PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801806

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801806

Analog Front-End (AFE) IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

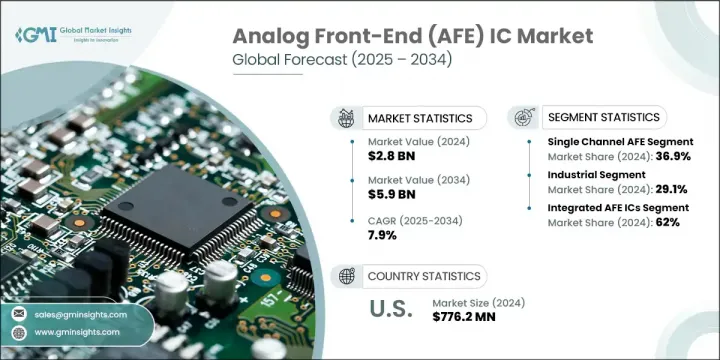

The Global Analog Front-End IC Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.9 billion by 2034. This growth is primarily driven by rising demand for wearable and portable medical devices, industrial automation, and advancements in wireless communication systems. Increasing reliance on programmable and multi-channel AFE ICs is contributing to the development of smarter sensor systems across healthcare, automotive, and industrial sectors. As IoT systems become more advanced, real-time analog signal processing is becoming critical.

The emergence of compact, energy-efficient AFE ICs is accelerating adoption in wearable and implantable medical devices, enabling continuous biosignal monitoring while conserving power and enhancing patient comfort. In automotive and transportation, the evolution of ADAS and electronic vehicle systems is intensifying demand for high-reliability, precision-focused AFE ICs that perform under extreme environmental conditions. Additionally, the aerospace sector's electrification and automation trends are boosting requirements for sensor fusion and radar interface solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 7.9% |

The multi-channel AFE segment is experiencing the fastest growth in the AFE IC market, projected to grow at a CAGR of 9.4% between 2025 and 2034. This acceleration is largely driven by rising integration of complex sensor networks in sectors such as automotive safety systems, industrial monitoring, and advanced medical diagnostics. To meet these needs, developers must focus on configurable, low-noise AFE ICs with built-in digital interfaces. Manufacturers that design compact, power-efficient multi-channel solutions tailored to mission-critical sectors will remain competitive and gain broader adoption.

The automotive and transportation segment is expected to grow at a CAGR of 10% throughout 2034. Rapid advancements in electric vehicles and ADAS technologies are fueling the demand for low-noise, multi-channel AFE ICs that enable precise data acquisition from radar, camera, and lidar systems. Additionally, accurate battery monitoring systems are essential in EVs, driving the need for automotive-grade analog front-end solutions built to meet stringent safety and reliability standards.

U.S. Analog Front-End (AFE) IC Market generated USD 776.2 million in 2024. Growth across the country is fueled by its leadership in semiconductor innovation, and strong demand from healthcare diagnostics, automation, and automotive electronics sectors. With the growing market for wearable health tech and automotive sensors, manufacturers in the U.S. must prioritize developing low-power, highly integrated AFEs that are both compact and compliant with regulatory standards. Strategic collaboration with domestic OEMs and healthcare technology providers is essential to accelerate product development, localization, and faster time-to-market.

Key players operating in the Global Analog Front-End (AFE) IC Market include NXP Semiconductors, Monolithic Power Systems, Inc., Texas Instruments Incorporated, Analog Devices Inc., Infineon Technologies AG, STMicroelectronics, Microchip Technology Inc., and Nisshinbo Micro Devices Inc. Leading companies in the analog front-end IC market are focusing on enhancing product performance while reducing size and power consumption. Priorities include expanding portfolios with multi-channel, low-noise AFEs that support digital integration and deliver superior signal fidelity.

