PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801892

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801892

Endoscope Reprocessing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

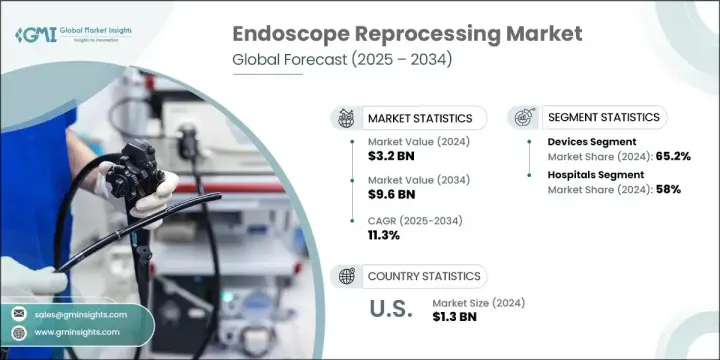

The Global Endoscope Reprocessing Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 9.6 billion by 2034. This rapid market expansion is being fueled by the increasing shift toward minimally invasive surgical techniques, coupled with the rising prevalence of conditions such as gastrointestinal diseases and cancers that require frequent diagnostic and therapeutic endoscopic procedures. As more procedures shift to outpatient and ambulatory surgical centers, the need for reliable and efficient reprocessing systems that ensure endoscope safety between users becomes more critical.

Ensuring the disinfection and safety of reusable endoscopes is central to infection control in clinical environments. Regulatory bodies continue to enforce strict protocols for cleaning and disinfecting endoscopic devices. As healthcare providers face heightened pressure to mitigate healthcare-associated infections, the importance of thorough, validated reprocessing protocols has grown considerably. Additionally, increasing concerns surrounding antimicrobial resistance and the demand for greater infection prevention continue to intensify the need for effective, high-quality endoscope reprocessing systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 11.3% |

The accessories segment is expected to grow at a CAGR of 10.9% through 2034, driven by innovation in device components that enhance performance and simplify workflows. Continued investments in R&D are allowing companies to introduce automated technologies that not only improve reprocessing consistency but also reduce reliance on manual labor, which often leads to variability and potential error. The steady rise of automated endoscope reprocessors is enhancing efficiency while ensuring regulatory compliance and minimizing the risk of improper sterilization.

In 2024, the hospitals segment held 58% share. The dominance of this segment is primarily attributed to the high volume of patients and the increasing focus on reducing infection transmission through strict adherence to sterilization protocols. Facilities are placing strong emphasis on technician training, compliance tracking, and documentation of cleaning cycles to ensure that proper disinfection is achieved consistently. As a result, hospitals are integrating advanced tracking systems to monitor the reprocessing history of every scope and optimize workflow safety.

U.S. Endoscope Reprocessing Market was valued at USD 1.3 billion in 2024. The country's dominance stems from high procedural volumes tied to chronic diseases, as well as federal focus on improving infection control across healthcare facilities. Upgrades to healthcare infrastructure and growing financial investment in patient safety initiatives are supporting stronger adoption of automated and digitalized reprocessing solutions across North America.

Key players driving innovation and competition in the Global Endoscope Reprocessing Market include Olympus, Wassenburg Medical, Steelco, Getinge, Metrex, Ecolab, Belimed, ASP, Shinva Medical Instrument, Creo Medical, CONMED Corporation, Karl Storz, ARC Group of Companies, and STERIS. To strengthen their position in the endoscope reprocessing market, leading companies are investing heavily in R&D to develop advanced systems that deliver consistent cleaning performance and reduce human error. Many are focusing on automation and digital integration to enhance traceability, improve workflow efficiency, and ensure regulatory compliance. Strategic collaborations with hospitals and surgical centers are helping expand their client base and tailor solutions to real-world needs. Some players are offering value-added services such as staff training, maintenance, and compliance tracking. Global expansion through regional manufacturing facilities and localized service support is helping manufacturers increase market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for endoscopy procedures

- 3.2.1.2 Technological advancements in endoscope reprocessing

- 3.2.1.3 Rising preferences for minimally invasive procedures

- 3.2.1.4 Increasing prevalence of GI disorders, cancer, and other chronic ailments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of chemical disinfectants

- 3.2.2.2 High cost of endoscope reprocessing devices

- 3.2.3 Market opportunities

- 3.2.3.1 Rising awareness of infection control

- 3.2.3.2 Growth in healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Growth potential analysis

- 3.5 Reimbursement scenario

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Future market trends

- 3.9 New product development landscape

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Automated endoscope reprocessors (AERs)

- 5.2.1.1 By Type

- 5.2.1.1.1 Single-door AERs

- 5.2.1.1.2 Double-door AERs

- 5.2.1.2 By Portability

- 5.2.1.2.1 Standalone AERs

- 5.2.1.2.2 Portable AERs

- 5.2.1.1 By Type

- 5.2.2 Endoscope drying, storage, and transport systems

- 5.2.3 Other devices

- 5.2.1 Automated endoscope reprocessors (AERs)

- 5.3 Consumables

- 5.3.1 Valves and adaptors

- 5.3.2 High level disinfectants

- 5.3.3 Bedside kits

- 5.3.4 Other consumables

- 5.4 Accessories

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.3.7 Austria

- 7.3.8 Switzerland

- 7.3.9 CEE

- 7.3.9.1 Poland

- 7.3.9.2 Hungary

- 7.3.9.3 Romania

- 7.3.9.4 Czech Republic

- 7.3.9.5 Bulgaria

- 7.3.9.6 Rest of CEE

- 7.3.10 Nordic countries

- 7.3.10.1 Denmark

- 7.3.10.2 Sweden

- 7.3.10.3 Norway

- 7.3.10.4 Rest of Nordic countries

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia and New Zealand

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ARC Group of Companies

- 8.2 ASP

- 8.3 Belimed

- 8.4 CONMED Corporation

- 8.5 Creo Medical

- 8.6 Ecolab

- 8.7 Getinge

- 8.8 Metrex

- 8.9 Olympus

- 8.10 Shinva Medical Instrument

- 8.11 Steelco

- 8.12 STERIS

- 8.13 Karl Storz

- 8.14 Wassenburg Medical