PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801823

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801823

Spine Robotic Surgery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

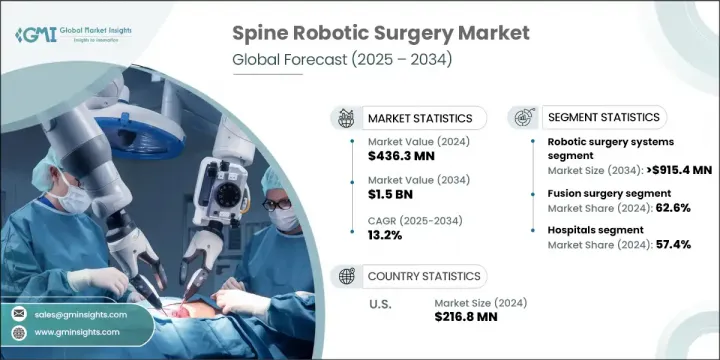

The Global Spine Robotic Surgery Market was valued at USD 436.3 million in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 1.5 billion by 2034. This substantial growth is largely driven by the rising incidence of spinal disorders, increased healthcare investment, and a global shift toward minimally invasive surgical procedures. The need for advanced surgical options continues to grow as patients and providers alike seek safer, more accurate procedures that also reduce recovery time. As the aging population increases and healthcare systems evolve, the demand for robot-assisted spinal procedures is expanding across various regions.

Innovations in surgical robotics-combined with developments in artificial intelligence, navigation, and real-time imaging-are making these systems more reliable and widely adopted. These technologies are improving precision during complex spine procedures and enabling outcomes that traditional surgical methods struggle to achieve. In this evolving medical landscape, robotic systems are becoming an essential component of spinal surgery, enhancing both safety and efficiency. Their growing presence in hospitals and surgical centers signals a strong market trajectory through the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $436.3 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 13.2% |

Spine robotic surgery offers a level of control and accuracy that dramatically improves the way spinal procedures are performed. Its minimally invasive nature supports faster healing and lowers complication risks, which appeals to both surgeons and patients. By using robotic systems, clinicians can make smaller, more precise incisions, which helps minimize trauma to surrounding tissue. These systems enable fine-tuned maneuvers that are difficult to replicate manually, reducing the potential for surgical error and delivering better results. Hospitals benefit from reduced recovery times and shorter patient stays, which in turn lowers overall healthcare costs and increases efficiency in surgical workflows.

The robotic surgery systems segment held a 58.3% share in 2024. Experts pointed to technological advancement and strong clinical outcomes as key drivers for this performance. Modern surgical robotics are equipped with enhanced imaging, AI-driven planning, and real-time navigation, helping surgeons perform highly complex procedures with ease. This translates into more precise surgeries and less risk of revision, making robotic platforms a preferred choice in many facilities. Additionally, robotic systems are built to support minimally invasive techniques, offering advanced tools that assist with delicate and intricate tasks. This precision not only improves surgical quality but also boosts surgeon confidence.

The fusion surgery segment accounted for a 62.6% share in 2024, reflecting its continued popularity in spinal treatment. Spinal fusion remains one of the most frequently performed procedures, particularly as spine-related issues become more common with aging populations and lifestyle factors. Robotic-assisted fusion surgeries offer heightened precision, fewer complications, and lower revision rates, all of which contribute to their dominance in this space. The integration of robotics has helped refine these procedures, making them safer and more predictable for patients dealing with chronic spine conditions.

United States Spine Robotic Surgery Market generated USD 216.8 million in 2024. The region's dominance is fueled by advanced hospital systems, quick adoption of innovative technologies, and increasing investments in research and development. The US shows strong growth due to its established infrastructure and reimbursement landscape, alongside a large patient population affected by spine disorders. These factors make North America an innovation hub and commercial leader in robotic spine surgery, drawing interest from companies aiming to expand their global footprint.

Major players influencing the Global Spine Robotic Surgery Market include Johnson & Johnson, Zimmer Biomet, Siemens Healthineers, Medtronic, Intuitive Surgical Operations, Stryker, Brainlab, CUREXO, Orthofix Medical, R2 Surgical, B Braun, Globus Medical, and others. Their continued R&D investments and focus on product innovation are shaping the future of spinal surgery technologies. To build a strong market presence, leading companies in the spine robotic surgery space are focusing on continual innovation and strategic partnerships. They're investing heavily in AI integration, next-gen navigation tools, and advanced imaging capabilities to offer precision-enhanced systems. Many are expanding their clinical trial pipelines to gain regulatory approvals faster across global markets. Collaborations with hospitals and academic institutions are helping accelerate the adoption of robotic platforms by providing training and demonstration facilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of spinal disorders

- 3.2.1.2 Technological advancements

- 3.2.1.3 Surge in minimally invasive surgical procedures

- 3.2.1.4 Increased healthcare spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity of robotic devices

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Growth potential in developing economies

- 3.2.3.2 Continued investment in research and development for product development

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Growth potential analysis

- 3.5 Reimbursement scenario

- 3.6 Regulatory landscape

- 3.6.1 U.S.

- 3.6.2 Europe

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Future market trends

- 3.9 New product development landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Gap analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Robotic surgery systems

- 5.2.1 Fully robotic systems

- 5.2.2 Robotic arm-assisted systems

- 5.3 Surgical navigation systems

- 5.3.1 Electromagnetic navigation systems

- 5.3.2 Optical navigation systems

- 5.3.3 Hybrid navigation systems

- 5.4 Software solutions

- 5.5 Accessories and consumables

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fusion surgery

- 6.3 Non-fusion surgery

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Brainlab

- 9.3 CUREXO

- 9.4 Globus Medical

- 9.5 Intuitive Surgical Operations

- 9.6 Johnson & Johnson

- 9.7 Medtronic

- 9.8 Orthofix Medical

- 9.9 R2 Surgical

- 9.10 Siemens Healthineers

- 9.11 Stryker

- 9.12 Zimmer Biomet