PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801851

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801851

Resistance Spot Welding Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

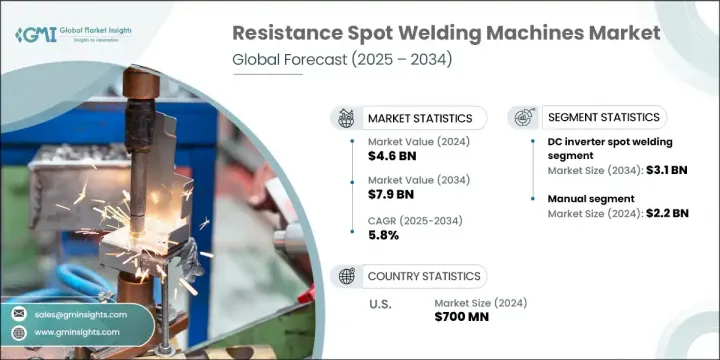

The Global Resistance Spot Welding Machines Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 7.9 billion by 2034. This growth is being fueled by continued advancements in manufacturing automation, especially in high-output industries such as automotive, aerospace, and appliance production. Manufacturers are integrating digital controls and robotic welding systems to optimize quality, efficiency, and throughput. Favorable industrial policies and the expansion of manufacturing in the Asia-Pacific region have further positioned resistance spot welding as a key process in high-volume production environments.

As electric vehicle adoption rises, demand for resistance spot welding intensifies due to its relevance in assembling lightweight, multi-metal structures and battery components. The method's high-speed operation, reliability, and cost-effectiveness continue to make it indispensable in structural joining applications. Resistance welding also supports engineering shifts toward lightweight materials like high-strength steel and aluminum, offering low thermal distortion and strong weld joints-attributes crucial to modern design requirements. As a result, OEMs and Tier-1 suppliers globally continue to invest in both traditional and advanced RSW machines to meet production and material flexibility demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.8% |

The DC inverter segment generated USD 1.8 billion during 2024 and is projected to reach USD 3.1 billion by 2034. These machines provide enhanced precision, faster current response, and shorter weld cycles compared to AC-based equipment. Inverter technology improves consistency, lowers operational costs, and consumes up to 30% less energy, making it increasingly attractive for manufacturers pursuing sustainability and efficiency.

The manual spot-welding segment accounted for USD 2.2 billion in 2024, securing a 49.1% share. A significant portion of this demand stems from small and medium enterprises in regions such as Latin America, Asia, and Eastern Europe. These operations often rely on manual machines for their affordability, ease of operation, and minimal maintenance needs. Manual spot welders are widely used in small-batch production, varied part sizes, and industries require frequent setup changes. Sectors such as HVAC fabrication, custom metalwork, and furniture production continue to favor manual systems for their adaptability and low operating cost in low-volume or specialized tasks.

United States Resistance Spot Welding Machines Market generated USD 700 million in 2024 and is expected to grow at a CAGR of 4.9% through 2034. The US remains a global manufacturing hub for automotive and defense applications, where structural welding is critical. The accelerated growth of electric vehicle production has also strengthened domestic demand, with major automotive manufacturers deploying spot welding machines for key components like battery modules and BIW structures. Additionally, federal investments in defense and reshoring production capacity have supported a steady increase in demand for RSW systems from local OEMs and suppliers.

Major Resistance Spot Welding Machines Market players include Miyachi Unitek (AMADA WELD TECH), CenterLine (Windsor) Ltd., Panasonic Welding Systems Co., Ltd., Nimak GmbH, and Automation International, Inc., all of which continue to hold leading positions in this space. Leading companies in the resistance spot welding machines market are enhancing their competitive edge through investments in automation, energy efficiency, and advanced control systems. Strategic partnerships with automotive OEMs and industrial manufacturers allow for collaborative development of tailored welding solutions that meet evolving material and design needs. Several manufacturers are scaling up their R&D activities to introduce next-generation inverter-based systems with smart monitoring, predictive maintenance, and AI-driven welding precision. Additionally, expanding service networks and localization of production in high-growth regions enable faster support and lower distribution costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Material Welded

- 2.2.4 Welding Thickness

- 2.2.5 Power Supply

- 2.2.6 Automation Level

- 2.2.7 End Use Industry

- 2.2.8 Distribution Channel

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and materials welded

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 AC Resistance Spot Welding

- 5.3 DC Inverter Spot Welding

- 5.4 Capacitor Discharge Spot Welding

- 5.5 Servo-Gun Spot Welding

Chapter 6 Market Estimates & Forecast, By Material Welded, 2021 - 2034, (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Mild Steel

- 6.3 Stainless Steel

- 6.4 Aluminum

- 6.5 Galvanized Steel

- 6.6 Copper & Alloys

- 6.7 Others (High Strength Low Alloy (HSLA) Steel, Dissimilar Metal Combination, etc.)

Chapter 7 Market Estimates & Forecast, By Welding Thickness, 2021 - 2034, (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Up to 2 mm

- 7.3 2 - 5 mm

- 7.4 Above 5 mm

Chapter 8 Market Estimates & Forecast, By Power Supply, 2021 - 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Single-phase Power Supply

- 8.3 Three-phase Power Supply

- 8.4 Direct Current Power Supply

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 Manual

- 9.3 Semi-automatic

- 9.4 Automatic

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Manufacturing

- 10.4 Aerospace and Defense

- 10.5 Electronics and Semiconductors

- 10.6 Construction

- 10.7 Agricultural Equipment

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 ARO Welding Technologies SAS

- 13.2 Automation International, Inc.

- 13.3 CenterLine (Windsor) Ltd.

- 13.4 Dengensha Manufacturing Co., Ltd.

- 13.5 Guangzhou CEA Welding Equipment Co., Ltd.

- 13.6 Heron Intelligent Equipment Co., Ltd.

- 13.7 Janda Company, Inc.

- 13.8 Miyachi Unitek (AMADA WELD TECH)

- 13.9 Nimak GmbH

- 13.10 Panasonic Welding Systems Co., Ltd.

- 13.11 T. J. Snow Company, Inc.

- 13.12 TECNA S.p.A.