PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801807

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801807

BREEAM-Compliant Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

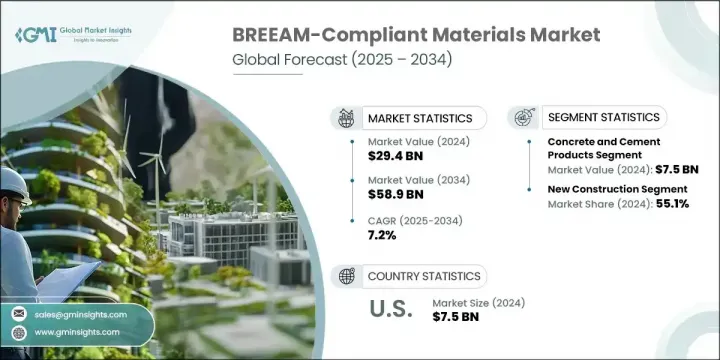

The Global BREEAM-Compliant Materials Market was valued at USD 29.4 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 58.9 billion by 2034. These materials are designed to align with BREEAM's sustainability requirements, ensuring minimal environmental impact throughout their lifecycle-from sourcing and manufacturing to end-of-life disposal. Growing environmental awareness, increased regulatory obligations, and the push toward stronger corporate sustainability commitments are significantly fueling demand for these eco-conscious construction products. As industries and governments strive to reduce their carbon footprints, BREEAM-certified materials are becoming an essential component in modern building practices.

With environmental challenges intensifying, companies and policymakers are working in unison to implement green solutions in construction, accelerating the adoption of these sustainable alternatives. The market is seeing continuous growth due to strong regulatory support, especially in regions where environmental policies are more rigorous and green construction is heavily incentivized. As sustainable construction evolves from a trend into a standard, the momentum behind BREEAM-compliant materials continues to grow rapidly, reinforcing their role in creating eco-friendly infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $58.9 Billion |

| CAGR | 7.2% |

The concrete and cement-based materials generated USD 7.5 billion in 2024, leading the BREEAM-compliant segment due to their pivotal role in foundational and structural construction. These products are widely adopted thanks to their cost-efficiency and adaptability in both newly built structures and eco-focused retrofits. As urbanization expands and infrastructure projects increase, especially in regions focused on sustainable development, demand for low-carbon alternatives is gaining pace. Manufacturers are increasingly prioritizing environmentally responsible versions of these materials to meet evolving green building expectations.

The new construction projects segment held 55.1% share in 2024, emerging as the top application segment. The rise in projects committed to meeting high environmental performance standards has made new builds a central driver of market growth. Nonetheless, retrofitting and refurbishing older buildings are gaining traction as developers and owners look to upgrade outdated structures in line with current energy efficiency benchmarks. Fit outs and interior applications are also on the rise, particularly in the commercial real estate space, as design professionals seek sustainable solutions for hospitality, retail, and office environments.

U.S. BREEAM-Compliant Materials Market generated USD 7.5 billion in 2024, positioning itself as a major player due to a strong focus on sustainable construction and regulatory frameworks that encourage the use of green materials. The increasing prioritization of eco-friendly building practices is boosting the adoption of BREEAM-certified products across commercial, residential, and institutional projects. Canada is also witnessing accelerated growth thanks to proactive governmental policies and collaborative efforts between academic institutions and the construction industry, further promoting sustainability across key sectors.

Prominent players shaping the Global BREEAM-Compliant Materials Market include EcoCocon, Kingspan, Holcim, Owens Corning, Amorim Cork, Saint-Gobain, Concrete Centre, and BRE Global Ltd. These companies are instrumental in setting sustainability benchmarks and delivering innovative construction materials. To enhance their presence in the BREEAM-compliant materials market, leading companies are investing significantly in product innovation focused on lowering carbon emissions, boosting energy efficiency, and improving recyclability. Many are reengineering existing product lines to meet or exceed BREEAM standards and are introducing new eco-conscious solutions tailored to both structural and interior applications. Partnerships with sustainability certifying bodies and strategic collaborations within the construction value chain are helping brands secure trust and visibility. Companies are also leveraging digital platforms to educate customers on the benefits of BREEAM-compliant products while expanding manufacturing capabilities to meet growing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Application trends

- 2.2.3 End use sector trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Concrete and Cement Products

- 5.2.1 Ready-Mix Concrete

- 5.2.2 Precast Concrete Elements

- 5.2.3 Cement Alternatives and Blends

- 5.3 Steel and Metal Products

- 5.3.1 Structural Steel

- 5.3.2 Reinforcing Steel

- 5.3.3 Metal Cladding and Roofing

- 5.3.4 Recycled Metal Content Products

- 5.4 Insulation Materials

- 5.4.1 Wood Fiber Insulation

- 5.4.2 Cork-based Insulation

- 5.4.3 Hemp and Bio-based Insulation

- 5.4.4 Recycled Content Insulation

- 5.5 Timber and Wood Products

- 5.5.1 Certified Sustainable Timber

- 5.5.2 Engineered Wood Products

- 5.5.3 Reclaimed and Recycled Wood

- 5.5.4 Bamboo and Alternative Wood Materials

- 5.6 Flooring and Finishing Materials

- 5.6.1 Sustainable Flooring Solutions

- 5.6.2 Low-VOC Paints and Coatings

- 5.6.3 Recycled Content Tiles and Surfaces

- 5.6.4 Bio-based Finishing Materials

- 5.7 Roofing and Envelope Materials

- 5.7.1 Green Roofing Systems

- 5.7.2 High-Performance Glazing

- 5.7.3 Sustainable Cladding Materials

- 5.7.4 Weather Barrier Systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 New construction

- 6.2.1 Commercial buildings

- 6.2.2 Residential buildings

- 6.2.3 Industrial facilities

- 6.2.4 Infrastructure projects

- 6.3 Refurbishment and retrofit

- 6.3.1 Heritage building restoration

- 6.3.2 Energy efficiency upgrades

- 6.3.3 Sustainable renovation projects

- 6.3.4 Building performance improvements

- 6.4 Fit-out and interior applications

- 6.4.1 Office fit-outs

- 6.4.2 Retail spaces

- 6.4.3 Healthcare facilities

- 6.4.4 Educational buildings

Chapter 7 Market Estimates and Forecast, By End Use Sector, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial real estate

- 7.2.1 Office buildings

- 7.2.2 Retail and shopping centers

- 7.2.3 Hotels and hospitality

- 7.2.4 Mixed-use developments

- 7.3 Residential sector

- 7.3.1 Single-family homes

- 7.3.2 Multi-family housing

- 7.3.3 Affordable housing projects

- 7.3.4 Luxury residential developments

- 7.4 Institutional buildings

- 7.4.1 Healthcare facilities

- 7.4.2 Educational institutions

- 7.4.3 Government buildings

- 7.4.4 Cultural and community centers

- 7.5 Industrial and infrastructure

- 7.5.1 Manufacturing facilities

- 7.5.2 Warehouses and distribution centers

- 7.5.3 Transportation infrastructure

- 7.5.4 Utilities and energy projects

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Amorim Cork

- 9.2 BRE Global Ltd

- 9.3 Concrete Centre

- 9.4 EcoCocon

- 9.5 Holcim

- 9.6 Kingspan

- 9.7 Owens Corning

- 9.8 Saint-Gobain