PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801888

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801888

Gas Analyzer Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

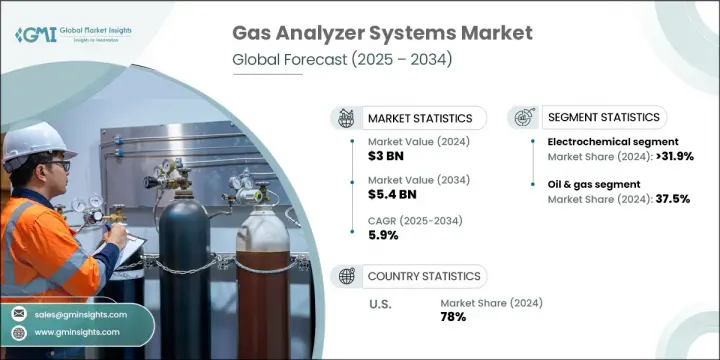

The Global Gas Analyzer Systems Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 5.4 billion by 2034. The surge in industrial automation and the rising demand for precise air quality monitoring are key drivers fueling the adoption of advanced gas analyzer systems. These systems are increasingly essential across multiple industries due to strict emissions regulations, heightened focus on environmental compliance, and a growing need for workplace safety. Technological advancements and real-time monitoring capabilities are making gas analysis equipment more effective and reliable.

As awareness around environmental impact and industrial safety increases, industries such as food and beverage, pharmaceuticals, and energy are turning to gas analyzers to maintain compliance and ensure operational efficiency. Government policies enforcing emissions control are also propelling industry adoption, while continuous improvements in sensor technologies support innovation and market expansion. The demand is further reinforced by the need to improve energy efficiency, detect harmful gas mixtures, and prevent environmental hazards across rapidly evolving industrial landscapes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.9% |

Electrochemical gas analyzer systems captured a 31.9% share in 2024 and is forecast to grow at a CAGR of 5.6% through 2034. This technology is gaining prominence due to the rising industrial emissions and the increasing demand for accurate and sensitive gas monitoring tools. These systems are widely utilized in process optimization and safety compliance across manufacturing units, laboratories, and other industrial environments that require robust gas detection capabilities to maintain operational standards.

The oil & gas segment held a 37.5% share in 2024 and is projected to grow at a CAGR of 5.5% through 2034. The segment's growth is largely attributed to the critical need for real-time monitoring of hazardous gases in hydrocarbon processing operations. Gas analyzer systems are pivotal in detecting corrosive mixtures and water vapor, helping to enhance system integrity, prevent corrosion-related damage, and maintain safe working environments across oil refineries and gas plants.

United States Gas Analyzer Systems Market held 78% share, generating USD 798 million in 2024. Robust investments in energy infrastructure, manufacturing modernization, and industrial safety are supporting this growth. Regulatory efforts mandating emissions monitoring and the push toward automation and sustainability in industrial processes are encouraging broader deployment of high-performance gas analyzers across US industries.

Key market players shaping the Global Gas Analyzer Systems Market include Fuji Electric, ABB, Siemens, Emerson Electric, and Yokogawa Electric. Leading companies in the gas analyzer systems market are strengthening their competitive edge through R&D investments aimed at enhancing sensor accuracy, durability, and real-time monitoring features. Strategic collaborations with industrial automation firms help integrate gas analysis systems into broader control architectures. To meet compliance demands, businesses are tailoring solutions based on evolving regulatory standards across different regions. Additionally, players are expanding their product portfolios with compact, user-friendly, and IoT-enabled systems to cater to next-generation industrial needs. Geographic expansion into emerging markets with growing industrial bases is also a priority.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of gas analyzer systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Electrochemical

- 5.3 Paramagnetic

- 5.4 Zirconia (ZR)

- 5.5 Non-Dispersive IR (NDIR)

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Oil & Gas

- 6.3 Chemical & Petrochemical

- 6.4 Healthcare

- 6.5 Research

- 6.6 Water & Wastewater

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Norway

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Advanced Micro Instruments, Inc.

- 8.3 AVL List GmbH

- 8.4 Buhler Technologies GmbH

- 8.5 DAIICHI NEKKEN CO., LTD.

- 8.6 DURAG GROUP

- 8.7 Ecotech

- 8.8 Emerson Electric Co.

- 8.9 ENVEA

- 8.10 Fuji Electric Co., Ltd

- 8.11 Hiden Analytical

- 8.12 HORIBA Group

- 8.13 Leybold

- 8.14 M&C TechGroup Germany

- 8.15 METTLER TOLEDO

- 8.16 Nova Analytical Systems

- 8.17 Servomex

- 8.18 Shimadzu Corporation

- 8.19 SICK AG

- 8.20 Siemens

- 8.21 Thermo Fisher Scientific Inc.

- 8.22 Yokogawa Electric Corporation