PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801860

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801860

Surface Treatments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

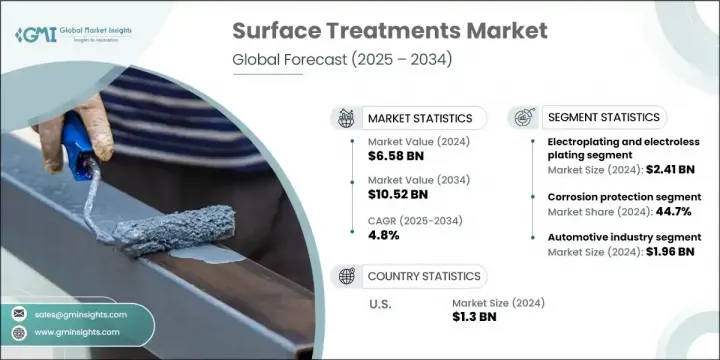

The Global Surface Treatments Market was valued at USD 6.58 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 10.52 billion by 2034. This growth is fueled by rising demand for enhanced surface performance in sectors like automotive, aerospace, construction, and electronics. Surface treatments improve properties like wear resistance, corrosion protection, adhesion, and aesthetics for a variety of materials, including metals, composites, and polymers. As structural materials face exposure to environmental stressors like moisture, UV rays, and chemical degradation, surface treatments act as essential barriers that preserve functionality and longevity. These treatments come in forms such as sealants, hydrophobic coatings, or eco-conscious protective layers on substrates like concrete, steel, and timber.

The shift toward sustainable building practices has also encouraged the adoption of water-based and bio-sourced treatment solutions, aligning with green construction standards. With industries demanding better performance in harsher conditions, customized treatment technologies are playing a more prominent role. From increasing efficiency to reducing maintenance needs, the surface treatment market is quickly evolving toward more tailored and environmentally sound solutions that deliver long-term operational advantages across various industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.58 Billion |

| Forecast Value | $10.52 Billion |

| CAGR | 4.8% |

Technological investments in methods like laser texturing, plasma treatment, and nanocoatings are gaining traction, especially in precision-focused industries such as electronics and aerospace. These advanced treatments allow for highly specific performance modifications at the surface level, where even microscopic inconsistencies can impact overall functionality. Manufacturers continue to develop solutions that meet exacting industrial specifications with customizable finishes that promote product durability.

The electroplating and electroless plating segment generated USD 2.41 billion in 2024. These widely adopted methods deliver cost-effective corrosion protection and are especially useful in manufacturing environments where consistent finish and wear resistance are vital. Alongside these, other mature technologies such as anodizing and chemical conversion coatings continue to see extensive usage in industries that value durability and environmental compatibility. These methods create protective oxide layers that enhance surface resilience while offering long-term performance.

The corrosion protection segment held a 44.7% share in 2024. This application is vital across marine, automotive, and infrastructure sectors where harsh environmental exposure makes long-lasting surface protection a necessity. Coating systems, conversion treatments, and plating processes help extend component life, limit replacement costs, and boost safety. Equally critical is the focus on wear resistance, particularly for aerospace machinery and tools under high-friction, high-load conditions. Enhanced surface strength ensures steady performance and structural reliability in extreme operating environments.

U.S. Surface Treatments Market generated USD 1.3 billion in 2024. Its leadership is backed by a robust manufacturing ecosystem and the widespread use of advanced materials. Innovation remains a central pillar of growth in the U.S., supported by strong research programs across high-stakes industries like defense, aerospace, and electronics. This market also places increasing emphasis on sustainability, driving interest in environmentally responsible treatment technologies and the integration of surface treatments into performance-critical applications.

Key players driving the Surface Treatments Market include Jotun A/S, BASF SE (Surface Technologies Division), Kansai Paint Co., Ltd., RPM International Inc., Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, Henkel AG & Co. KGaA, PPG Industries Inc., and AkzoNobel N.V. Companies operating in the surface treatments market are focusing on developing advanced, eco-friendly technologies to enhance product functionality while meeting regulatory compliance. Strategic R&D investments are enabling firms to innovate in areas such as nanocoatings, bio-based surface modifiers, and low-VOC (volatile organic compound) formulations. Collaborations with aerospace, electronics, and automotive manufacturers allow them to create customized, performance-oriented solutions. Market leaders are also expanding their global presence through mergers, acquisitions, and joint ventures to gain access to emerging markets and broaden their product portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology type trends

- 2.2.2 Application trends

- 2.2.3 End user trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million) (Kilo tons)

- 5.1 Key trends

- 5.2 Electroplating and electroless plating

- 5.3 Anodizing and chemical conversion coatings

- 5.4 Thermal spraying technologies

- 5.5 Physical vapor deposition (PVD)

- 5.6 Chemical vapor deposition (CVD)

- 5.7 Plasma surface treatment

- 5.8 Laser surface engineering

- 5.9 Emerging technologies

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo tons)

- 6.1 Key trends

- 6.2 Corrosion protection

- 6.3 Wear resistance enhancement

- 6.4 Decorative and aesthetic finishes

- 6.5 Electrical and electronic properties

- 6.6 Biocompatibility and medical applications

- 6.7 Thermal management

- 6.8 Optical properties enhancement

Chapter 7 Market Estimates and Forecast, By End User, 2021-2034 (USD Million) (Kilo tons)

- 7.1 Key trends

- 7.2 Automotive industry

- 7.3 Aerospace and defense

- 7.4 Electronics and semiconductors

- 7.5 Industrial machinery and equipment

- 7.6 Medical devices and healthcare

- 7.7 Energy and power generation

- 7.8 Construction and architecture

- 7.9 Marine and offshore

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Chile

- 8.5.4 Colombia

- 8.5.5 Mexico

- 8.5.6 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 PPG Industries Inc.

- 9.2 The Sherwin-Williams Company

- 9.3 AkzoNobel N.V.

- 9.4 BASF SE (Surface Technologies Division)

- 9.5 Henkel AG & Co. KGaA

- 9.6 Axalta Coating Systems Ltd.

- 9.7 RPM International Inc.

- 9.8 Jotun A/S

- 9.9 Kansai Paint Co., Ltd.

- 9.10 Nippon Paint Holdings Co., Ltd.