Firms are also investing in advanced packaging technologies to enable high-density integration for space-constrained applications like wearables and automotive modules. To address diverse End user requirements, players are tailoring products for specific verticals such as industrial IoT, healthcare diagnostics, and electric vehicles. Additionally, companies are forming strategic alliances with OEMs, semiconductor foundries, and regional distributors to optimize supply chain efficiency and improve market reach. These strategies help accelerate innovation cycles, reduce design complexity for clients, and strengthen brand positioning across key growth regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Architecture trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of portable & wearable medical devices

- 3.2.1.2 Expansion of industrial automation & IIoT

- 3.2.1.3 Rising need for higher channel density & flexibility

- 3.2.1.4 Advancements in wireless & high-speed communications

- 3.2.1.5 Expansion of automotive electronics and ADAS

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High design complexity and cost pressure

- 3.2.2.2 Supply chain volatility and semiconductor shortages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Single channel AFE

- 5.3 Dual channel AFE

- 5.4 Multi channel AFE

Chapter 6 Market Estimates & Forecast, By Architecture, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Discrete AFE ICs

- 6.3 Integrated AFE ICs

- 6.4 Hybrid AFE ICs

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Industrial

- 7.2.1 Process automation & control systems

- 7.2.2 Robotics & motion systems

- 7.2.3 Energy & power monitoring systems

- 7.2.4 Industrial data acquisition & instrumentation

- 7.2.5 Others

- 7.3 Automotive & transportation

- 7.3.1 ADAS

- 7.3.2 EV battery management systems

- 7.3.3 In-vehicle infotainment & telematics

- 7.3.4 Motor control & powertrain

- 7.3.5 Others

- 7.4 Medical & healthcare devices

- 7.4.1 Patient monitoring equipment

- 7.4.2 Diagnostic imaging systems

- 7.4.3 Implantable & wearable devices

- 7.4.4 Laboratory & clinical instrumentation

- 7.4.5 Others

- 7.5 Telecom & communication equipment

- 7.5.1 Wireless base stations & small cells

- 7.5.2 RF front-ends & transceivers

- 7.5.3 Optical communication modules

- 7.5.4 Network monitoring & test equipment

- 7.5.5 Others

- 7.6 Consumer electronics & wearables

- 7.6.1 Audio & voice processing

- 7.6.2 Imaging & camera modules

- 7.6.3 Health & fitness wearables

- 7.6.4 Smart home & IoT devices

- 7.6.5 Others

- 7.7 Aerospace & defense

- 7.7.1 Radar & electronic warfare systems

- 7.7.2 Avionics & flight control systems

- 7.7.3 Secure communication modules

- 7.7.4 Navigation & positioning systems

- 7.7.5 Others

- 7.8 Test, measurement & instrumentation

- 7.8.1 Oscilloscopes & analyzers

- 7.8.2 Data loggers & handheld test devices

- 7.8.3 Scientific & environmental instruments

- 7.8.4 Calibration systems

- 7.8.5 Others

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Analog Devices Inc.

- 9.1.2 Texas Instruments Incorporated

- 9.1.3 STMicroelectronics

- 9.1.4 Infineon Technologies AG

- 9.1.5 NXP Semiconductors

- 9.1.6 ROHM Co., Ltd.

- 9.1.7 Microchip Technology Inc.

- 9.2 Regional Key Players

- 9.2.1 North America

- 9.2.1.1 Cirrus Logic, Inc.

- 9.2.1.2 Monolithic Power Systems, Inc.

- 9.2.1.3 Onsemi

- 9.2.1.4 MaxLinear

- 9.2.2 Europe

- 9.2.2.1 ams-OSRAM AG

- 9.2.2.2 Ricoh

- 9.2.3 Asia Pacific

- 9.2.3.1 Nisshinbo Micro Devices Inc.

- 9.2.3.2 Renesas Electronics Corporation

- 9.2.3.3 Hycon Technology Corp

- 9.2.3.4 SINOWEALTH Electronic Ltd.

- 9.2.1 North America

- 9.3 Disruptors/Niche Players

- 9.3.1 Qorvo

- 9.3.2 Asahi Kasei Microdevices Corporation

- 9.3.3 Trusignal Microelectronics