PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801871

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801871

North America Medical Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

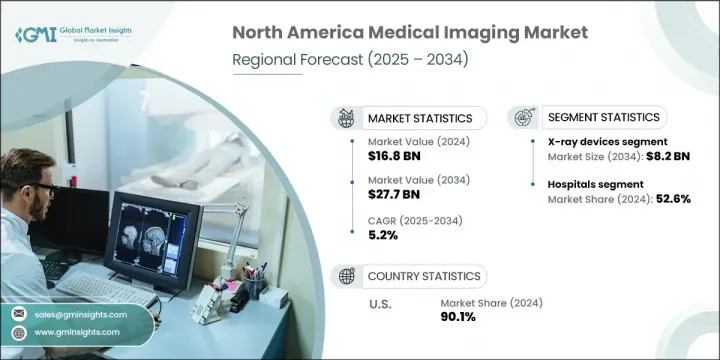

The North America Medical Imaging Market was valued at USD 16.8 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 27.7 billion by 2034. The market's expansion is supported by the growing burden of chronic illnesses, a rapidly aging population, and ongoing advancements in imaging technologies. As healthcare infrastructure strengthens across the region, medical imaging is becoming increasingly vital for early diagnosis, treatment planning, and patient monitoring. The steady rise in healthcare expenditure and the integration of advanced imaging systems into clinical workflows are enhancing diagnostic accuracy and improving patient care outcomes.

The market is also benefiting from increased demand for organ transplants, where high-resolution imaging is essential for evaluating candidates, guiding surgical interventions, and monitoring post-operative success. With chronic diseases on the rise and more patients experiencing multiple conditions simultaneously, the need for timely and precise diagnostics continues to grow. Imaging modalities are now crucial tools for physicians, enabling detailed visualization of bones, tissues, and internal organs. This shift is driving greater investment in modern imaging systems that offer higher precision, improved efficiency, and a more patient-centric experience across healthcare settings in North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.8 Billion |

| Forecast Value | $27.7 Billion |

| CAGR | 5.2% |

The magnetic resonance imaging (MRI) segment accounted for USD 2.6 billion in 2024 and is projected to reach USD 4.6 billion by 2034, growing at a CAGR of 6%. MRI systems are in high demand due to their ability to generate detailed images without ionizing radiation. Their excellent soft tissue contrast and versatility make them invaluable for diagnosing neurological, cardiovascular, musculoskeletal, and oncological conditions. These non-invasive systems offer advanced imaging capabilities that not only improve diagnostic outcomes but also reduce patient discomfort and support faster clinical decision-making. Innovations in MRI are transforming diagnostic workflows by enhancing image quality, increasing scan speed, and reducing overall operating costs.

The hospitals segment held 52.6% share in 2024. Their leading position is attributed to the high volume of patients, demand for early diagnostics, and the integration of imaging into everyday medical care. Hospitals are investing in advanced imaging systems to offer more comprehensive and accurate diagnostic services. The ability to support multiple departments with centralized imaging infrastructure allows hospitals to remain at the forefront of diagnostic innovation and improve overall patient care outcomes.

United States Medical Imaging Market held 90.1% share in 2024. This leadership position is largely driven by a growing aging population, which is increasingly affected by chronic health issues like cancer, cardiovascular disease, and neurological disorders. As life expectancy rises, the demand for detailed, high-resolution imaging systems is surging. The U.S. also sees consistently rising healthcare expenditures, which is accelerating the adoption of advanced diagnostic technologies. The market continues to benefit from strong clinical infrastructure, increased patient awareness, and continuous investment in innovation across imaging modalities.

Notable players operating in the North America Medical Imaging Market include Carestream Health, Canon Medical Systems, GE HealthCare Technologies, Fujifilm Holdings, Esaote, Shimadzu, Hologic, Samsung Medison, Siemens Healthineers, Konica Minolta, and Koninklijke Philips. To maintain a competitive edge in the North America medical imaging market, major companies are prioritizing innovation in imaging technologies with a focus on AI integration, cloud-based image sharing, and remote diagnostics. Many are enhancing system capabilities through real-time analytics and predictive imaging solutions to boost clinical accuracy and workflow efficiency. Strategic partnerships with healthcare providers help expand market access and provide tailored solutions across care settings. Firms are also investing heavily in R&D to create compact, energy-efficient, and patient-friendly systems. Localization of manufacturing, expansion of service networks, and aggressive regulatory compliance are enabling faster product approvals and regional adaptability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 End use

- 2.2.3 Country

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Ongoing technological advancements in medical imaging.

- 3.2.1.2 Increasing healthcare expenditure in North America

- 3.2.1.3 Increasing disease burden along with a rapidly growing geriatric population base

- 3.2.1.4 Rising demand for organ transplantation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging devices

- 3.2.2.2 Stringent regulatory concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Personalized and precision imaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Canada

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-ray devices

- 5.2.1 Digital

- 5.2.1.1 Direct radiography systems

- 5.2.1.2 Computed radiography systems

- 5.2.2 Analog

- 5.2.1 Digital

- 5.3 MRI

- 5.4 Ultrasound

- 5.4.1 2D Ultrasound

- 5.4.2 3D Ultrasound

- 5.4.3 Other ultrasounds

- 5.5 Computed tomography

- 5.6 Nuclear imaging

- 5.7 Mammography

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 Canon Medical Systems

- 8.2 Carestream Health

- 8.3 Esaote

- 8.4 Fujifilm Holdings

- 8.5 GE HealthCare Technologies

- 8.6 Hologic

- 8.7 Konica Minolta

- 8.8 Koninklijke Philips

- 8.9 Samsung Medison

- 8.10 Shimadzu

- 8.11 Siemens Healthineers