PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801808

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801808

Agriculture Hand Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

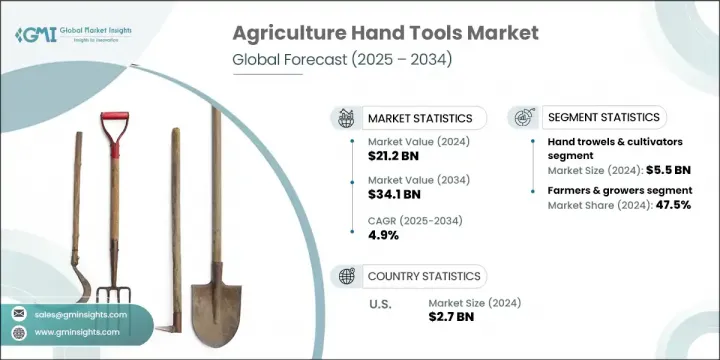

The Global Agriculture Hand Tools Market was valued at USD 21.2 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 34.1 billion by 2034. The ongoing demand for higher food production and the need for affordable farming solutions continue to fuel market growth. Manual tools remain a critical part of operations for smallholder farmers and agricultural communities worldwide, assisting in core tasks such as planting, weeding, and harvesting. As sustainable farming practices gain momentum, there's an increasing preference for durable, eco-conscious tools made using recycled or low-impact materials. At the same time, technological upgrades-like ergonomic handles and multi-use designs-are improving ease of use and labor efficiency, making hand tools more appealing across user segments.

Key companies in this market are focusing on enhancing their product portfolios, entering regional partnerships, and expanding globally to improve their footprint. The development of user-friendly, lightweight, and ergonomically designed tools that reduce strain and improve accuracy has become central to new launches. Manufacturers are also prioritizing environmentally friendly options to meet growing customer expectations. Changes in distribution, such as the rise of digital platforms and outreach to rural supply chains, help improve access to these tools. In a price-sensitive sector, product durability, functionality, and brand perception significantly influence purchasing behavior. A substantial portion of market demand stems from farmers and growers who rely on reliable tools for daily operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.2 Billion |

| Forecast Value | $34.1 Billion |

| CAGR | 4.9% |

The Hand trowels and cultivators segment generated USD 5.5 billion in 2024, leading the product category due to their importance in tasks like planting, transplanting, aerating soil, and fertilizing in small spaces. These tools are adopted in applications ranging from home gardening to large-scale agriculture and landscaping. Their compact form and precision make them ideal for confined environments such as container gardens, vegetable beds, and ornamental patches-especially in urban and suburban settings where space is limited.

The farmers and growers segment held a 47.5% share in 2024. This user group forms the backbone of tool demand due to their daily involvement in core crop production, from soil preparation to harvesting. Manual equipment such as hoes, pruning tools, spades, and hand cultivators play a key role in the workflows of small- to mid-sized farms, particularly those embracing organic and sustainable farming methods.

U.S. Agriculture Hand Tools Market generated USD 2.7 billion in 2024. The country's expansive farming industry, which merges traditional methods with advanced agri-tech, plays a pivotal role in the global agricultural economy. As one of the top producers and exporters of crops and livestock, the U.S. integrates modern techniques like automation, smart farming, and real-time data monitoring. Growing consumer interest in organic produce and eco-conscious practices continues to shape farming trends, while policy support and R&D investments further influence equipment adoption.

Notable companies shaping the Global Agriculture Hand Tools Market include Stanley Black & Decker, Corona Tools, GARDENA, Fiskars Group, WOLF-Garten, A.M. Leonard, Ames True Temper, Truper, Bahco, Griffon, Husqvarna, Lowell Corporation, JCB Tools, Walter Stern Inc., and Vaughan & Bushnell. Leading players in the agriculture hand tools market are focusing on innovation, localization, and sustainability to strengthen their market standing. Many manufacturers are investing in R&D to produce tools with improved ergonomics and durability while keeping materials lightweight and environmentally responsible. Partnerships with regional distributors and agricultural cooperatives are enabling deeper rural penetration and wider product accessibility. Companies are expanding online retail channels to reach tech-savvy farmers and urban gardeners, while also leveraging data to refine product offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Adoption of sustainable farming

- 3.2.1.2 Rising small-scale and urban farming

- 3.2.1.3 Cost-effectiveness and versatility of applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition from mechanized and power tools

- 3.2.2.2 Market fragmentation and counterfeiting

- 3.2.3 Opportunities

- 3.2.3.1 Technological and design innovations

- 3.2.3.2 Commercial landscaping and horticulture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hand trowels & cultivators

- 5.3 Pruning & sheering tools

- 5.4 Digging & spading tools

- 5.5 Hoes & weeders

- 5.6 Sprayers & applicators

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Crop cultivation

- 6.3 Soil preparation

- 6.4 Planting & transplanting

- 6.5 Weeding & pest control

- 6.6 Harvesting

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Farmers & growers

- 7.3 Horticulturists

- 7.4 Landscapers & gardeners

- 7.5 Agricultural institutions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 A.M. Leonard

- 10.2 Ames True Temper

- 10.3 Bahco

- 10.4 Corona Tools

- 10.5 Fiskars Group

- 10.6 GARDENA

- 10.7 Griffon

- 10.8 Husqvarna

- 10.9 JCB Tools

- 10.10 Lowell Corporation

- 10.11 Stanley Black & Decker

- 10.12 Truper

- 10.13 Vaughan & Bushnell

- 10.14 Walter Stern Inc

- 10.15 WOLF-Garten