PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801831

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801831

Temperature-Controlled Packaging Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

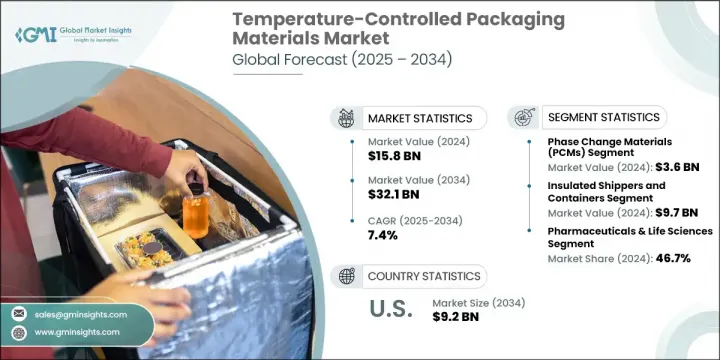

The Global Temperature-Controlled Packaging Materials Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 32.1 billion by 2034. The growth is driven by demand surges across critical industries such as pharmaceuticals, biotechnology, clinical research, and perishable food logistics. With increasing pressure to ensure the safe transportation of temperature-sensitive products, manufacturers are shifting toward high-performance materials that can provide stability, sterility, and consistent thermal control throughout transit. This growing complexity in product handling has made advanced packaging materials a necessity rather than an option. This upward trend reflects the global push for more sophisticated supply chain solutions amid an increasingly temperature-sensitive product landscape.

The need for efficient thermal packaging is especially critical in the pharmaceutical and biopharma sectors, where even slight temperature deviations can compromise product integrity. As biologics, gene therapies, and other complex treatments become more mainstream, packaging solutions must adapt to support stricter temperature controls and longer shipping durations. Companies are investing in insulated packaging formats that can meet these demands, and the integration of Internet of Things (IoT)-based monitoring systems has become more common to ensure transparency and traceability across the cold chain. Moreover, the growing push for sustainable and cost-efficient packaging options is influencing the design and deployment of newer materials that are both reusable and compliant with international regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $32.1 Billion |

| CAGR | 7.4% |

In terms of material type, phase change materials are emerging as a major segment, reaching a valuation of USD 3.6 billion in 2024. Expected to grow at a CAGR of 8.4% through 2034, these materials are preferred for their ability to maintain precise temperature ranges during shipping. Water-based and gel formulations are gaining traction due to their efficiency in preserving required thermal conditions and their potential for reuse in passive cold chain solutions. These materials are being favored not only for their technical performance but also for their lower environmental impact compared to traditional refrigerants. The market's growing inclination toward reliable and energy-efficient options is accelerating innovation in phase change technologies, which are now central to both pharmaceutical and food-grade logistics.

From a product perspective, insulated shippers and containers dominate the landscape, with a market value of USD 9.7 billion in 2024 and a forecasted CAGR of 7% through 2034. These solutions are designed to accommodate various shipping formats such as small parcels, pallets, and bulk shipments. Demand is being driven by the logistics needs of pharmaceuticals, biologics, and temperature-sensitive food products. Increasing customization in packaging design is helping cater to emerging applications like clinical trials and personalized therapies, where strict temperature control is mandatory. Products such as insulated cartons, crates, boxes, and pouches continue to see wide usage due to their effectiveness in last-mile delivery and regional distribution networks.

On the basis of application, pharmaceuticals and life sciences represent the largest segment, accounting for 46.7% of the global market share in 2024. This sector is anticipated to grow at a CAGR of 7.9% through 2034, fueled by the expanding pipeline of biologics, vaccines, and personalized medicine. Pharmaceutical companies are demanding packaging systems that ensure sterility, precision, and compliance with regulatory frameworks while also offering scalability for mass deployment. The increasing importance of single-use packaging formats and advanced cooling solutions, along with the adoption of digitally monitored containers, is reshaping logistics operations in this sector. As the global health landscape evolves, packaging technologies are playing an essential role in ensuring that these high-value products reach their destinations intact.

In the United States, the temperature-controlled packaging materials market was worth USD 4.8 billion in 2024 and is expected to climb to USD 9.2 billion by 2034, reflecting a CAGR of 6.7%. The continued expansion of the U.S. biotechnology and pharmaceutical industries is driving this growth. The market is experiencing increased adoption of advanced thermal packaging systems, such as vacuum insulation panels and next-generation phase change materials. Furthermore, the growth of direct-to-patient delivery models is creating new demands for packaging that ensures consistent temperature maintenance across varied transport conditions. U.S. stakeholders are also pushing for intelligent tracking solutions and packaging innovations that meet the narrow thermal tolerances required by specialized therapies.

Market leadership is concentrated among a few major players, with the top five companies collectively holding approximately 40% of the global market share in 2024. These companies have established a stronghold by offering a mix of reusable and single-use solutions that comply with Good Distribution Practices (GDP) and other global standards. Competitive intensity is growing as regulations become more stringent and customers demand superior reliability, cost-efficiency, and sustainability. Companies are responding by integrating smart tracking technologies, expanding global infrastructure, and investing in materials that lower environmental impact. Strategic collaborations, including M&A and partnerships with logistics and tech providers, are being prioritized to stay competitive.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Insulation Materials

- 5.3 Phase Change Materials (PCMs)

- 5.4 Refrigerants and Cooling Agents

- 5.5 Smart Sensors and Monitoring Devices

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Insulated Shippers and Containers

- 6.3 Custom and Specialty Solutions

- 6.4 Refrigerated and Frozen Packaging

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals and Life Sciences

- 7.3 Food and Beverage

- 7.4 Chemicals and Industrial Goods

- 7.5 Other Applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AmerisourceBergen

- 9.2 Avery Dennison

- 9.3 Cold Chain Technologies

- 9.4 Cryopak

- 9.5 Envirotainer

- 9.6 Intelsius

- 9.7 Nordic Cold Chain Solutions

- 9.8 Pelican BioThermal

- 9.9 Sealed Air

- 9.10 Sofrigam

- 9.11 Softbox Systems

- 9.12 Sonoco Products Company

- 9.13 TemperPack

- 9.14 Tower Cold Chain

- 9.15 Va-Q-Tec