PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801890

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801890

Cooler Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

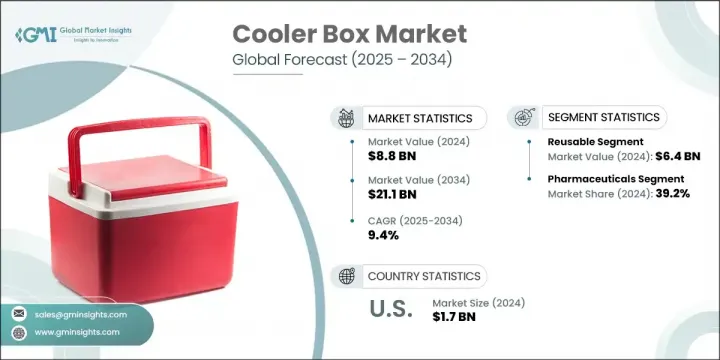

The Global Cooler Box Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 21.1 billion by 2034. Market momentum is being driven by a combination of rising demand for temperature-sensitive goods and a broader shift toward sustainable cold storage solutions. The diverse range of cooling capacities, from low-wattage units to systems exceeding 1.5 MW, illustrates the adaptability of cooler boxes across residential, commercial, and industrial sectors. Increasing attention on environmental responsibility is also steering buyers toward reusable cooler boxes, which emerge as cost-effective, durable alternatives to disposable containers. With growing environmental awareness influencing buying behavior, reusable cooler boxes are becoming integral to waste-reduction strategies for both consumers and businesses. As companies and industries align with global sustainability goals, the market for long-lasting, eco-conscious cold storage products is set to advance steadily in the years ahead.

The dependence on temperature-controlled logistics has become essential for protecting product quality and ensuring public health. A lack of cold chain solutions continues to impact critical sectors, particularly in healthcare, where millions of preventable child deaths are linked to failures in vaccine storage and transport. As the need for dependable, energy-efficient cooling systems expands, cooler boxes are proving vital in delivering reliable performance across variable temperature ranges, including ultra-low storage conditions. These cold chain logistics requirements are expected to sustain market expansion globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 9.4% |

The reusable cooler box segment led the market in 2024, reaching USD 6.4 billion and is anticipated to grow at a CAGR of 9.8% between 2025 and 2034. The rising shift away from single-use packaging is fueling interest in reusable models engineered for extended service life. Built from resilient materials, these cooler boxes are designed for repeated use without compromising insulation performance or structural durability. This evolution supports global sustainability targets while meeting the cost-efficiency needs of modern supply chains.

The pharmaceuticals segment generated USD 3.4 billion in 2024 holding a 39.2% share. Cold chain integrity remains a top priority in the pharmaceutical industry, where strict compliance standards require stable thermal environments for transportation and storage. The need for temperature-controlled solutions is amplified by the global demand for vaccine distribution and regulated storage of temperature-sensitive medications. Cooler boxes built to meet exacting pharmaceutical standards are seeing strong adoption to support consistent product efficacy and regulatory adherence.

United States Cooler Box Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 10.3% from 2025 to 2034. Market growth in the US is driven by the expanding footprint of industries that depend on cold storage infrastructure. From meal delivery services to pharmaceutical logistics and grocery distribution, demand is climbing alongside infrastructure improvements. A surge in electricity usage across residential and commercial spaces is also supporting the adoption of high-efficiency cooling technologies. These factors point to a sustained rise in cold chain investments, creating favorable conditions for cooler box deployment across the country.

Notable companies active in the Global Cooler Box Market include Cold Chain Technologies Inc., va-Q-tec Thermal Solutions GmbH, WILD Coolers, FEURER Group GmbH, Pelican Products Inc., Igloo Products Corp., YETI COOLERS, LLC., K2Coolers, Sofrigam Group, Sonoco ThermoSafe, Cool Ice Box Company, Bison Coolers, Eurobox Logistics, Blowkings, and B Medical System. Companies operating in the cooler box industry are investing in material innovation, modular product design, and technological integration to build long-term competitiveness. Many players are focusing on producing reusable, durable, and thermally efficient cooler boxes to address rising environmental concerns. Customization options for diverse industries, including healthcare and food logistics, are being expanded to enhance market reach. Strategic partnerships with logistics providers and cold chain infrastructure developers are also strengthening supply chain connectivity. Leading manufacturers are actively enhancing R&D efforts to design lightweight, high-performance units compatible with smart temperature monitoring systems. Several firms are boosting their geographic presence by establishing regional manufacturing hubs, helping reduce shipping costs and respond more efficiently to localized demand across both developed and emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type

- 2.2.2 Raw Material

- 2.2.3 Price Range

- 2.2.4 End Use

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reusable

- 5.3 Disposable

Chapter 6 Market Estimates & Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Extruded polystyrene

- 6.3 Expanded polystyrene

- 6.4 Expanded polypropylene

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (Upto USD 30)

- 7.3 Medium (USD 30 - USD 50)

- 7.4 High (Above USD 50)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.3 Food & beverages

- 8.4 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 Company Website

- 9.2.2 E-commerce website

- 9.3 Offline

- 9.3.1.1 Supermarkets and hypermarkets

- 9.3.1.2 Specialty outdoor stores

- 9.3.1.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 B Medical System

- 11.2 Bison Coolers

- 11.3 Blowkings

- 11.4 Cold Chain Technologies Inc.

- 11.5 Cool Ice Box Company

- 11.6 Eurobox Logistics

- 11.7 FEURER Group GmbH

- 11.8 Igloo Products Corp.

- 11.9 K2Coolers

- 11.10 Pelican Products Inc.

- 11.11 Sofrigam Group

- 11.12 Sonoco ThermoSafe

- 11.13 va-Q-tec Thermal Solutions GmbH

- 11.14 WILD Coolers

- 11.15 YETI COOLERS, LLC.