PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801848

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801848

Cargo Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

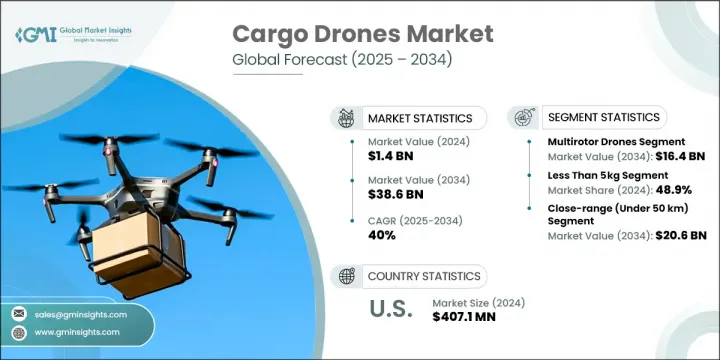

The Global Cargo Drones Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 40% to reach USD 38.6 billion by 2034. This growth is largely driven by the increasing adoption of drone-network-as-a-service (DNaaS) models, a booming e-commerce industry, and the growing importance of last-mile logistics. As e-commerce activities escalate, the need for fast, cost-effective, and automated delivery systems becomes essential. Cargo drones have emerged as an efficient alternative, offering fast service with low operating costs and requiring minimal ground-based infrastructure. Their ability to support short-haul routes and last-mile delivery positions them as a crucial component in the evolving logistics ecosystem. The introduction of universal docking and charging systems is streamlining drone operations and enhancing cross-platform compatibility. Efforts from key industry groups to introduce unified standards are further paving the way for wider-scale adoption and streamlined deployment in commercial logistics.

The multirotor drones segment will generate USD 16.4 billion by 2034 due to their vertical takeoff and landing capabilities and agility in urban operations. These drones are particularly well-suited for dense city environments where precision, maneuverability, and minimal space usage are vital. To increase market penetration, manufacturers are focusing on optimizing flight duration and enhancing payload capacity by advancing battery technologies and minimizing drone weight.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 40% |

In 2024, the less than 5 kg payload segment held 48.9% share. The growing demand for small parcel deliveries, especially in healthcare and online retail sectors, is fueling the momentum of this segment. Despite regulatory hurdles and the need for more sophisticated propulsion systems, compact drones delivering high performance are in demand. Companies in this space are prioritizing the development of reliable and agile drones to meet expectations for faster and more efficient last-mile services.

Canada Cargo Drones Market is expected to grow at a 38.1% CAGR from 2025 to 2034. Government programs focused on overcoming logistical limitations in isolated and hard-to-reach regions are contributing significantly to this growth. The increasing use of drones in last-mile supply chains, resource distribution, and medical logistics is gaining traction as favorable policies and pilot initiatives continue to roll out.

Key companies shaping the Global Cargo Drones Market include Elroy Air, Sabrewing Aircraft Company, Natilus, Silent Arrow, and Dronamics. Leading players in the cargo drones market are adopting several strategic approaches to solidify their market position. Many are investing heavily in R&D to enhance drone payload capacity, increase flight endurance, and reduce weight through advanced materials. Collaborations and partnerships with logistics firms and government agencies are being leveraged to accelerate real-world deployment and regulatory approvals. Companies are also focusing on establishing drone infrastructure networks and integrating AI for optimized route planning. Additionally, several players are pursuing certification from aviation authorities to build trust and expand operational range. Strategic geographic expansion, particularly into remote and underserved areas, and investment in scalable DNaaS platforms are becoming key moves to capture long-term value and ensure consistent growth.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Drone type trends

- 2.2.2 Payload capacity trends

- 2.2.3 Range trends

- 2.2.4 Technology trends

- 2.2.5 End use application trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Emergence of drone-network-as-a-service (DNaaS) models

- 3.2.1.2 Expansion of e-commerce and last-mile logistics

- 3.2.1.3 Supportive regulatory developments and UAV policies

- 3.2.1.4 Military and defense applications for unmanned logistics

- 3.2.1.5 Need for improved access in remote and hard-to-reach areas

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory uncertainty and airspace restrictions

- 3.2.2.2 Limited payload capacity and range

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for remote area logistics

- 3.2.3.2 Integration with smart city and urban air mobility programs

- 3.2.3.3 Advancements in AI and autonomy for BVLOS operations

- 3.2.3.4 Application in offshore and industrial supply chains

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Drone Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing drones

- 5.3 Multirotor drones

- 5.4 Hybrid drones

Chapter 6 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Less than 5 kg

- 6.3 5 kg to 20 kg

- 6.4 20 kg to 50 kg

- 6.5 Above 50 kg

Chapter 7 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Close-range (under 50 km)

- 7.3 Short-range (50-149 km)

- 7.4 Mid-range (150-650 km)

- 7.5 Long range (more than 650 km)

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Autonomous drones

- 8.3 Remote-controlled drones

Chapter 9 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Healthcare and emergency services

- 9.2.1 Medical supply delivery

- 9.2.2 Blood and organ transport

- 9.2.3 Emergency response and disaster relief

- 9.2.4 Others

- 9.3 Retail and e-commerce

- 9.3.1 Last-mile delivery

- 9.3.2 Inter-hub cargo transport

- 9.3.3 Warehouse transfer operations

- 9.3.4 Others

- 9.4 Defense and security

- 9.4.1 Field resupply

- 9.4.2 Border patrol logistics

- 9.4.3 Disaster evacuation support

- 9.4.4 Others

- 9.5 Agriculture

- 9.6 Infrastructure and construction

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Natilus

- 11.1.2 DRONAMICS

- 11.1.3 Sabrewing Aircraft Company

- 11.1.4 Elroy Air

- 11.1.5 Silent Arrow

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 DroneUp

- 11.2.1.2 Flirtey

- 11.2.1.3 UPS Flight Forward

- 11.2.1.4 Zipline International

- 11.2.2 Europe

- 11.2.2.1 Wingcopter

- 11.2.2.2 Manna Aero

- 11.2.2.3 FlyingBasket

- 11.2.3 APAC

- 11.2.3.1 Chengdu JOUAV Automation Tech

- 11.2.3.2 SZ DJI Technology

- 11.2.3.3 Throttle Aerospace Systems

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Skye Air Mobility

- 11.3.2 H3 Dynamics Holdings

- 11.3.3 Matternet

- 11.3.4 Wing Aviation

- 11.3.5 UAVOS