PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801843

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801843

Crack Repair Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

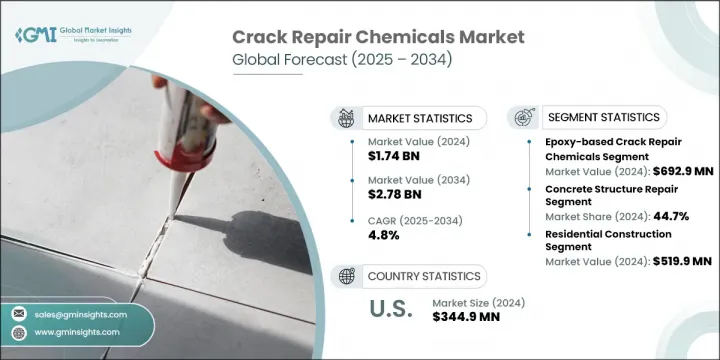

The Global Crack Repair Chemicals Market was valued at USD 1.74 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 2.78 billion by 2034. This growth is fueled by rising demand for durable, quick, and efficient repair solutions across various sectors, including residential, commercial, infrastructure, and industrial projects. These chemicals are vital not only for new construction but also for restoring aged structures, especially in developed regions where roads, bridges, and public buildings face wear and deterioration. The demand is also supported by a focus on enhancing the longevity, safety, and performance of critical assets.

With innovation in material science, crack repair solutions are being engineered to offer better flexibility, chemical resistance, and adhesion, enabling them to withstand harsh environmental conditions such as earthquakes, moisture, and extreme temperatures. Ongoing infrastructure modernization projects and the prioritization of sustainable construction practices continue to amplify the use of crack repair chemicals globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.74 Billion |

| Forecast Value | $2.78 Billion |

| CAGR | 4.8% |

In 2024, the epoxy-based crack repair materials generated USD 692.9 million, driven by their high strength and durability. Polyurethane-based chemicals are gaining rapid momentum due to their elasticity and ability to adjust to movement and temperature fluctuations, making them ideal for dynamic environments such as tunnels, bridges, and high-traffic zones. Their quick curing time also ensures minimal downtime during structural repairs. Acrylic-based options offer a practical balance between performance and affordability, especially in non-critical applications where budget remains a priority. Each type caters to distinct performance requirements and environmental demands.

The concrete repair segment generated 44.7% share in 2024. This is largely attributed to the wide use of concrete in key infrastructure, including highways, buildings, and industrial units. As these structures age, maintaining integrity becomes critical, increasing reliance on crack repair chemicals. These products offer strong adhesion, long-term resistance to environmental stress, and endurance under varying conditions, ensuring structural stability and extended service life.

U.S. Crack Repair Chemicals Market generated USD 344.9 million in 2024. Its leadership stems from substantial investment in infrastructure rehabilitation and a mature construction industry. The country places emphasis on high-performance repair materials-especially epoxy and polyurethane-based systems-to support large-scale infrastructure projects. The presence of major players, strong research and development activity, and increased awareness around preventive maintenance further boost demand for advanced chemical repair solutions across the country.

Key players driving Crack Repair Chemicals Market include Sika AG, MAPEI S.p.A, Fosroc International Limited, Dow Inc., RPM International Inc., BASF SE, Arkema S.A., Master Builders Solutions (MBCC Group), Henkel AG & Co. KGaA, and 3M Company. To strengthen their market footprint, companies in the crack repair chemicals sector are focusing on R&D to develop formulations with higher elasticity, chemical resistance, and quick-setting properties. Partnerships with infrastructure developers and governments for long-term supply contracts are also key strategies. Firms are expanding into emerging markets through localized production and distribution and emphasizing eco-friendly and low-VOC formulations to meet environmental regulations. Customization of solutions based on regional climatic challenges and construction standards is another tactic being used to stay competitive and boost brand loyalty globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 End user trends

- 2.2.4 Technology trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo tons)

- 5.1 Key trends

- 5.2 Epoxy-based crack repair chemicals

- 5.2.1 Low-viscosity epoxy resins

- 5.2.2 High-modulus epoxy systems

- 5.2.3 Moisture-tolerant epoxy solutions

- 5.2.4 Rapid-curing epoxy formulations

- 5.3 Polyurethane-based solutions

- 5.3.1 Hydrophobic polyurethane grouts

- 5.3.2 Flexible polyurethane sealants

- 5.3.3 Expanding polyurethane systems

- 5.4 Acrylic-based repair materials

- 5.4.1 Water-based acrylic systems

- 5.4.2 Solvent-based acrylic solutions

- 5.4.3 Modified acrylic polymers

- 5.5 Cement-based repair compounds

- 5.5.1 Polymer-modified cement systems

- 5.5.2 Rapid-setting cement mortars

- 5.5.3 Shrinkage-compensating cement

- 5.6 Silane/siloxane-based products

- 5.7 Others (hybrid systems, bio-based materials)

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo tons)

- 6.1 Key trends

- 6.2 Concrete structure repair

- 6.2.1 Building and construction

- 6.2.2 Bridge and infrastructure

- 6.2.3 Industrial facilities

- 6.3 Foundation repair

- 6.3.1 Residential foundations

- 6.3.2 Commercial foundations

- 6.3.3 Industrial foundations

- 6.4 Pavement and road repair

- 6.4.1 Highway and arterial roads

- 6.4.2 Airport runways and taxiways

- 6.4.3 Parking structures

- 6.5 Marine and coastal structures

- 6.6 Underground and tunnel applications

- 6.7 Others (swimming pools, water treatment facilities)

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Kilo tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 New construction

- 7.2.2 Renovation and repair

- 7.2.3 Maintenance services

- 7.3 Commercial construction

- 7.3.1 Office buildings

- 7.3.2 Retail and shopping centers

- 7.3.3 Hospitality and entertainment

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities

- 7.4.2 Warehouses and distribution centers

- 7.4.3 Power generation facilities

- 7.5 Infrastructure and public works

- 7.5.1 Transportation infrastructure

- 7.5.2 Water and wastewater treatment

- 7.5.3 Government and municipal buildings

Chapter 8 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo tons)

- 8.1 Key trends

- 8.2 Conventional repair technologies

- 8.2.1 Injection-based systems

- 8.2.2 Surface application methods

- 8.2.3 Structural strengthening systems

- 8.3 Advanced repair technologies

- 8.3.1 Self-healing systems

- 8.3.2 Nanotechnology-enhanced products

- 8.3.3 Smart and responsive materials

- 8.4 Emerging technologies

- 8.4.1 Bio-based healing systems

- 8.4.2 Ai-assisted application systems

- 8.4.3 IoT-enabled monitoring solutions

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Sika AG

- 10.2 MAPEI S.p.A.

- 10.3 RPM International Inc.

- 10.4 Master Builders Solutions (MBCC Group)

- 10.5 BASF SE

- 10.6 Arkema S.A.

- 10.7 Dow Inc.

- 10.8 3M Company

- 10.9 Henkel AG & Co. KGaA

- 10.10 FOSROC International Limited