PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801855

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801855

Jewelry Making and Precious Metals Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

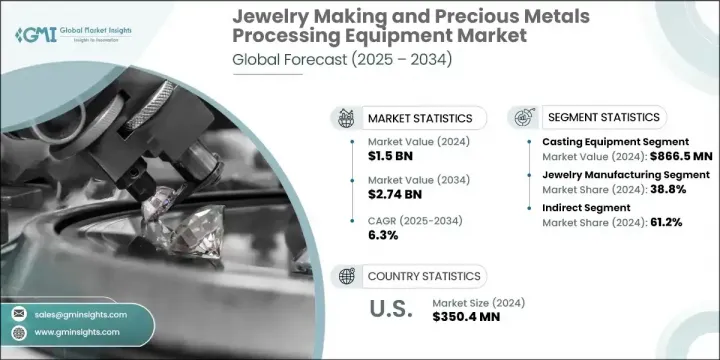

The Global Jewelry Making and Precious Metals Processing Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.74 billion by 2034. This market is witnessing strong and sustained growth, primarily driven by increasing consumer interest in high-quality, custom-designed jewelry. The demand is especially strong among younger demographics and affluent consumers in both established and emerging economies who seek pieces that express their lifestyle and individuality. As the need for precision manufacturing rises, industry players are embracing advanced production technologies that ensure accuracy and scalability.

Computer-aided design software, 3D printing tools, and automated systems are helping manufacturers deliver detailed, consistent, and scalable designs while minimizing material waste and production time. These advancements are also contributing to significant reductions in labor costs. The Asia-Pacific region remains the dominant hub for this industry, thanks to its established infrastructure, skilled labor force, and growing domestic and global demand. Countries across the region benefit from low-cost labor, favorable regulatory frameworks, and cultural preferences that promote jewelry purchases, which collectively strengthen APAC's influence on the global market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.74 Billion |

| CAGR | 6.3% |

The casting equipment segment generated USD 866.5 million in 2024 and is forecasted to grow at a CAGR of 6.7% between 2025 and 2034. This equipment is highly favored in jewelry and precious metal applications due to its suitability for mass production, flexibility in customization, and cost efficiency. While laser-based systems like engraving and welding tools are increasingly used for precision finishing, casting technology remains the go-to for scalable production, particularly in emerging markets and among small to mid-sized manufacturers. Its adaptability and economic value continue to drive its widespread adoption across the sector.

The jewelry manufacturing segment accounted for a 38.8% share in 2024 and is expected to register a CAGR of 6.8% through 2034. As the leading application within the precious metals processing and jewelry equipment industry, this segment is expanding due to rising consumer demand, advancements in digital manufacturing processes, and the internationalization of jewelry production networks. Compared to other applications like industrial refining or recycling, jewelry production requires a greater variety of tools and equipment, giving it a central role in the industry's continued development and innovation.

U.S. Jewelry Making and Precious Metals Processing Equipment Market held a 76.5% share and generated USD 350.4 million in 2024. This strong position can be attributed to the country's advanced manufacturing capabilities and well-established presence of luxury jewelry brands. American manufacturers widely utilize digital technologies such as CAD software, 3D printing systems, and laser-based tools to streamline workflows and enhance product output. This technological edge supports the country's continued dominance in the high-end jewelry manufacturing space, making it a critical player in the overall market.

Key companies shaping the Global Jewelry Making and Precious Metals Processing Equipment Market include Durston Tools, UIHM, Orotig, Supermelt, Indutherm, LaserStar Technologies, CDOCAST Machinery, Gesswein, Rio Grande, EnvisionTEC, Gravotech, Schultheiss, Contenti, and Pepetools. To reinforce their market position, companies in this sector are focusing on product innovation, expanding digital design capabilities, and upgrading manufacturing technologies. Many are integrating automation and AI-driven tools to enhance design accuracy and streamline production timelines. Investing in user-friendly interfaces and modular machines allows businesses to serve a wide range of customer needs-from small artisan workshops to large-scale manufacturers. Firms are also increasing their global presence by establishing partnerships with regional distributors and offering responsive after-sales support.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Metal type

- 2.2.4 End use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom and luxury jewelry

- 3.2.1.2 Technological advancements in processing equipment

- 3.2.1.3 Growing use of automation and digital design tools

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced equipment

- 3.2.2.2 Volatility in precious metal prices

- 3.2.3 Opportunities

- 3.2.3.1 Emergence of 3d printing in jewelry manufacturing

- 3.2.3.2 Increasing demand for sustainable and ethical jewelry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Regulatory environment

- 3.7 Value Chain Analysis

- 3.7.1 Raw material suppliers and component manufacturers

- 3.7.2 Equipment manufacturers and OEMs

- 3.7.3 Distribution channels and sales networks

- 3.7.4 End use segments and applications

- 3.7.5 After-sales service providers

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By equipment type

- 3.9 Regulatory landscape

- 3.9.1 standards and compliance requirements

- 3.9.2 Regional regulatory frameworks

- 3.10 Certification standards Trade statistics

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Casting equipment

- 5.2.1 Melting and refining equipment

- 5.2.2 Stamping and forming equipment

- 5.3 Laser equipment

- 5.3.1 Polishing and finishing equipment

- 5.3.2 Electroplating equipment

- 5.3.3 Other equipment

Chapter 6 Market Estimates & Forecast, By Metal Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gold processing equipment

- 6.3 Silver processing equipment

- 6.4 Platinum group metals equipment

- 6.5 Other precious metals equipment

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Jewelry manufacturing

- 7.3 Precious metals refining

- 7.4 Watch manufacturing

- 7.5 Other industries

Chapter 8 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 CDOCAST Machinery

- 10.2 Contenti

- 10.3 Durston Tools

- 10.4 EnvisionTEC

- 10.5 Gesswein

- 10.6 Gravotech

- 10.7 Indutherm

- 10.8 LaserStar Technologies

- 10.9 Orotig

- 10.10 Pepetools

- 10.11 Rio Grande

- 10.12 Schultheiss

- 10.13 Superbmelt

- 10.14 UIHM