PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801882

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801882

Peritoneal Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

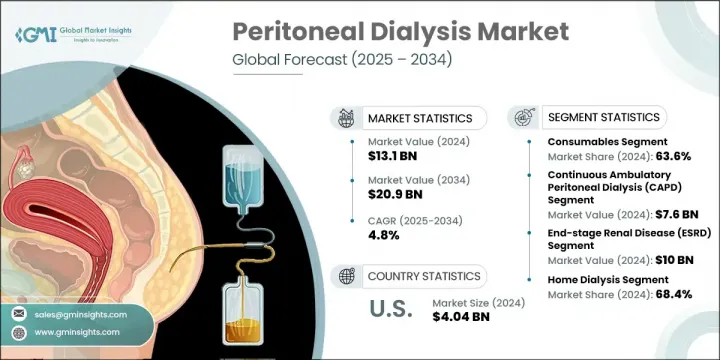

The Global Peritoneal Dialysis Market was valued at USD 13.1 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 20.9 billion by 2034. Key drivers fueling this expansion include the rising incidence of kidney-related conditions, increasing adoption of home-based dialysis solutions, and favorable reimbursement structures supporting dialysis treatment. Additionally, cost efficiency over traditional hemodialysis, combined with a persistent shortfall in kidney donors, further bolsters market demand. Peritoneal dialysis, a life-sustaining therapy for individuals facing end-stage renal disease (ESRD) and acute kidney injury, allows for the effective removal of waste and excess fluid when the kidneys lose function. A growing shift toward patient-managed care at home continues to shape the industry landscape. Moreover, the aging population and a growing number of patients affected by chronic kidney issues are contributing heavily to the uptake of PD solutions globally.

In 2024, the consumables segment held a 63.6% share. This dominance is largely attributed to a higher volume of ESRD cases and increasing demand for essential PD components such as dialysate solutions, PD catheters, and other related consumables. The shift toward home-based therapies has significantly influenced this trend, as patients require a steady supply of these products to conduct regular sessions independently. This growing patient reliance on consumables is magnified by the rising prevalence of both chronic and acute kidney failures, particularly within the elderly population. These demographic changes continue to push demand for dependable, home-compatible dialysis solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.1 Billion |

| Forecast Value | $20.9 Billion |

| CAGR | 4.8% |

The continuous ambulatory peritoneal dialysis (CAPD) segment generated USD 7.6 billion in 2024 and is forecasted to grow at a 4.6% CAGR during 2025-2034. CAPD remains a preferred choice in regions where access to automated dialysis equipment is limited. This approach enables patients to perform manual exchanges multiple times a day without relying on machines, offering affordability, ease of use, and the flexibility to maintain normal routines. Its growing popularity stems from its ability to empower patients with greater control over their treatment while reducing dependence on dialysis centers.

United States Peritoneal Dialysis Market was valued at USD 4.04 billion in 2024 and is expected to grow at a 3.5% CAGR from 2025 through 2034. The rising acceptance of PD in the country is due to its patient-centric benefits, including treatment flexibility, at-home administration, and improved quality of life. Healthcare providers are increasingly recommending PD as a viable alternative to center-based hemodialysis, especially as the healthcare system embraces value-based care models. This upward trend is further fueled by growing awareness and better training programs for patients opting for home dialysis.

The top-tier companies actively shaping the Global Peritoneal Dialysis Market are Terumo Corporation, Vantive (Baxter), Diaverum (M42), BD, B. Braun, Davita Kidney Care, Polymed, Utah Medical Products, Vivance, Fresenius Medical Care, medCOMP, and Mozarc Medical. To secure their market positions and enhance competitiveness, companies operating in the peritoneal dialysis sector are actively pursuing several strategic initiatives.

These include expanding their product portfolios with more advanced and user-friendly dialysis solutions tailored for home use, as well as forming partnerships with healthcare providers to strengthen service delivery networks. Many firms are investing heavily in R&D to develop next-generation PD devices with improved efficiency and safety profiles. Additionally, strategic mergers and acquisitions are being used to widen geographic reach and integrate specialized capabilities. Training programs and awareness campaigns are also being launched to boost patient adoption and adherence, particularly in developing regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Category trends

- 2.2.3 Type trends

- 2.2.4 Disease condition trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end stage renal diseases (ESRD) patients

- 3.2.1.2 Shortage of donor kidneys

- 3.2.1.3 Cost advantages over hemodialysis

- 3.2.1.4 Favourable reimbursement scenario for dialysis treatment

- 3.2.1.5 Growing prevalence of diabetes and hypertension

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications in the treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in home dialysis adoption

- 3.2.3.2 Increasing demand in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.6 Historical timeline and industry evolution

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Pricing analysis by region, 2024

- 3.8.1 Dialysis machines/cyclers

- 3.8.2 Peritoneal dialysis solution/Dialysate

- 3.8.3 Services

- 3.9 Gap analysis

- 3.10 Consumer behaviour analysis

- 3.11 Epidemiology outlook

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Future market trends

- 3.15 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1.4 Rest of the world (RoW)

- 4.3.1 By Region

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dialysis machines/Cyclers

- 5.2.1 Consumables

- 5.2.1.1 Peritoneal dialysis solution/Dialysate

- 5.2.1.1.1 Dextrose

- 5.2.1.1.2 Icodextrin

- 5.2.1.1.3 Amino Acid

- 5.2.1.2 Catheters

- 5.2.1.3 Access products

- 5.2.1.4 Other consumables

- 5.2.1.1 Peritoneal dialysis solution/Dialysate

- 5.2.2 Services

- 5.2.2.1 Chronic dialysis

- 5.2.2.2 Acute dialysis

- 5.2.1 Consumables

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Continuous ambulatory peritoneal dialysis (CAPD)

- 6.3 Automated peritoneal dialysis (APD)

Chapter 7 Market Estimates and Forecast, By Disease Condition, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 End-stage renal disease (ESRD)

- 7.3 Acute kidney injury (AKI)

- 7.4 Other conditions

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home dialysis

- 8.3 In-center dialysis

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 B. Braun

- 10.1.2 BD

- 10.1.3 Davita Kidney Care

- 10.1.4 Diaverum (M42)

- 10.1.5 Fresenius Medical Care

- 10.1.6 medCOMP

- 10.1.7 Mozarc Medical

- 10.1.8 Polymed

- 10.1.9 Terumo Corporation

- 10.1.10 Utah Medical Products

- 10.1.11 Vantive (Baxter)

- 10.1.12 Vivance

- 10.2 Regional players

- 10.2.1 Apollo Dialysis

- 10.2.2 Mitra Industries

- 10.2.3 Newsol Technologies

- 10.2.4 Northwest Kidney Centers