PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844353

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844353

Superhydrophobic Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

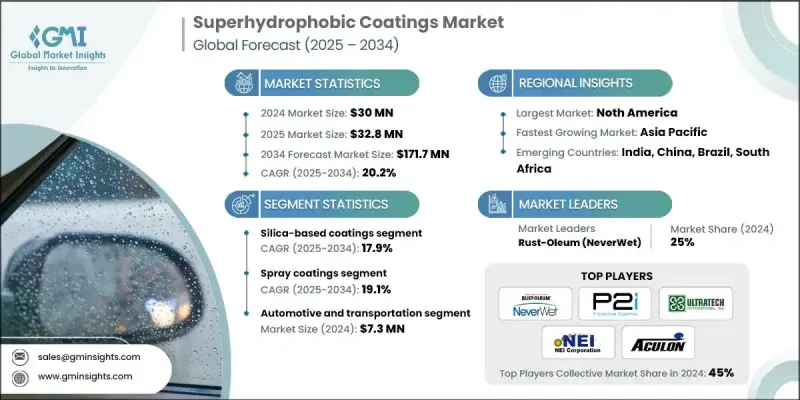

The Global Superhydrophobic Coatings Market was valued at USD 30 million in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 171.7 million by 2034.

Market momentum is building as demand intensifies across industries for surfaces that resist moisture, corrosion, and contamination. This surge is largely due to rising usage in electronics requiring water resistance, anti-icing applications in mobility sectors, and the shift toward low-maintenance solar panels. Healthcare is also emerging as a growth contributor, with medical devices increasingly integrating liquid-repelling surfaces for sterility and longevity. Initially restricted to aerospace and defense due to performance needs, adoption is now scaling across renewable energy, construction, and consumer electronics as awareness improves and R&D opens new possibilities. Heightened attention toward environmental sustainability and stricter regulations around PFAS are pushing innovation toward fluorine-free or bio-based materials, paving the way for more eco-conscious product formulations. This rising trend of multifunctional coatings offering self-cleaning, anti-fouling, and water-repellency across high-growth sectors like automotive, infrastructure, and smart devices is significantly accelerating market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30 Million |

| Forecast Value | $171.7 Million |

| CAGR | 20.2% |

The aerospace and defense segment held 13.5% share in 2024, driven by increasing demand for corrosion-resistant and stealth-enhancing coatings. Superhydrophobic materials are utilized in aircraft systems, military-grade electronics, and equipment exposed to harsh environments. These applications are growing rapidly in line with government-led modernization programs and tightening aviation safety mandates, pushing manufacturers to adopt high-performance coating technologies.

The carbon nanotube and graphene-enhanced coatings segment is projected to grow at a CAGR of 26.1% through 2034. These nanomaterial-based formulations deliver excellent conductivity, mechanical strength, and corrosion resistance, making them particularly suitable for advanced electronics, aerospace, and defense applications where performance reliability is critical.

Asia-Pacific Superhydrophobic Coatings Market will grow at a CAGR of 20.8% from 2024 to 2034, underpinned by rising demand across electronics, solar, and infrastructure sectors in major economies like Japan, South Korea, India, and China. Supportive government policies for clean energy adoption and industrial modernization are further bolstering this expansion. China's lead in solar PV output and India's push to adopt water-repellent solutions for public infrastructure are among the regional factors contributing to increased product penetration and long-term development.

Leading players in the Global Superhydrophobic Coatings Market include BASF SE, Surfactis Technologies, Lotus Nano, DryWired, 3M Company, NEI Corporation, UltraTech International, Inc., The Sherwin-Williams Company, Nanex Company, United Protective Technologies (UPT), Lotus Leaf Coatings, Inc., Pearl Nano LLC, Aculon, Inc., NTT Advanced Technology Corp., Rust-Oleum (NeverWet), Advanced NanoTech Lab, Hydrobead, P2i Ltd, NanoTech Solutions, and Cytonix, LLC. To strengthen their competitive position, companies in the superhydrophobic coatings market are prioritizing advanced R&D efforts aimed at developing PFAS-free and environmentally friendly alternatives. Strategic collaborations with aerospace, electronics, and solar manufacturers help to ensure direct integration into next-gen product pipelines. Firms are expanding their global reach through local production units and channel partnerships, especially in Asia-Pacific, to tap into emerging demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Manufacturing Process

- 2.2.4 Application

- 2.3 TAM Analysis, 2021-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Silica-based superhydrophobic coatings

- 5.3 Fluoropolymer-based coatings

- 5.4 PDMS and silicone-based coatings

- 5.5 Titanium dioxide-based coatings

- 5.6 Carbon nanotube and graphene-based coatings

- 5.7 Bio-inspired and plant-based coatings

Chapter 6 Market Estimates & Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Spray coating methods

- 6.3 Dip coating processes

- 6.4 Sol-gel processing

- 6.5 Electrodeposition methods

- 6.6 Chemical Vapor Deposition (CVD)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Automotive and transportation

- 7.3 Aerospace and defense

- 7.4 Marine and offshore

- 7.5 Construction and architecture

- 7.6 Textiles and apparel

- 7.7 Electronics and telecommunications

- 7.8 Medical and healthcare

- 7.9 Solar energy and renewable applications

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Aculon, Inc.

- 9.3 Advanced NanoTech Lab

- 9.4 BASF SE

- 9.5 Cytonix, LLC

- 9.6 DryWired

- 9.7 Hydrobead

- 9.8 Lotus Leaf Coatings, Inc.

- 9.9 Lotus Nano

- 9.10 Nanex Company

- 9.11 NanoTech Solutions

- 9.12 NEI Corporation

- 9.13 NTT Advanced Technology Corp.

- 9.14 P2i Ltd

- 9.15 Pearl Nano LLC

- 9.16 Rust-Oleum (NeverWet)

- 9.17 Surfactis Technologies

- 9.18 The Sherwin-Williams Company

- 9.19 UltraTech International, Inc.

- 9.20 United Protective Technologies (UPT)