PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801824

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801824

China Low-Carbon Concrete and Cement Alternatives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

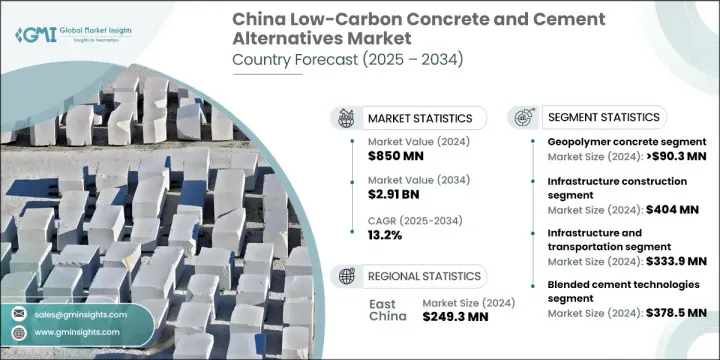

China Low-Carbon Concrete and Cement Alternatives Market was valued at USD 850 million in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 2.91 billion by 2034. The national goal of achieving carbon neutrality by 2060 is a major force accelerating the adoption of low-emission materials in construction. The government's environmental policies, including the integration of the cement industry into the national carbon emission trading scheme, are prompting manufacturers to shift toward alternative binders and supplementary cementitious materials. This momentum is supported by China's rapid urban expansion and rising demand for eco-conscious construction inputs in large-scale public infrastructure and residential projects.

With urbanization levels reaching 67% in 2024, the push for sustainable urban development continues to fuel the market. Government-backed investments into green construction and tighter emission control laws are transforming how building materials are produced and applied. As more developers and contractors are urged to align with green building practices, the cement sector is under pressure to reduce carbon footprints and incorporate climate-aligned technologies into their offerings. Emerging low-carbon technologies and robust policy implementation are redefining the competitive landscape across key regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $850 Million |

| Forecast Value | $2.91 Billion |

| CAGR | 13.2% |

The infrastructure construction segment generated USD 404 million in 2024. This segment holds the largest share due to substantial government-backed investments in public works, utilities, and transport systems. The surge in civil engineering projects, coupled with demand for durable, high-performance building materials, continues to drive the uptake of sustainable alternatives in this segment. The need for resilient and long-lasting materials in infrastructure aligns well with the push toward low-emission construction practices.

The blended cement technologies segment generated USD 378.5 million in 2024. The growing reliance on materials such as slag, fly ash, and calcined clays reflects China's strategy to reduce clinker content in cement products. These materials offer a practical solution to meeting emissions targets without compromising durability or cost-efficiency. With ample supply from industrial sources and advanced processing capabilities, blended cements are becoming the preferred option for decarbonizing the sector.

East China Low-Carbon Concrete and Cement Alternatives Market generated USD 249.3 million in 2024, held a 29.3% share. This region remains the most mature and dynamic market for low-carbon concrete and cement alternatives due to its high construction activity and early adoption of green building initiatives. East China's strong industrial base and commitment to sustainable urban growth are key factors propelling regional market dominance.

Key players driving innovation and supply in the China Low-Carbon Concrete and Cement Alternatives Market include China Shanshui Cement Group Limited, Anhui Conch Cement Company Limited, Huaxin Cement Co., Ltd., China Resources Cement Holdings Limited, and China National Building Material Group Corporation (CNBM). Leading companies in the China low-carbon concrete and cement alternatives market are adopting aggressive decarbonization measures to strengthen their market position. Major players are investing in R&D to develop advanced blended cements using locally sourced SCMs, including fly ash and slag, to reduce clinker dependency. Partnerships with environmental authorities and participation in the national emissions trading program are also central to aligning with regulatory trends. Several firms are expanding their green material portfolios through strategic acquisitions and scaling up low-carbon production lines in high-demand regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 China's Carbon Neutrality Goals and Policy Framework

