PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801903

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801903

Portable X-ray Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

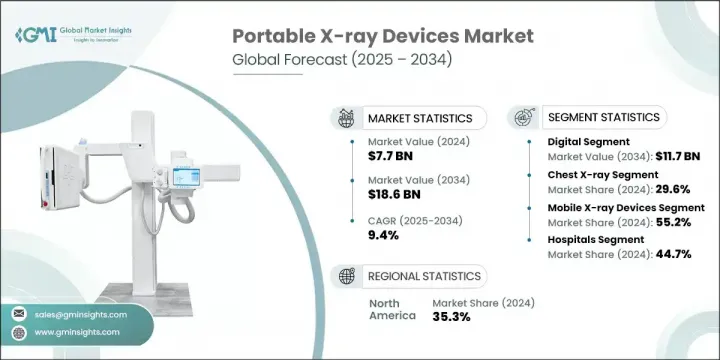

The Global Portable X-ray Devices Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 18.6 billion by 2034. The market's consistent growth is attributed to the rising burden of chronic illnesses and the increasing preference for point-of-care diagnostics. As early and accessible imaging becomes essential for managing health conditions, demand continues to grow. Another key driver is the expanding elderly population, which is more prone to requiring regular imaging procedures. Technological advancements such as AI-enhanced imaging, cloud integration, and wireless data transfer are also helping streamline diagnostics while improving accuracy and efficiency, making portable X-ray devices a go-to solution across multiple healthcare settings.

Portable X-ray units, designed for mobility and efficiency, are now vital tools in diagnostic routines, especially where in-hospital imaging is impractical. These systems are increasingly used in emergency departments, home-care environments, and field applications due to their ease of use, quick setup, and compatibility with existing digital infrastructure. By offering real-time imaging with wireless capabilities, these devices not only enhance speed but also reduce unnecessary patient movement, improving both care and workflow efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $18.6 Billion |

| CAGR | 9.4% |

The digital systems segment generated USD 4.8 billion in 2024 and is projected to reach USD 11.7 billion by 2034 at a CAGR of 9.6%. Digital portable X-ray units dominate due to their rapid imaging speed, high-resolution outputs, and ability to link with IT ecosystems within hospitals. These systems support AI integration, real-time viewing, and streamlined cloud-based sharing-features that are particularly important for critical care, tele-radiology, and remote diagnostics. Their reduced radiation output and improved clarity are major contributors to their growing preference across various clinical domains.

The mobile X-ray systems held a 55.2% share in 2024. This high share results from their widespread use in inpatient wards, intensive care units, and healthcare facilities requiring bedside imaging. Mobile systems reduce the need to transport patients and come equipped with enhanced digital imaging technology and wireless connectivity, making them essential for trauma care, infection control zones, and chronic disease management. Their adaptability to varied clinical needs and ability to perform imaging at the point of care continue to drive growth in this segment.

North America Portable X-ray Devices Market held a 35.3% share in 2024. This dominance can be credited to the region's advanced healthcare infrastructure, early technology adoption, and growing demand for remote diagnostics and automated workflow solutions. High disease prevalence, along with the increasing demand for digital medical imaging among professionals, continues to fuel the uptake of portable solutions. Strong public health initiatives, combined with rapid private sector innovation, are supporting this robust growth outlook.

Key players involved in the Global Portable X-ray Devices Market include Canon Medical Systems, GE Healthcare, Philips, Siemens Healthineers, and Fujifilm. Companies in the portable X-ray devices market are focusing heavily on R&D to incorporate advanced technologies like AI, edge computing, and cloud connectivity into their systems. They are expanding their portfolios to include lightweight, battery-operated models tailored for emergency and remote use. Strategic alliances with healthcare institutions and IT providers are enabling smoother integration of imaging solutions into hospital infrastructures. Additionally, firms are leveraging digital platforms for real-time diagnostics and remote consultations, enhancing service value. Investments in training programs and service networks are helping strengthen customer retention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Modality trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancement in x-ray devices

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High risk of radiation exposure

- 3.2.3 Market opportunities

- 3.2.3.1 AI-powered imaging and smart integration

- 3.2.3.2 Government screening and health programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital X-ray

- 5.3 Analog X-ray

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental X-ray

- 6.3 Mammography

- 6.4 Chest X-ray

- 6.5 Cardiovascular

- 6.6 Orthopedics

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mobile X-ray devices

- 7.3 Handheld X-ray devices

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 GE Healthcare

- 10.2 Siemens Healthineers

- 10.3 Canon Medical Systems

- 10.4 Philips

- 10.5 Shimadzu

- 10.6 MinXray

- 10.7 Hitachi Medical

- 10.8 Hologic

- 10.9 Carestream Health

- 10.10 Samsung Electronics

- 10.11 Ziehm Imaging

- 10.12 Fujifilm

- 10.13 Agfa HealthCare

- 10.14 DRGEM

- 10.15 OR Technology