PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801813

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801813

Hybrid Composite for Additive Manufacturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

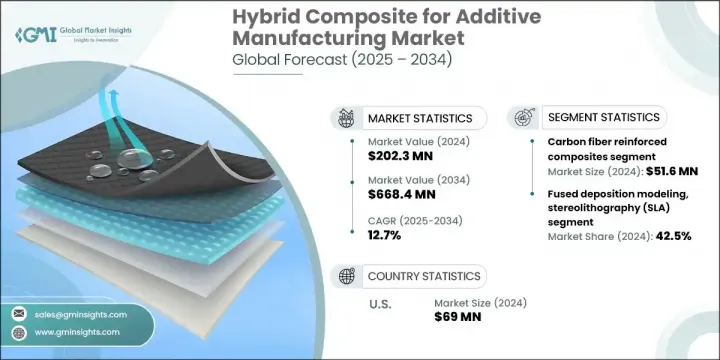

The Global Hybrid Composite for Additive Manufacturing Market was valued at USD 202.3 million in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 668.4 million by 2034. This market is advancing rapidly due to the increasing need for manufacturing complex, lightweight, and high-strength components with precision and efficiency. Hybrid composite additive manufacturing brings together traditional subtractive methods with additive techniques to produce intricate structures that meet rigorous quality and strength requirements. Its applications span across several high-demand sectors, especially those that require parts with superior surface finish, complex geometries, and optimized mechanical performance.

Industries such as aerospace, healthcare, and automotive are driving this growth. In aviation, particularly, the focus on fuel-efficient, lightweight parts has pushed manufacturers to invest heavily in hybrid AM to meet sustainability goals and emission regulations. The market is also gaining traction as governments continue to encourage green technology initiatives. As environmental standards tighten, hybrid manufacturing offers a reliable solution that aligns with global sustainability efforts, while enhancing manufacturing speed and material efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $202.3 Million |

| Forecast Value | $668.4 Million |

| CAGR | 12.7% |

Carbon fiber-reinforced composites led the segment with USD 51.6 million in 2024 due to their excellent strength-to-weight ratio and resilience. Their dominance is especially visible in industries that demand lightweight yet durable components, helping manufacturers meet rising fuel economy and performance standards. These composites are becoming foundational in applications like high-end sporting gear, automotive performance parts, and structural aerospace components.

Technologies like fused deposition modeling and stereolithography collectively held 42.5% of the market in 2024. Fused deposition modeling (FDM) continues to gain popularity thanks to its cost-effectiveness, versatility, and ease of use across multiple sectors. FDM enables faster production of prototypes and End use parts, making it ideal for industries that prioritize rapid design iterations, including automotive, healthcare, and industrial tooling.

United States Hybrid Composite for Additive Manufacturing Market generated USD 69 million in 2024. With a robust ecosystem of advanced manufacturing and a strong presence of End use sectors, the U.S. has become a hotspot for innovation and adoption of hybrid composites. Government support for sustainable materials, increased focus on clean tech, and funding for next-gen manufacturing initiatives are key drivers pushing market development in the country.

Leading players in the Hybrid Composite for Additive Manufacturing Market include SGL Carbon, Arris Composites, Ultimaker, EOS, 3D Systems, Hewlett-Packard, Formlabs, Markforged, Phillips, and Stratasys. Major players are focusing on integrating hybrid capabilities into their existing 3D printing platforms to offer solutions that balance speed, accuracy, and material versatility. Strategic partnerships with OEMs and End use industries are helping manufacturers co-develop application-specific components in aerospace and automotive. Companies are also increasing R&D investment to develop next-generation materials like reinforced polymers and carbon-based composites. Expansion into sustainable product lines and compliance with green regulations are other major strategies to appeal to eco-conscious sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carbon fiber reinforced composites

- 5.3 Glass fiber reinforced composites

- 5.4 Metal-polymer hybrid composites

- 5.5 Ceramic matrix composites

- 5.6 Aramid fiber composites

- 5.7 Natural fiber hybrid composites

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fused deposition modeling

- 6.3 Stereolithography (SLA) and digital light processing (DLP)

- 6.4 Selective laser sintering (SLS)

- 6.5 Hybrid manufacturing systems

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace and defense

- 7.2.1 Commercial aviation components

- 7.2.2 Military and defense applications

- 7.2.3 Space and satellite systems

- 7.2.4 eVTOL and urban air mobility

- 7.3 Automotive industry

- 7.3.1 Electric vehicle components

- 7.3.2 Hybrid vehicle applications

- 7.3.3 Performance and racing applications

- 7.3.4 Tooling and manufacturing aids

- 7.4 Medical and healthcare

- 7.4.1 Prosthetics and orthotics

- 7.4.2 Surgical instruments

- 7.4.3 Medical device components

- 7.4.4 Dental applications

- 7.5 Industrial and manufacturing

- 7.5.1 Tooling and fixtures

- 7.5.2 End use parts production

- 7.5.3 Prototyping and development

- 7.6 Consumer goods and sports equipment

- 7.7 Energy and renewable applications

- 7.7.1 Wind energy components

- 7.7.2 Solar panel applications

- 7.7.3 Energy storage systems

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 3D Systems

- 9.2 Arris Composites

- 9.3 EOS

- 9.4 Formlabs

- 9.5 Hewlett-Packard

- 9.6 Markforged

- 9.7 Philips

- 9.8 SGL Carbon

- 9.9 Stratasys

- 9.10 Ultimaker