- 3.2.1.2 Infrastructure Development and Urbanization Trends

- 3.2.1.3 Environmental Regulations and Emission Reduction Targets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technology Adoption Barriers and Quality Standardization

- 3.2.2.2 Supply Chain Constraints and Raw Material Availability

- 3.2.2.3 Initial Investment Requirements and Cost Considerations

- 3.2.2.4 Regulatory Compliance and Certification Processes

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging Technology Applications and Innovations

- 3.2.3.2 Government Investment and Funding Initiatives

- 3.2.3.3 International Trade and Export Opportunities

- 3.2.3.4 Circular Economy and Waste Utilization Potential

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 Regulatory landscape

- 3.3.2 North China Region

- 3.3.3 East China Region

- 3.3.4 South China Region

- 3.3.5 Southwest China Region

- 3.3.6 Northwest China Region

- 3.3.7 Central China Region

- 3.3.8 Northeast China Region

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.5.1 Technology and Innovation Landscape

- 3.5.2 Current technological trends

- 3.5.3 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Future market trends

- 3.8 Technology and Innovation Landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North China Region

- 4.2.1.2 East China Region

- 4.2.1.3 South China Region

- 4.2.1.4 Southwest China Region

- 4.2.1.5 Northwest China Region

- 4.2.1.6 Central China Region

- 4.2.1.7 Northeast China Region

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Geopolymer Concrete

- 5.2.1 Fly Ash-Based Geopolymer Concrete

- 5.2.2 Slag-Based Geopolymer Concrete

- 5.2.3 Metakaolin-Based Geopolymer Concrete

- 5.2.4 Multi-Component Geopolymer Systems

- 5.3 Supplementary Cementitious Materials (SCMs)

- 5.3.1 Fly Ash Concrete

- 5.3.2 Ground Granulated Blast Furnace Slag (GGBFS) Concrete

- 5.3.3 Silica Fume Concrete

- 5.3.4 Natural Pozzolan Concrete

- 5.4 Recycled and Waste-Based Concrete

- 5.4.1 Recycled Aggregate Concrete

- 5.4.2 Municipal Solid Waste Incineration Ash Concrete

- 5.4.3 Industrial Waste-Based Concrete

- 5.4.4 Construction and Demolition Waste Concrete

- 5.5 Bio-Based and Organic Alternatives

- 5.5.1 Bio-Cement and Microbial Concrete

- 5.5.2 Plant-Based Fiber Reinforced Concrete

- 5.5.3 Organic Polymer-Modified Concrete

- 5.6 Ultra-High Performance Concrete (UHPC)

- 5.6.1 Low-Carbon UHPC Formulations

- 5.6.2 Fiber-Reinforced UHPC

- 5.6.3 Self-Healing UHPC Systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Infrastructure Construction

- 6.2.1 Transportation Infrastructure (Roads, Bridges, Tunnels)

- 6.2.2 Water and Wastewater Treatment Facilities

- 6.2.3 Energy Infrastructure (Power Plants, Renewable Energy)

- 6.2.4 Port and Marine Infrastructure

- 6.3 Building Construction

- 6.3.1 Residential Construction

- 6.3.2 Commercial and Office Buildings

- 6.3.3 Industrial Buildings and Warehouses

- 6.3.4 Institutional Buildings (Schools, Hospitals)

- 6.4 Specialized Applications

- 6.4.1 Precast Concrete Products

- 6.4.2 Ready-Mix Concrete

- 6.4.3 Concrete Blocks and Masonry Units

- 6.4.4 Decorative and Architectural Concrete

- 6.5 Green Building and Sustainable Construction

- 6.5.1 LEED and Green Building Certified Projects

- 6.5.2 Nearly Zero Energy Buildings (NZEB)

