PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801842

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801842

Motorcycle Carbon Ceramic Brake Rotors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

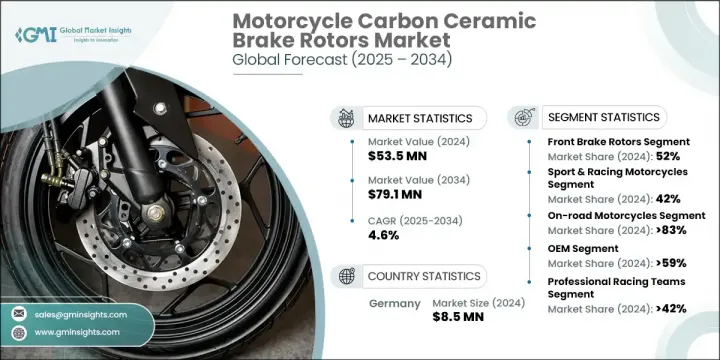

The Global Motorcycle Carbon Ceramic Brake Rotors Market was valued at USD 53.5 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 79.1 million by 2034. Growth in this market is driven by the rising popularity of high-performance and luxury motorcycles, particularly in the sport and racing categories. These brake rotors are favored for their lightweight structure, superior heat resistance, and increased braking precision, making them ideal for aggressive riding and high-speed control. The appeal of these systems is especially strong among riders who prioritize safety, durability, and reduced maintenance. Innovations in composite materials are enhancing the lifespan and thermal management of these rotors, even under extreme riding conditions.

With expanding demand across motorsports-heavy regions like Europe and North America, leading manufacturers are leveraging advanced cooling technologies and modular rotor architecture to bring track-level performance to road-legal motorcycles. Suppliers are tailoring designs to match OEM specifications and consumer expectations around safety, efficiency, and performance. Premium segment growth has encouraged manufacturers like EBC Brakes, Sunstar, and Braketech to expand their offerings across both aftermarket and factory-fit channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.5 Million |

| Forecast Value | $79.1 Million |

| CAGR | 4.6% |

In 2024, the front brake rotor segment held a 52% share and is projected to grow at a CAGR of 5% through 2034. Since most braking power is handled by front rotors, performance upgrades and innovations are centered around these components. Technologies like ventilated and slotted rotor designs are gaining traction as sport touring and superbike sales continue to rise. Manufacturers such as Galfer Brakes and Brembo are actively releasing high-efficiency rotor systems to meet this demand.

The sport and racing motorcycles segment held a 50% share in 2024. These motorcycles require unmatched braking control and thermal balance at high speeds. The segment is seeing ongoing product development with rotors offering reduced thermal distortion and enhanced ventilation to manage prolonged high-performance use. Riders prefer carbon ceramic for its consistent stopping power, even under aggressive conditions, contributing to its rising adoption across track-inspired models.

Germany Motorcycle Carbon Ceramic Brake Rotors Market held a 50% share and generated USD 8.5 million in 2024. The country's leadership is anchored in its robust motorsports culture and strong OEM-supplier networks. Innovation in ceramic composites is being accelerated by the demand for lighter and more heat-tolerant materials, especially for electric motorcycles. Advanced R&D centers are emerging, pushing the limits of rotor technology, with an emphasis on efficiency and safety, making Germany a major contributor to global product evolution.

Key players shaping the Motorcycle Carbon Ceramic Brake Rotors Market include AP Racing, Braketech, SICOM Brakes, Galfer Brakes, Sunstar, Brembo S.p.A., and EBC Brakes. Manufacturers in this market are expanding their product portfolios with advanced rotor technologies that focus on thermal stability, lightweight construction, and improved airflow. Strategic collaborations with OEMs have helped brands secure long-term supply deals while aligning with evolving motorcycle designs. Several players are investing in R&D to develop rotor materials with extended life cycles and enhanced performance at high operating temperatures. Companies are also enhancing their global distribution networks, particularly in motorsport-dominant regions, to improve aftermarket accessibility.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Motorcycle

- 2.2.4 Application

- 2.2.5 Sales Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance motorcycles

- 3.2.1.2 Superior heat resistance & reduced brake fade

- 3.2.1.3 Rising popularity of motorsport & track racing

- 3.2.1.4 Technological advancements in rotor manufacturing

- 3.2.1.5 Lightweight and improved handling

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of carbon ceramic rotors

- 3.2.2.2 Limited compatibility with standard motorcycles

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into mid-range motorcycles

- 3.2.3.2 Growth in electric motorcycles (EVs)

- 3.2.3.3 Technological advancements in material science

- 3.2.3.4 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.8 Statistical overview

- 3.8.1 Global premium motorcycle production statistics

- 3.8.1.1 Carbon ceramic adoption rates by segment

- 3.8.1.2 Performance comparison vs traditional rotors

- 3.8.1.3 Cost analysis and price premium assessment

- 3.8.1 Global premium motorcycle production statistics

- 3.9 Technology and material analysis

- 3.9.1 Material composition and structure

- 3.9.1.1 Carbon fiber reinforcement systems

- 3.9.1.2 Ceramic matrix compositions

- 3.9.1.3 Binding agents and additives

- 3.9.1.4 Microstructure and performance relationship

- 3.9.2 Manufacturing processes

- 3.9.2.1 Preform preparation and layup

- 3.9.2.2 Chemical vapor infiltration (CVI)

- 3.9.2.3 Liquid silicon infiltration (LSI)

- 3.9.2.4 Machining and finishing operations

- 3.9.3 Performance characteristics

- 3.9.3.1 Thermal properties and heat dissipation

- 3.9.3.2 Mechanical strength and durability

- 3.9.3.3 Friction coefficient and wear resistance

- 3.9.3.4 Weight reduction and density analysis

- 3.9.1 Material composition and structure

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Brand analysis and market perception

- 4.4.1 Brand strength and recognition

- 4.4.2 Customer loyalty and satisfaction

- 4.4.3 Racing heritage and performance credibility

- 4.4.4 Technology leadership perception

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front brake rotors

- 5.3 Rear brake rotors

- 5.4 Full set (Front & Rear)

Chapter 6 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Sport & racing motorcycles

- 6.3 Cruisers & touring motorcycles

- 6.4 Dirt & off-road motorcycles

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 On-road

- 7.3 Off-road

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Professional racing teams

- 9.3 Individual motorcycle owners

- 9.4 Motorcycle manufacturers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 ANZ

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 UAE

- 10.5.2 Saudi Arabia

- 10.5.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alth Brakes

- 11.2 AP Racing

- 11.3 Braketech

- 11.4 BRAKING

- 11.5 Brembo

- 11.6 Carbon Lorraine

- 11.7 EBC Brakes

- 11.8 Ferodo

- 11.9 Galfer Brakes

- 11.10 Galfer USA

- 11.11 Moto-Master

- 11.12 NG Brakes

- 11.13 Nissin Kogyo

- 11.14 SBS Friction

- 11.15 SICOM Brakes

- 11.16 Sunstar Engineering

- 11.17 TRW Automotive

- 11.18 Yutaka Giken