PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801812

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801812

Wireless Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

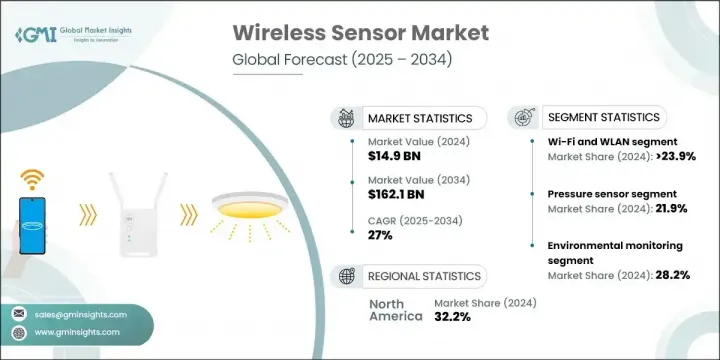

The Global Wireless Sensor Market was valued at USD 14.9 billion in 2024 and is estimated to grow at a CAGR of 27% to reach USD 162.1 billion by 2034. The expansion is fueled by rising automation across industries, a sharp increase in robotics adoption, and continued investment in smart infrastructure. The automotive sector is playing a key role, particularly with demand for advanced driver-assistance systems and autonomous technologies. As industrial ecosystems modernize, wireless sensors are becoming essential to real-time data capture and remote monitoring, helping reduce wiring complexity and enabling more flexible system configurations.

From smart cities to Industry 4.0 transformations, these sensors are instrumental in enabling predictive analytics, system optimization, and connected operations. They serve as the backbone for intelligent environments where machines, infrastructure, and devices interact seamlessly. In manufacturing, wireless sensors support condition-based monitoring, minimizing unplanned downtime through early fault detection and maintenance alerts. Within smart cities, they power real-time tracking of air quality, traffic flow, energy usage, and public safety systems-helping urban planners make data-driven decisions. In energy and utilities, wireless sensors optimize load distribution, monitor grid performance, and enable remote asset management. Their role extends to supply chains as well, where sensors enhance visibility, traceability, and inventory control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.9 billion |

| Forecast Value | $162.1 Billion |

| CAGR | 27% |

The Wi-Fi and WLAN technology segment will grow at a CAGR of 28.2% through 2034. Its high adoption across enterprise networks, smart homes, and consumer electronics is supported by advancements in standards like Wi-Fi 6E and Wi-Fi 7, which offer lower latency, enhanced speeds, and improved device handling in high-density environments. These improvements are further strengthening its role in streaming, industrial IoT, and gaming applications.

In 2024, the pressure sensors segment will be dominated by application type, widely deployed in sectors such as manufacturing, automotive, healthcare, and climate control systems. Their ability to deliver real-time, highly accurate data makes them vital for operations requiring tight monitoring and precise control across mission-critical systems.

North America Wireless Sensor Market held 32.2% share in 2024, driven by rapid advances in smart manufacturing and widespread deployment of low-power wireless technologies. Major sensor manufacturers are boosting R&D to focus on energy efficiency, edge computing, and protocol standardization. Recent expansions of wireless sensor networks in American cities have supported real-time environmental monitoring, improving data-driven decisions for urban planning and public health initiatives.

Key players in the Global Wireless Sensor Market include Honeywell International, Inc., Emerson Electric Co., Siemens AG, ABB Ltd., and Texas Instruments Incorporated. Leading companies are prioritizing investments in product innovation to develop ultra-low power and highly integrated sensor platforms that support edge computing. They are expanding strategic partnerships with industrial IoT providers to integrate sensors into end-to-end solutions. Firms are also entering new application verticals such as healthcare and smart agriculture to diversify market reach. Significant R&D budgets are being directed toward enhancing connectivity protocols and optimizing performance for real-time analytics. Many players are also strengthening global distribution networks and digital platforms to improve market penetration and after-sales support, while actively exploring mergers and collaborations to scale technological capabilities and geographic footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Sensor type

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of energy-efficient technologies

- 3.2.1.2 Growing automotive industries worldwide

- 3.2.1.3 Growing industrial automation and Industry 4.0 adoption

- 3.2.1.4 Demand for remote monitoring and asset tracking

- 3.2.1.5 Rising investment in smart infrastructure worldwide

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardization

- 3.2.2.2 Power and battery limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of smart cities across the globe

- 3.2.3.2 Growth in precision agriculture

- 3.2.3.3 Healthcare and remote patient monitoring

- 3.2.3.4 Advancements in energy harvesting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Biosensors

- 5.3 Temperature sensors

- 5.4 Pressure sensors

- 5.5 Humidity sensors

- 5.6 Gas / chemical sensors

- 5.7 Flow sensors

- 5.8 Level sensors

- 5.9 Motion & positioning sensors

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Bluetooth

- 6.3 Wi-Fi and WLAN

- 6.4 Zigbee

- 6.5 Wireless HART

- 6.6 RFID

- 6.7 EnOcean

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Environmental monitoring

- 7.3 Asset tracking

- 7.4 Structural health monitoring

- 7.5 Energy management

- 7.6 Security and surveillance

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Healthcare

- 8.4 Industrial

- 8.5 Consumer electronics

- 8.6 Agriculture

- 8.7 Aerospace & defense

- 8.8 Transportation & logistics

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Honeywell International

- 10.1.2 Texas Instruments Inc

- 10.1.3 Siemens AG

- 10.1.4 ABB Ltd.

- 10.1.5 Emerson Electric Co.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Analog Devices Inc.

- 10.2.1.2 Cisco Systems Inc.

- 10.2.1.3 Monnit Corporation

- 10.2.2 Europe

- 10.2.2.1 STMicroelectronics N.V.

- 10.2.2.2 Infineon Technologies AG

- 10.2.2.3 TE Connectivity Ltd.

- 10.2.2.4 NXP Semiconductors N.V.

- 10.2.3 APAC

- 10.2.3.1 Yokogawa Electric Corporation

- 10.2.3.2 Huawei Investment Holding Co., Ltd.

- 10.2.3.3 Toshiba Corporation

- 10.2.3.4 Holykell Technology Co., Ltd.

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 BAE Systems PLC

- 10.3.2 Phoenix Sensors LLC

- 10.3.3 IntelliSense.io

- 10.3.4 Inovonics Corporation