PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801897

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801897

Lawn and Garden Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

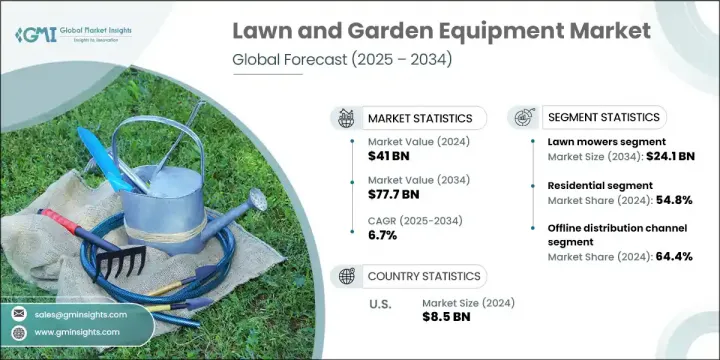

The Global Lawn and Garden Equipment Market was valued at USD 41 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 77.7 billion by 2034. Rising disposable incomes and the expanding middle-class population are fueling consumer interest in home improvement and outdoor aesthetics. As homeowners increasingly prioritize personalized outdoor spaces, the demand for landscaping tools, smart gardening systems, and efficient yard maintenance equipment is steadily rising. New residential developments, especially in suburban and semi-urban zones, are encouraging people to treat lawns and gardens as integral living spaces.

This trend, supported by greater online accessibility, easier financing options, and a growing emphasis on eco-friendly and tech-integrated living, is shaping the outlook of the market. With a growing preference for user-friendly and connected equipment, manufacturers are focusing on automated solutions such as robotic lawn mowers, app-based irrigation systems, and intelligent gardening tools. These innovations not only reduce manual workload but also allow users to achieve precise control and enhance the overall functionality of their green spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41 Billion |

| Forecast Value | $77.7 Billion |

| CAGR | 6.7% |

The lawn mowers generated USD 12.3 billion in 2024 and is forecast to reach USD 24.1 billion by 2034. These tools remain the most utilized product category due to their functionality, ease of use, and critical role in maintaining healthy grass. Consistent mowing supports optimal lawn health, improves curb appeal, and provides a neat and welcoming outdoor setting for homeowners. Whether for small residential yards or larger green areas, lawn mowers are an essential component in outdoor maintenance routines.

The commercial segment is anticipated to grow at a CAGR of 7.1% between 2025 and 2034. Businesses and institutions are increasingly investing in landscaping and green infrastructure as part of urban beautification and sustainability initiatives. Well-maintained outdoor environments help enhance brand image and provide welcoming surroundings across hospitality, corporate, and public settings. With growing urban planning that incorporates green zones, the demand for efficient, cost-effective lawn and garden equipment to manage larger spaces continues to rise.

United States Lawn and Garden Equipment Market was valued at USD 8.5 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2034. The U.S. leads the market due to widespread homeownership, especially in rural and suburban areas where lawns are common. A strong do-it-yourself culture, coupled with the seasonal nature of lawn care, keeps demand high for various products such as robotic mowers, riding mowers, and environmentally conscious tools. The popularity of outdoor living, particularly during warmer months, drives recurring investments in garden and yard maintenance equipment.

Leading players in the Global Lawn and Garden Equipment Market include Kubota Corporation, Briggs & Stratton Corporation, Stanley Black & Decker, Fiskars Group, Honda Motor Co., Ltd, Ariens Company, STIGA S.p.A, Koki Holdings Co., Ltd, Makita Corporation, Falcon Garden Tools, The Toro Company, Husqvarna Group, Techtronic Industries Co., Ltd (TTI), Robert Bosch GmbH, MTD Holdings Inc, Stihl Holding AG & Co. KG, and Deere & Company. Companies in the lawn and garden equipment sector are focusing on multiple strategic priorities to strengthen their market position. Emphasis is being placed on R&D to develop smart, connected products such as robotic mowers and sensor-driven irrigation systems. Firms are investing in sustainability by introducing electric and battery-powered tools that cater to growing environmental concerns. Product line expansion tailored to both residential and commercial applications is also a key growth strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Power type

- 2.2.4 Price

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

2.3.1 Key decision points for industry executives

2.3.2. Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Increasing interest in eco-friendly and sustainable products

- 3.2.1.3 Growth in home improvement and outdoor leisure activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.1 Growth drivers

3.2.2.1 Environmental concerns regarding the use of fuel-powered tools

3.2.2.2 High maintenance cost of advanced equipment

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for smart gardening tools

- 3.2.3.2 Expansion in emerging markets

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 8432)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Blowers

- 5.3 Chain saws

- 5.4 Cutters & shredders

- 5.5 Tractors

- 5.6 Lawn mowers

- 5.7 Sprinkler & hoses

- 5.8 Others (pruners, diggers, etc.)

Chapter 6 Market Estimates and Forecast, By Power, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Electric powered

- 6.4 Gas powered

- 6.5 Others (gasoline powered, etc.)

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End User, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Others (public parks, institutions, and community spaces)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Home Improvement stores

- 9.3.3 Others (individual, department stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ariens Company

- 11.2 Briggs & Stratton Corporation

- 11.3 Deere & Company

- 11.4 Falcon Garden Tools

- 11.5 Fiskars Group

- 11.6 Honda Motor Co., Ltd

- 11.7 Husqvarna Group

- 11.8 Koki Holdings Co., Ltd

- 11.9 Kubota Corporation

- 11.10 Makita Corporation

- 11.11 MTD Holdings Inc

- 11.12 Robert Bosch GmbH

- 11.13 Stanley Black & Decker

- 11.14 STIGA S.p.A

- 11.15 Stihl Holding AG & Co. KG

- 11.16 Techtronic Industries Co. Ltd (TTI)

- 11.17 The Toro Company