PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801875

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801875

Underwater Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

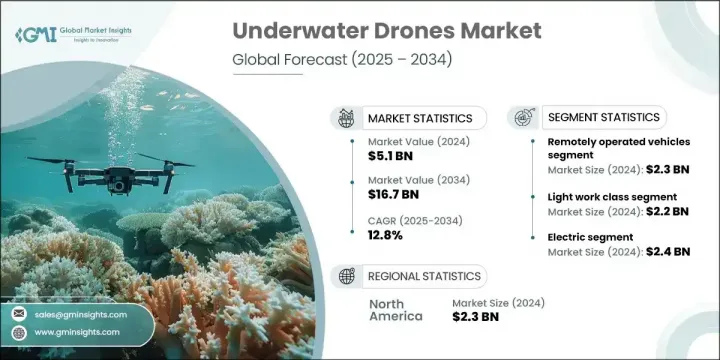

The Global Underwater Drones Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 16.7 billion by 2034. The expansion is largely supported by increasing demand for subsea exploration, rising investments in offshore oil and gas projects, maritime security enhancements, and the integration of renewable energy ventures. Additionally, constant improvements in autonomy, propulsion systems, and imaging technologies are driving broader market adoption across both commercial and defense sectors.

A key trend reshaping this space is the growing preference for electric propulsion systems. These upgrades enhance mission range, reduce acoustic footprint, and improve energy efficiency, making electric-powered underwater drones ideal for a range of applications. With the integration of lithium-ion batteries, brushless DC motors, and supercapacitors, modern electric drones now operate over 72 hours in certain missions. This transformation is especially valuable in mid-water and nearshore operations where low-noise and high-efficiency performance is essential. At the same time, there's a surge in interest for autonomous underwater vehicles (AUVs), which operate independently using onboard navigation, sensors, and mission software, enabling precision without real-time operator input.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 billion |

| Forecast Value | $16.7 billion |

| CAGR | 12.8% |

In 2024, the remotely operated vehicle (ROV) segment was valued at USD 2.3 billion. This segment is growing rapidly due to the rising need for real-time underwater operations in oil and gas, defense, and infrastructure inspections. ROVs are equipped with versatile tool systems, have strong payload capacities, and provide operators with full manual control, making them ideal for deepwater inspections, maintenance work, and underwater recovery tasks.

The light work-class drone segment generated USD 2.2 billion in 2024. These drones are widely adopted due to their operational flexibility, affordability, and effectiveness in performing inspection and light intervention missions. Their adaptability with sensors and manipulators, along with low deployment complexity and minimal surface support needs, makes them suitable for confined and harsh environments. To support evolving operational needs, manufacturers are focusing on plug-and-play designs, edge AI integration, and improved tether control systems to serve industries such as port management, infrastructure surveillance, and offshore contracting.

Canada Underwater Drones Market will reach USD 775.1 million by 2034. This growth is driven by the nation's expanding offshore energy operations, increased maritime territorial monitoring, and deepening investments in marine science. The use of drones for under-ice navigation, remote subsea monitoring, and habitat mapping continues to rise. Equipment developers are advised to prioritize ruggedized, cold-water-capable drone systems with modular sensor configurations suitable for both scientific exploration and defense applications.

Key players in the Global Underwater Drones Market include PowerRay, Gavia AUV, SRV-8 ROV, Neptune ROV, Phantom ROV Series, FIFISH V6, Flying Nodes AUV, Marlin AUV, HUGIN AUV, Seaeye Falcon ROV, Sibiu Pro, SeaDrone ROV, SeaCat AUV, Seasam ROV, BW Space Pro, Blueye X3, Bluefin-21 AUV, Oceaneering ROVs, Eelume Subsea Robot, and Absolute Ocean AUV.

Companies in the underwater drones space are reinforcing their competitive position through multi-faceted strategies. A strong emphasis is placed on R&D to advance autonomy, sensor integration, battery longevity, and propulsion technology. Manufacturers are prioritizing modular designs to enable rapid customization for specific missions, such as exploration, defense, inspection, or scientific research. Strategic partnerships with government bodies, energy firms, and marine institutes are helping companies secure long-term contracts.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Product class trends

- 2.2.3 Propulsion system trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising Demand for Ocean Exploration

- 3.3.1.2 Expansion of Offshore Oil & Gas Activities

- 3.3.1.3 Maritime Security and Surveillance Needs

- 3.3.1.4 Growing Investment in Renewable Energy Projects

- 3.3.1.5 Technological Advancements in Autonomy & Imaging

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Limited Battery Life and Power Management

- 3.3.2.2 High Cost of Advanced Underwater Drones

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Defense budget analysis

- 3.14 Global defense spending trends

- 3.15 Regional defense budget allocation

- 3.15.1 North america

- 3.15.2 Europe

- 3.15.3 Asia Pacific

- 3.15.4 Middle East and Africa

- 3.15.5 Latin america

- 3.16 Key defense modernization programs

- 3.17 Budget forecast (2025-2034)

- 3.17.1 Impact on industry growth

- 3.17.2 Defense budgets by country

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, by Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Remotely operated vehicles

- 5.3 Autonomous underwater vehicles

- 5.4 Hybrid underwater vehicles

Chapter 6 Market estimates and forecast, by Product Class, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Micro class

- 6.3 Small and medium class

- 6.4 Light work class

- 6.5 Heavy work class

Chapter 7 Market estimates and forecast, by Propulsion System, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Mechanical

- 7.4 Hybrid

Chapter 8 Market estimates and forecast, by Application, 2021 - 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Defense and security

- 8.2.1 Naval surveillance

- 8.2.2 Mine countermeasures

- 8.2.3 Anti-submarine warfare

- 8.2.4 Underwater intelligence and reconnaissance

- 8.2.5 Search and rescue missions

- 8.2.6 Others

- 8.3 Scientific research and exploration

- 8.3.1 Oceanographic studies

- 8.3.2 Marine biodiversity monitoring

- 8.3.3 Seabed mapping

- 8.3.4 Climate and environmental studies

- 8.4 Infrastructure inspection and maintenance

- 8.4.1 Pipeline and rig inspection

- 8.4.2 Underwater cable monitoring

- 8.4.3 Dam and bridge inspection

- 8.4.4 Port and harbour maintenance

- 8.4.5 Nuclear facility inspection

- 8.4.6 Others

- 8.5 Others

Chapter 9 Market estimates and forecast, by Region, 2021 - 2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 General Dynamics Mission Systems

- 10.1.2 Deep Ocean Engineering, Inc.

- 10.1.3 Nido Robotics

- 10.1.4 Oceanbotics

- 10.1.5 Neptune Robotics

- 10.1.6 Terradepth

- 10.1.7 SeaDrone Inc.

- 10.1.8 Edgerov (Notilo Plus)

- 10.1.9 Autonomous Robotics Ltd.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Oceaneering International, Inc.

- 10.2.1.2 Lockheed Martin Corporation

- 10.2.1.3 Teledyne Marine

- 10.2.2 Europe

- 10.2.2.1 Kongsberg Maritime

- 10.2.2.2 Saab Group

- 10.2.2.3 Atlas Elektronik

- 10.2.3 Asia-Pacific

- 10.2.3.1 QYSEA Technology

- 10.2.3.2 PowerVision Inc.

- 10.2.3.3 Youcan Robotics(Shanghai) Co., Ltd.

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 Blueye Robotics

- 10.3.2 Eelume AS