PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801828

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801828

Absorbable Surgical Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

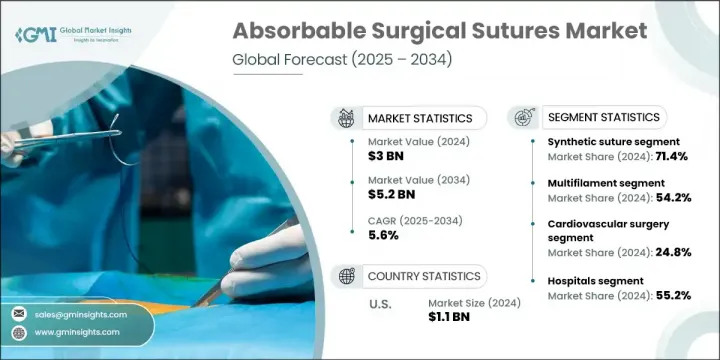

The Global Absorbable Surgical Sutures Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 5.2 billion by 2034. Market growth is being driven by a sharp rise in the number of surgical procedures worldwide, increasing incidences of chronic illnesses, advancements in suture technology, and a surge in gynecological surgeries. The demand for absorbable sutures is also growing as healthcare systems focus more on minimally invasive techniques, faster recovery timelines, and improved patient outcomes. Continuous improvements in materials and technologies, including innovations in coatings and thread structures, are playing a major role in expanding usage across hospitals, surgical centers, and outpatient facilities globally.

Absorbable surgical sutures are designed to naturally break down within the body, removing the need for manual removal and simplifying postoperative care. Enhanced features such as antimicrobial properties, barbed thread structures, and high-performance polymer blends are helping reduce infection risks and accelerate healing. As more clinical practices adopt these advanced tools, the overall efficiency and patient experience improve, reinforcing the product's relevance in modern healthcare. Increasing focus on patient comfort and procedure optimization is positioning absorbable sutures as a preferred choice across multiple surgical specialties.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.6% |

The synthetic sutures segment held 71.4% share in 2024, supported by their reliable absorption profiles, high strength retention, and reduced biological reactivity. Materials like polydioxanone (PDO), polylactic acid (PLA), and polyglycolic acid (PGA) offer surgeons precise control over degradation timelines, allowing tailored support during each phase of wound healing. Their adaptability in both open and minimally invasive procedures makes them a trusted solution in high-precision environments.

The hospitals segment held a 55.2% share in 2024. This dominance is linked to expanding hospital infrastructure, especially in high-growth countries, alongside rising chronic disease burdens and enhanced access to surgical technologies. As healthcare systems evolve, newly built and existing hospitals are prioritizing advanced suturing options to improve outcomes, reduce complication rates, and meet modern surgical standards.

United States Absorbable Surgical Sutures Market generated USD 1.1 billion in 2024. Rising chronic conditions and the need for advanced surgical care continue to elevate demand. With a growing number of cardiovascular, oncological, and general surgeries performed annually, there's a strong shift toward sutures that promote faster recovery, lower infection risks, and minimize patient discomfort through natural absorption.

Key players dominating the Global Absorbable Surgical Sutures Market include Demetech, Corza Medical, Futura Surgicare, B. Braun, Medtronic, Unisur, Vitrex Medical Group, Healthium Medtech, Genesis MedTech, Vital Sutures, Advanced Medical Solutions, Lotus Surgicals, Integra Lifesciences, Johnson & Johnson, and CONMED. Companies operating in the absorbable surgical sutures market are strengthening their positions through innovation in biomaterial design and antimicrobial technologies. Firms are focusing on R&D to develop sutures with enhanced tensile strength, controlled degradation rates, and compatibility with minimally invasive techniques. Mergers, acquisitions, and strategic collaborations are being pursued to expand product portfolios and global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Material trends

- 2.2.3 Structure trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rising surgical procedures worldwide

- 3.2.1.3 Advancements in suture materials

- 3.2.1.4 Increasing number of gynecological procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of procedures

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for minimally invasive surgeries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Natural suture

- 5.3 Synthetic suture

- 5.3.1 Vicryl

- 5.3.2 Polydioxanone suture (PDS)

- 5.3.3 Poliglecaprone suture (Monocryl)

Chapter 6 Market Estimates and Forecast, By Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Monofilament

- 6.3 Multifilament

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cardiovascular surgery

- 7.3 Gynaecology surgery

- 7.4 Orthopaedic surgery

- 7.5 Ophthalmic surgery

- 7.6 Neurological surgery

- 7.7 Other surgical applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centres

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Medical Solutions

- 10.2 B. Braun

- 10.3 Corza Medical

- 10.4 CONMED

- 10.5 Demetech

- 10.6 Futura Surgicare

- 10.7 Genesis MedTech

- 10.8 Healthium Medtech

- 10.9 Integra Lifesciences

- 10.10 Johnson & Johnson

- 10.11 Medtronic

- 10.12 Lotus Surgicals

- 10.13 Unisur

- 10.14 Vital Sutures

- 10.15 Vitrex Medical Group