- 6.5.3 Sponge City Construction Projects

- 6.5.4 Carbon Neutral Building Initiatives

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction and Real Estate

- 7.2.1 Residential Development

- 7.2.2 Commercial Real Estate

- 7.2.3 Industrial Real Estate

- 7.2.4 Mixed-Use Development Projects

- 7.3 Infrastructure and Transportation

- 7.3.1 Railway and High-Speed Rail Projects

- 7.3.2 Highway and Road Construction

- 7.3.3 Airport and Aviation Infrastructure

- 7.3.4 Urban Transit Systems

- 7.4 Energy and Utilities

- 7.4.1 Power Generation Facilities

- 7.4.2 Renewable Energy Projects

- 7.4.3 Oil and Gas Infrastructure

- 7.4.4 Water Treatment and Distribution

- 7.5 Industrial and Manufacturing

- 7.5.1 Manufacturing Facilities

- 7.5.2 Petrochemical and Chemical Plants

- 7.5.3 Mining and Extractive Industries

- 7.5.4 Data Centers and Technology Infrastructure

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Alkali-Activated Systems

- 8.2.1 Sodium Silicate Activated Systems

- 8.2.2 Sodium Hydroxide Activated Systems

- 8.2.3 Potassium-Based Activation Systems

- 8.2.4 Hybrid Activation Technologies

- 8.3 Blended Cement Technologies

- 8.3.1 Portland Pozzolan Cement (PPC)

- 8.3.2 Portland Slag Cement (PSC)

- 8.3.3 Composite Cement Systems

- 8.3.4 Ternary Blended Cements

- 8.4 Carbon Capture and Utilization

- 8.4.1 CO2 Mineralization in Concrete

- 8.4.2 Carbon Curing Technologies

- 8.4.3 Integrated CCUS Systems

- 8.5 Advanced Manufacturing Technologies

- 8.5.1 3D Printing and Additive Manufacturing

- 8.5.2 Automated Mixing and Batching Systems

- 8.5.3 Quality Control and Testing Technologies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North China Region

- 9.2.1 Beijing Municipality

- 9.2.2 Tianjin Municipality

- 9.2.3 Hebei Province

- 9.2.4 Shanxi Province

- 9.2.5 Inner Mongolia Autonomous Region

- 9.3 East China Region

- 9.3.1 Shanghai Municipality

- 9.3.2 Jiangsu Province

- 9.3.3 Zhejiang Province

- 9.3.4 Anhui Province

- 9.3.5 Fujian Province

- 9.3.6 Jiangxi Province

- 9.3.7 Shandong Province

- 9.4 South China Region

- 9.4.1 Guangdong Province

- 9.4.2 Guangxi Zhuang Autonomous Region

- 9.4.3 Hainan Province

- 9.5 Southwest China Region

- 9.5.1 Chongqing Municipality

- 9.5.2 Sichuan Province

- 9.5.3 Guizhou Province

- 9.5.4 Yunnan Province

- 9.5.5 Tibet Autonomous Region

- 9.6 Northwest China Region

- 9.6.1 Shaanxi Province

- 9.6.2 Gansu Province

- 9.6.3 Qinghai Province

- 9.6.4 Ningxia Hui Autonomous Region

- 9.6.5 Xinjiang Uygur Autonomous Region

- 9.7 Central China Region

- 9.7.1 Henan Province

- 9.7.2 Hubei Province

- 9.7.3 Hunan Province

- 9.8 Northeast China Region

- 9.8.1 Liaoning Province

- 9.8.2 Jilin Province

- 9.8.3 Heilongjiang Province

Chapter 10 Company Profiles

- 10.1 Anhui Conch Cement Company Limited

- 10.2 Betolar

- 10.3 China National Building Material Group Corporation

- 10.4 China Resources Cement Holdings Limited

- 10.5 China Shanshui Cement Group Limited

- 10.6 Hangzhou Hanrui Building Materials Co., Ltd

- 10.7 Hebei Jinniu Energy Group Co., Ltd.

- 10.8 Huaxin Cement Co., Ltd.

- 10.9 Jiangxi Wannianqing Cement Co., Ltd

- 10.10 Tangshan Jidong Cement Co., Ltd.

- 10.11 URETEK China

- 10.12 West China Cement Limited