sheets

- 6.3 Trays & clamshells

- 6.4 Foam coolers

- 6.5 Cups & bowls

- 6.6 Packaging peanuts

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.2.1 Black

- 7.2.2 Grey

- 7.2.3 White

- 7.3 Foodservice

- 7.3.1 Black

- 7.3.2 Grey

- 7.3.3 White

- 7.4 Healthcare

- 7.4.1 Black

- 7.4.2 Grey

- 7.4.3 White

- 7.5 Electronics and electrical appliances

- 7.5.1 Black

- 7.5.2 Grey

- 7.5.3 White

- 7.6 Building and constructions

- 7.6.1 Black

- 7.6.2 Grey

- 7.6.3 White

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpek S.A.B. de C.V.

- 9.2 BASF SE

- 9.3 Cellofoam

- 9.4 Dart Container Corporation

- 9.5 DuPont

- 9.6 Engineered Foam Products

- 9.7 Epsilyte LLC

- 9.8 Flint Hills Resources

- 9.9 Foam Holdings, Inc.

- 9.10 Foam Products Corporation

- 9.11 Foamcraft USA, LLC

- 9.12 Geofoam International LLC

- 9.13 Harbor Foam

- 9.14 K. K. Nag Pvt. Ltd.

- 9.15 KANEKA CORPORATION

- 9.16 Michigan Foam Products LLC

- 9.17 Poliestireno de San Luis S.A. de C.V.

- 9.18 Storopack

- 9.19 Styropek

- 9.20 Styrotech, Inc.

- 9.21 Synthos

- 9.22 Tamai Kasei Corporation

- 9.23 TotalEnergies

- 9.24 Versalis S.p.A.

- 9.25 Wuxi Xingda Foam Plastic